What Is the Czech Trade License for Freelancers?

The Czech trade license of a freelancer is the business status of a self-employed person with the ability to do several business activities. The person with a trade license will have a registered tax number and the same rights as a company registered in the Czech Republic.

There are 82 common activities that fall under one trade license. These activities don’t require any special education or university degrees. The most common activities for our clients include graphic design, IT and general consulting, foreign language teaching, sales, photography services, and event organizing. The trade license holder can participate in all 82 activities under one trade license and under a tax number.

The most important conditions for obtaining the trade license are a criminal clearance report from the home country if the foreigner doesn’t have permanent residency in the Czech Republic. The Czech Trade License Registration process typically takes 2 days to complete.

Criminal clearance report

Most foreigners need to provide a criminal clearance report from their home country when registering a Czech trade license. However, there are exceptions. Check below to see if you qualify for an exemption or if you'll need to submit the report.

EU citizens

A criminal clearance report or temporary residency is not required for EU citizens for registering a Czech Trade license and other authorities.

Ukrainian citizens with a protection visa

A criminal clearance report is not required from Ukrainian citizens with a Czech protection visa or foreign police registration

British Citizens After Brexit

After Brexit, British citizens are considered third-country nationals, and for obtaining a Trade license in the Czech Republic, you must obtain a Criminal Clearance Report from the UK and a Temporary residency permit. You can apply online here

British citizens with Temporary residency also alternatively can also get a UK criminal clearance report from any local Czech Point in the Czech Republic.

UK citizens who didn't obtain temporary residency under Brexit protection should apply for a freelancer visa to be able to legally obtain a trade license, invoice using a Czech trade license, and pay taxes.

US citizens

A criminal clearance report form doesn’t exist in the US. So, US citizens must provide an affidavit confirming they have not committed any crime. This is an affidavit that must be signed at the U.S. Embassy. Make an appointment online to visit the U.S. Embassy in the Czech Republic. They will provide the proper form to fill out and sign in person. The embassy fee is 50 USD.

For those who are still in the US, arrange an affidavit form at the nearest Czech embassy. US citizens who already have a Czech visa can get their affidavit authorized for trade license registration at any Czech notary as well.

Canadian citizens

A Canadian criminal clearance report should be translated into the Czech language. Here is a list of official translators in Canada, and it should have a super legalization stamp from the Czech embassy. For Canadians who are already living in the Czech Republic, please contact the Canadian embassy.

Citizens of Australia, Brazil, and South Africa

Criminal clearance reports should be translated into the Czech language and must have an Apostille stamp from the local authority of your country. Legal translations can be done for an additional fee in Prague.

Important: Criminal Clearance Report Validity for Czech Trade License

To register a Czech trade license, your criminal clearance report must be issued within the last 90 days. Reports older than 90 days on the registration date will not be accepted.

Exception for NON-EU citizens

A criminal clearance report is not required from:

Permanent Residency holders.

Partnership visa holders.

Blue Card holders.

Student Visa( visa code: D/VC/23) holders.

Refugees and Asylum Seekers.

Family Members of EU citizens.

Consent with the business address

Each trade license holder should have a business address. Renting an office is not necessary. It can be a so-called virtual or remote office. For those who already have their own apartments, the home address can be used as the business address.

Additionally, we can offer reliable business addresses from our office building for 7,300 CZK for 12 months. You can check our Contact Agent & Business Address Support Package here

Social Tax and Health Insurance in 2026

EU citizens are registered with public health insurance and social tax after registration and activation of trade licenses.

Other nationalities’ trade license is activated and registered at the social tax after they collect their Czech visas at the Czech embassy. Since May 2016, US citizens must be registered with public health insurance. Other non-EU nationalities should buy commercial health insurance according to the future period of stay.

Since 1.1.2015 maximum amount for health insurance was canceled, and there is no maximum amount limit for Czech insurance from the Czech trade license income.

Each trade license (OSVČ) holder in the Czech Republic pays a minimum monthly deposits to ČSSZ and a health insurance. In the first year, deposits stay at the fixed minimum. From January of the following year, health insurance increases and ČSSZ recalculates monthly deposits based on income.

The minimum monthly Social Tax deposit for existing trade license holders in 2026 is 5,720 CZK ( 68,640 CZK per year) and 3,575 CZK (42,900 CZK per year) for the new trade license holders. The minimum deposit amount is set only for the first year and can be higher in the next year depending on your total income for the tax year.

The minimum monthly Public health insurance of VZP for trade license holders is a minimum of 3,306 CZK (39,672 CZK per year) in 2026, and also only for the first year. You might pay a difference after the calculation of your final income for the previous year. The final calculation comes from your yearly clean (tax base) income. Social Security tax is 29.2%, on 55% of the net ( tax base) income. Health insurance is 13.5% of 50% of the net ( tax base) income.

Minimum social and health insurance contribution deposits are charged even if you have 0 CZK income. That is why it is wise to cancel or pause your trade license if you are not generating income to avoid expenses for minimum contribution deposits.

Social security tax has a maximum limit and is taxable up to 2,350,416 CZK of Net Income. Over this amount of income, social security is not taxable. The maximum limit of social security payment amount is calculated by multiplying 48 by the average salary, which is 48 × 48,967 CZK in 2026.

NOTE: During the first year of registering your trade license freelance business, you only pay minimal deposits for social tax and health insurance contributions. Depending on your income during the whole year, you may need to pay the remaining balance after deducting the total deposits you made in the previous year.

Once you submit your income tax report, new deposit amounts for social tax and health insurance will be calculated and set, assuming your income will be similar to the previous year. This ensures that you can settle all deposit payments and avoid any outstanding balances if your income is similar to last year’s income.

That is one of the reasons why you are paying higher deposits for social tax and health insurance higher than the previous year.

Czech social tax and Health insurance debts

If you owe any payments, both the Czech health insurance and the Czech social tax offices will follow up for missing payments. It can seem confusing why you owe anything for past months’ payments in the Czech Republic, even if you’ve been paying on time. In fact, the debt doesn’t always mean that the authorities didn’t receive or register your latest payment.

The system in the Czech Republic works like this: first, they use your recent payment to cover older missing payments, partly missing amounts, or penalties for late payments.

Let’s say you paid your monthly Czech social and health insurance payments a few days after the deadline. Because the Czech office received your payment late, they will charge a penalty. Until you pay the penalty, the amount keeps growing and the total debt gets bigger.

Or let’s say, by mistake, you paid less than the full amount for one month. Later, when the Czech social tax or health insurance office checks your records, they see that the month wasn’t fully paid. Then they take part of your latest payment to cover the old missing amount. That’s why, even if you fully paid last month, you might still owe money for health and social insurance in the Czech Republic.

How to avoid unexpected debts in the Czech health and social system?

At Pexpats, we recommend using the following official tools to track and confirm your social tax and health insurance payments in the Czech Republic.

Business Databox (Datová schránka)

If you're self-employed or have a trade license, set up a Czech business databox. With it, you can:

Log in to the social tax office system

See your payment history

Check for penalties or unpaid deposits

MojeVZP app

To check your Czech health insurance payments, download the MojeVZP app. Then:

Activate it at any VZP office or request an activation code by mail

Log in to see all past payments and current balances

Access VZP benefits and book appointments online

You can book an appointment with the VZP office here

Income tax or Annual tax report

Income tax for trade license holders is fair. The Czech trade license holders can choose various types of tax options. Income tax is 15% of net income, and there is a 30,840 CZK tax discount that is applicable for all trade license holders. The Income tax will be 23% for the amount over 1,762,812 CZK.

Method 60/40 is the most common. The collection of payment receipts or invoices from expenses is not necessary. You can simply deduct 60 % of your yearly gross income and pay taxes on 40% of your gross income when you do your yearly income tax.

It means a fixed 60% cost allowance and a 40% income. For example, if the total gross income for last year was 300,000 CZK, then 300,000 – 60% cost allowance( fixed expenses) = 120,000 clean income. 15% tax will be paid from 120,000, which means 120,000 - 15%= 18,000 (tax amount) - 30,840 (tax discount) = 0 CZK (final tax amount).

In this example, taxes will not be paid. This method is convenient and the best solution for EU citizens and EU family members(partner visa). We don’t recommend this method for other nationalities who need to renew their visas or residency permits in the future because income proof is required if they don’t have at least 750,000 CZK in 2026.

For the situation and calculation that was used above, other nationalities should use the method of tax from the full amount to avoid visa renewal rejections due to insufficient funds.Please check more information about the income proof calculation of MOI offices here.

The Tax method 60/40 applies to income up to 2,000,000 CZK. In case if your income is over 2,000,000 CZK, you can still use the 60/40 method.

For Example, your yearly gross income is 2,100,000 CZK, and the calculation would be 2,100,000 - 100,000= 2,000,000, and now we deduct 60 %, 2,000,000 - 60%= 800,00,0, and adjust 100,000. So, in case if our gross income is 2,100,000, which is over the limit of using 60/40 and using partly 60/40, the final tax base is 900,000 CZK.

Our Trade License Services & Fees

We offer a full-service package for obtaining a Czech trade license for a flat fee of 10,900 CZK.

This includes:

Trade license registration (all government fees included)

Activation of the trade license

Registration with the Financial Tax Office

Registration with the Social Security Office

Registration with the Public Health Insurance Office

Setting up payment instructions

Lifetime After-Service support

Non-EU and non-US clients may require certified translations of criminal clearance reports (an extra fee may apply). Trade licenses for third-country nationals are issued with expiration dates.

For full details and additional services, please visit our Service page

Income Tax 2026

The income tax amount is increased to 23% for income above 1,762,812 CZK. Income tax under the net income of 1,762,812 CZK is 15%.

For example, your gross income is 3,500,000 CZK and your Czech income tax from freelancing in 2026 would be the following.

Using the 60/40 method up to 2,000,000 - 60%( 1.2 million CZK) = 800,000 CZK

1,500,000 + 800,000 = 2,300,000 CZK is your tax base

2,300,000 CZK - 1,762,812 CZK = 537,188 CZK

1,762,812 CZK - 15%= 264,422 CZK.

537,188 CZK - 23% =123,553 CZK.

So the total amount of income tax from 3,500,000 CZK of gross income is 387,975 CZK (264,422 CZK + 123,553 CZK).

How to Pay Czech Taxes in 2026

Simple Guide for Handling Czech Tax and Contribution Payments in 2026:

1. Czech Income Tax

Where to Pay: Transfer your income tax payment to the account number of the tax office in the district where you live.

Example: If your business is in Prague 1 but you live in Prague 4, pay to the Prague 4 office.

Reference: Use your DIC number as the payment reference.

Deadline: The deadline for Czech income tax payment is 60 days after you file your tax report

2. Czech Social Tax and Health Insurance

Payment Instructions: Pay the balance to the same bank account where you make your monthly payments.

Deadline: The deadline for the contribution balance payment is 8 days after submitting your social tax and health insurance declaration.

3. Refunds for Overpayments

Contributions Overpayment: Include your bank account number on the application forms to receive refunds. Refunds for contributions are issued in April or May 2026.

Income Tax Overpayment: Income tax bonuses or overpayment refunds are returned within 60 days after submitting your income tax return.

Note: You’ll only get a tax refund if your overpayment is more than 200 CZK. If it’s 200 CZK or less, the Tax Office won’t send it back. They’ll keep it and use it for your future tax payments.

Capital Gain and Crypto Tax

In the Czech Republic, income from cryptocurrency and capital gains is taxed at either 15% or 23%, depending on your total annual net income (tax base).

15% tax rate applies if your total income is up to 1,762,812 CZK.

23% tax rate applies to income exceeding 1,762,812 CZK

Only net income( profit) from Capital gains and Crypto is taxed. This means you need to pay taxes when you sell your investments and make a profit, and the profit amount is taxed. If you had a loss( the amount you bought is less than what you sold), then you don't declare any tax.

When you have a trade license and income from capital gains and crypto, then both incomes are merged, and the final tax is calculated. But the income from capital gains and crypto should be declared as private income for better tax optimization. Because if you declare the capital gains and crypto income as business income, then your social security and health insurance payments become higher.

Please, check the Czech Crypto and Capital Gain Tax calculator for 2026/2027

0 % Crypto and Capital-Gains Tax in the Czech Republic

Starting 15 February 2025, the Czech Ministry of Finance confirmed two new rules that make the Czech Republic one of the few EU countries where crypto profits and capital gains can be tax-free under specific conditions.

1. Holding crypto for more than 3 years

If you hold cryptocurrency for at least three years, the profit from its sale is fully exempt from personal income tax.

Example: You bought Bitcoin in 2023 and sold it in 2026, you pay 0 % crypto tax, regardless of the amount.

2. Profit under €4 000 per year

If your total annual profit from crypto is below €4 000 (equivalent = 100 000 CZK), it is also tax-free, even if held for a shorter period.

Example: You bought Bitcoin for €4 200 and sold it for € 8,100 within the same year. Your €3 900 profit is tax-free.

Crypto profits under €4 000 per year are tax-free in the Czech Republic.

3. Capital-gains rule

The same three-year exemption applies to shares and other investment gains — after this period, the capital-gains tax is 0 %.

After three years, both crypto and capital gains profits are exempt from Czech income tax.

If your crypto or investment income doesn’t meet these exemptions, it must still be declared within your annual personal-income tax return.

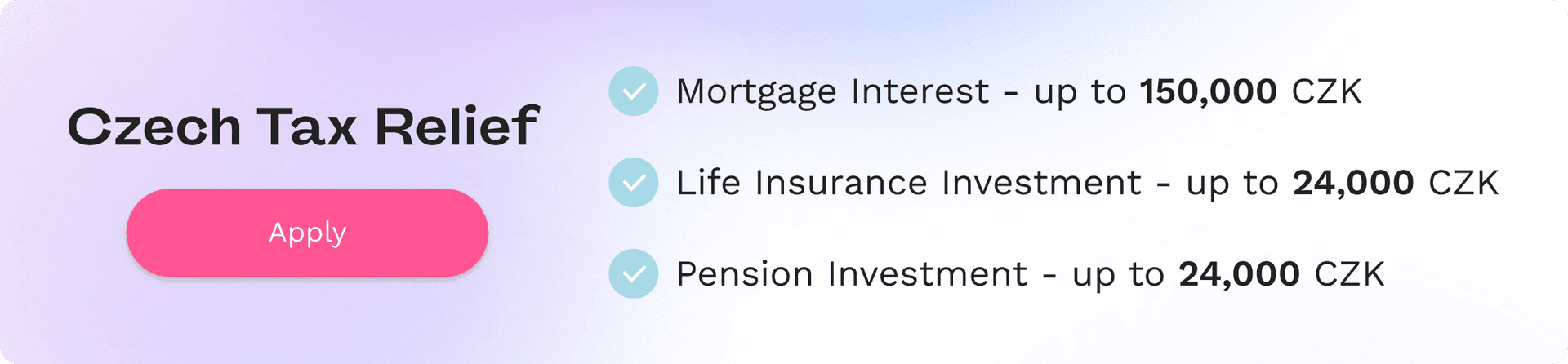

Tax Relief 2026

Tax relief in the Czech Republic is a deduction from your taxable income ( tax base), not from your gross income. It reduces the amount of income that is used to calculate your final tax.

Example:

If your annual gross income is 1,000,000 CZK and you use the 60-40 reporting method, only 40% of this amount is taxed. Your taxable base is:

1,000,000 CZK × 40% = 400,000 CZK

Any eligible tax relief is deducted from the 400,000 CZK tax base. Tax relief for 2026 can be used only if a freelancer’s annual net income is above 134,400 CZK.

These are the reliefs most frequently used by taxpayers in the Czech Republic.

Most Common Tax Reliefs 2026

Type of Relief | Who Qualifies | Maximum Deduction | Documents Needed |

|---|---|---|---|

Mortgage Interest Relief | Anyone paying mortgage interest during months with an active trade license | 150,000 CZK / year | Mortgage contract + bank confirmation of interest paid |

Private Pension Savings | Non-state pension contributors investing at least 1,700 CZK per month | 48,000 CZK | Payment confirmation with the total amount paid |

Life Insurance Relief | Czech private life insurance holders | 48,000 CZK | Payment confirmation with the total amount paid |

Financial Donations | At least 1,000 CZK donated to a Czech organization. | up to 30% of the tax base. | Donation receipt |

Blood, Plasma, and Organ Donation Relief | Anyone who donates blood, plasma, or organs in the Czech Republic | Blood or Plasma: 3,000 CZK Organ: 20,000 CZK | Confirmation from the hospital |

Continuing Education Examination Fees | Anyone who paid for exams confirming the improvement of qualifications | 10,000 CZK | Invoice or confirmation of examination fees |

Note:

Private Pension Savings and Life Insurance Relief together cannot exceed 48,000 CZK in total. All reliefs apply only to Czech-registered organizations and banks.

The maximum tax relief deduction is based on how many months you were eligible during the tax year.

For example, if you had a mortgage for only 1 month, you can deduct only 12,500 CZK — this is the monthly equivalent of the annual deduction limit of 150,000 CZK

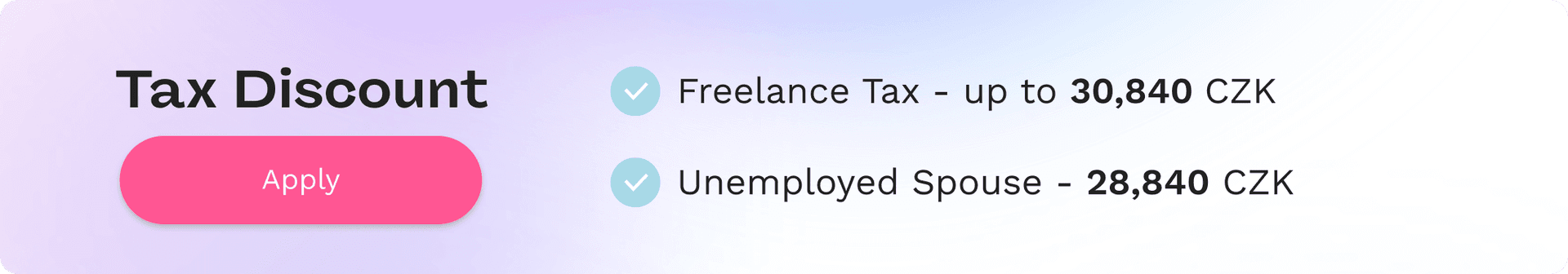

Tax Discounts 2026

Tax discounts in the Czech Republic reduce the final tax amount, not the tax base. They are applied after tax reliefs are deducted, and the tax is calculated. They lower the amount of tax you owe for the year.

The two main tax discounts used by freelancers in the Czech Republic are the freelancer discount and the spouse discount.

Most Common Tax Discounts 2026

Type of Tax Discount | Who Qualifies | Tax Discount Amount | Rules |

|---|---|---|---|

Freelancer Tax Discount | All self-employed people | 30,840 CZK/year | You get the full 30,840 CZK even if the trade license was active only part of the year. |

Spouse Discount | Married taxpayers with a spouse earning under 68,000 CZK/year | 24,480 CZK/year | Spouse must provide daily care to a child under 3; applies only for full months of marriage |

Additional Notes:

The freelancer tax discount can be applied even if self-employment is a side income under full-time employment.

Parental leave and maternity benefits do not count as income for the spouse discount.

The spouse discount applies only for full months of marriage in the previous tax year.

Example: If the marriage began on 30 November, only December counts as a full month, and you can claim 2,040 CZK for that month.

The spouse tax discount can be claimed only for the period the spouse lived in the Czech Republic.

Example: If your spouse moved to the Czech Republic in March, you can claim the spouse discount only for 10 months (March–December)

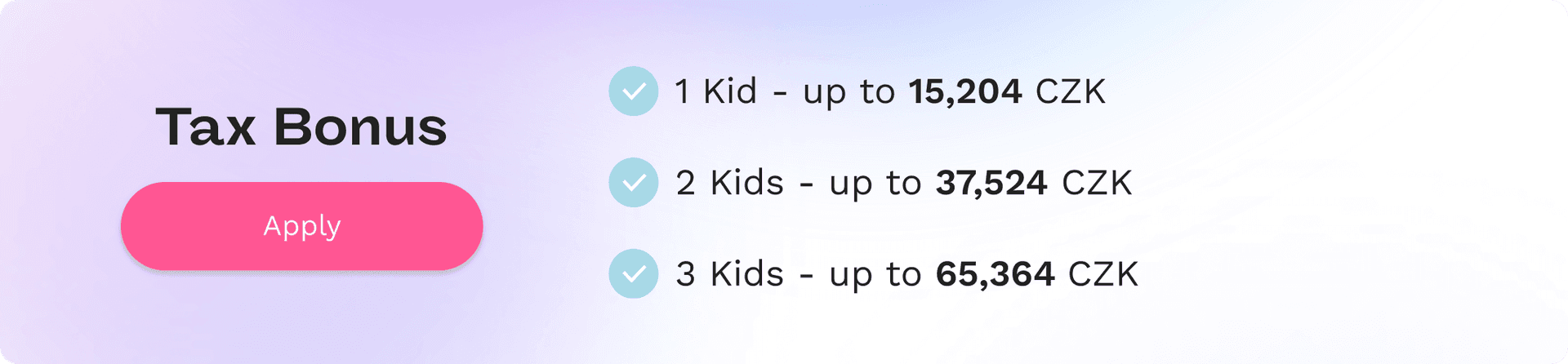

Tax bonuses 2026

A tax bonus in the Czech Republic is an amount you can receive back from the tax office when your tax discounts are higher than the tax you owe.

Parents may claim a bonus for each child, depending on the number of children and how many full months the child existed in the previous tax year.

Child Tax Bonuses 2026

Child Order | Tax Bonus Amount |

|---|---|

First child | 15,204 CZK/year |

Second child | 22,320 CZK/year |

Third or more children | 27,840 CZK/year per child |

Source: Based on current rules of the Czech Financial Administration (Finanční správa ČR). Reviewed and maintained by Pexpats.

Additional Notes

Only one parent can claim the child tax bonus.

The bonus depends on the number of full months the child existed during the tax year.

The length of your trade-license activity does not affect eligibility

Example: If a child was born on 30 November, only December counts as a full month. You can claim 1/12 of the yearly amount (for a first child: 1,267 CZK).

If the child existed for the full year but your trade license was active for only one month, you can still claim the full yearly bonus.

You can claim the Czech tax bonus only for the period the child lived in the Czech Republic.

Example: you moved to the Czech Republic with your child in April. As your child was not living in the Czech Republic for the full year but only since April, you can claim the child bonus only for 9 months.

Personal income tax advance deposit

If you pay over CZK 30,000 in income tax (after relief, discounts, and bonuses) in a given year, you should pay income tax advances the following year. Income tax advances are deposits that will go towards part of your income tax balance at the end of the next taxable period.

However, note that you do not need to make income tax deposits if:

Your income taxes were CZK 30,000 or less.

It is the first year of running a business or freelancing.

You also have full-time employment, which pays the advances.

You’re registered and paying flat taxes.

Categories in which you will need to pay an advance towards your personal income tax include:

You paid income tax over CZK 30,000 but less than CZK 150,000. In this case, you must make deposits semi-annually (2x per year) at 40% of the original tax obligation.

You paid income tax over CZK 150,000. In this case, you must make quarterly advance payments at 40% of the original tax obligation.

Important Note: If you cancel your trade license but have upcoming tax advance payments, you need to cancel them with the tax office. Otherwise, they’ll still expect the deposits, and you could face penalties for missing a payment.

Trade license validity and extension

After activating a trade license, how long the license is valid depends on your residency status. In some situations, there will be a validity (“valid until”) date. Other types of residency grant trade license validity for an unlimited amount of time.

Non-EU Zivno Visa or any Long-Term Residency holders have a trade license valid for the duration of their visa / residency. (Make sure to extend the trade license when applying for a new visa, biometric card, or bridge visa during the residency process.)

Ukrainian Citizens with Refugee Status possess a valid trade license for the duration of their temporary protection visa. (Remember to extend the license when applying for a new protection visa.)

Partnership Visa and Permanent Residency holders receive an unlimited trade license. (There is no need to file for extensions. However, it is important to remember to pause the trade license if not actively generating income from self-employed activities.)

EU Citizens, their family members, and UK Citizens with Temporary Residency under the Brexit deal have unlimited validity of the trade license.

Czech VAT

The Czech VAT registration limit amount is increased to 2,500,000 CZK from 1.1.2025. You will become a Czech national VAT payer if your income exceeds 2,500,000 CZK during the tax year.

To qualify for Czech national VAT, both of the following conditions must be met:

Your gross income/turnover over the tax year must exceed 2,500,000 CZK.

Your income source must be from Czech-registered companies or private individuals (non-business clients).

If you do not meet both conditions, you do not qualify for Czech national VAT.

Czech VAT rates and charging VAT in 2026

The Czech Republic has 2 VAT rates

The standard rate of VAT - 21%

The reduced rate of VAT - 12%

Examples of Charging VAT for Czech registered businesses while invoicing out of the Czech Republic for the services provided from the Czech Republic.

1. Invoicing as Czech VAT Registered business

a) Invoicing for services from Czech registered businesses to EU registered businesses, 0% VAT - EU reverse charge

b) Invoicing for services from Czech registered businesses to individual clients, charge 21 % VAT

c) Invoicing for services from Czech registered businesses to out-of-EU registered businesses, 0% VAT

2. Invoicing as Czech Light VAT-registered business

a) Invoicing for services from Czech registered businesses to EU registered businesses, 0% VAT - EU reverse charge

b) Invoicing for services from Czech registered businesses to individual clients, charge 21 % VAT

c) Invoicing for services from Czech registered businesses to out-of-EU registered businesses, 0% VAT

3. Accepting services from companies registered out of the Czech Republic

If you receive services from companies registered out of the Czech Republic( google/Facebook ads, Airbnb, etc) you should pay 21% VAT in the Czech Republic.

For example, you promote your business on Facebook and Facebook ads are running in the Czech Republic. Since Facebook is not a Czech-registered business, you should pay a 21% VAT on top of the Facebook ads fee.

Light VAT

Light VAT is needed if you invoice EU-registered companies that are registered out of the Czech Republic. You should apply light VAT statements monthly. Please contact us for the accounting service packages.

Contact us and we will help you to understand the tax system in the Czech Republic!

What is the Czech DIČ, VAT Number, and Light VAT?

Understanding the different types of tax identification numbers in the Czech Republic is important for proper tax administration. Here's a breakdown:

DIČ (Tax Identification Number): This is your Czech tax ID number. It's issued when you register with the Czech tax office and is required for all taxpayers.

VAT Number: This is your national VAT registration number. It's used when charging and reporting VAT on transactions within the Czech Republic. You must apply separately to become a VAT payer.

Light VAT (EU VAT Number): This is used specifically for EU cross-border transactions. It allows you to invoice EU-based companies with 0% VAT under the reverse charge mechanism. Like the VAT number, it also requires a separate registration process.

Important: Just because you have a DIČ (your Czech tax number) doesn’t mean you’re registered for VAT or Light VAT. Each one has its own requirements, and you’ll need to go through the application process to get them.

Bank Account and Invoicing

If you're doing business under a Czech trade license, it's important to understand how your taxes work. In the Czech Republic, your taxes are calculated based only on your invoices, not on your bank transactions.

The Czech tax system uses the 60/40 method:

60% of your income is automatically counted as expenses.

40% is considered your taxable income.

You don't need a Czech bank account or a dedicated business account to operate under a Czech trade license. You can easily get paid through Revolut, Wise, or any other international banking service.

If you issue an invoice in a currency other than Czech Koruna (CZK), you just need to show the official exchange rate valid on the invoice issue date.

Invoices don’t have to be written in Czech either — you can create invoices in any language that's convenient for you and your clients.

Czech trade license as a side income

Side income means you have both full-time employment at a Czech-registered company and have a trade license secondary income.

In the first year of side business, you don't pay social security and health insurance deposits. But depending on your income you might pay balances and start paying deposits for both health insurance and social security contributions after you declare income tax report for the previous tax year.

Even if you income from a trade license is much more higher then your full-time employment salary, the trade license income is always considered as a secondary side income. If you are registered under a flat tax regime and your income type changes from main income to secondary side income, you should cancel your trade license and switch flat tax to a regular tax regime

Trade licenses during the maternity stay, for students or Ritered self-employed are considered as a side income too.

Social Security balance

If your clean( net) income from your trade license is higher than 111,743 CZK ( your 40% when you use the 60/40 tax method) then you start paying the deposit next year.

So the limit for social tax is 117,521 CZK. If you are over this amount you will pay some balance and start paying a minimum deposit of 1,574 CZK next year, if your clean income for the full year is under 117,521 CZK, then you pay 0 CZK balance and deposits.

Social Tax is calculated in this way: 0,292 x 0,55 x your clean income (40%): months of your trade license last year.

For example, as a side income trade license, you earned 103,500 CZK last year. You used the tax method 60/40. So your clean income (40%) is 41,400 CZK.

Social Tax, you don’t pay any balance or deposit because 41,400 CZK is less than 117,521 CZK. Also, this rule applies if your side income lasts the full tax year.

Health Insurance balance

41 400 CZK (your clean income) x 0,50 x 0.135 = 2 795 CZK. That is what you should pay for your Health insurance balance while you have a trade license as a side business.

Income tax

Income tax of side business trade license, employee employment income, and trade license income for the full year are merged and declared in one tax report with all tax discounts and bonuses for the full previous tax year.

Flat Tax 2026

In 2021, the Czech Financial Office introduced a new flat tax reporting method. As of 2026, the minimum flat tax amount in the Czech Republic is 9,984 CZK per month. This amount covers health insurance, social insurance, and income tax, with no paperwork and limited legwork involved.

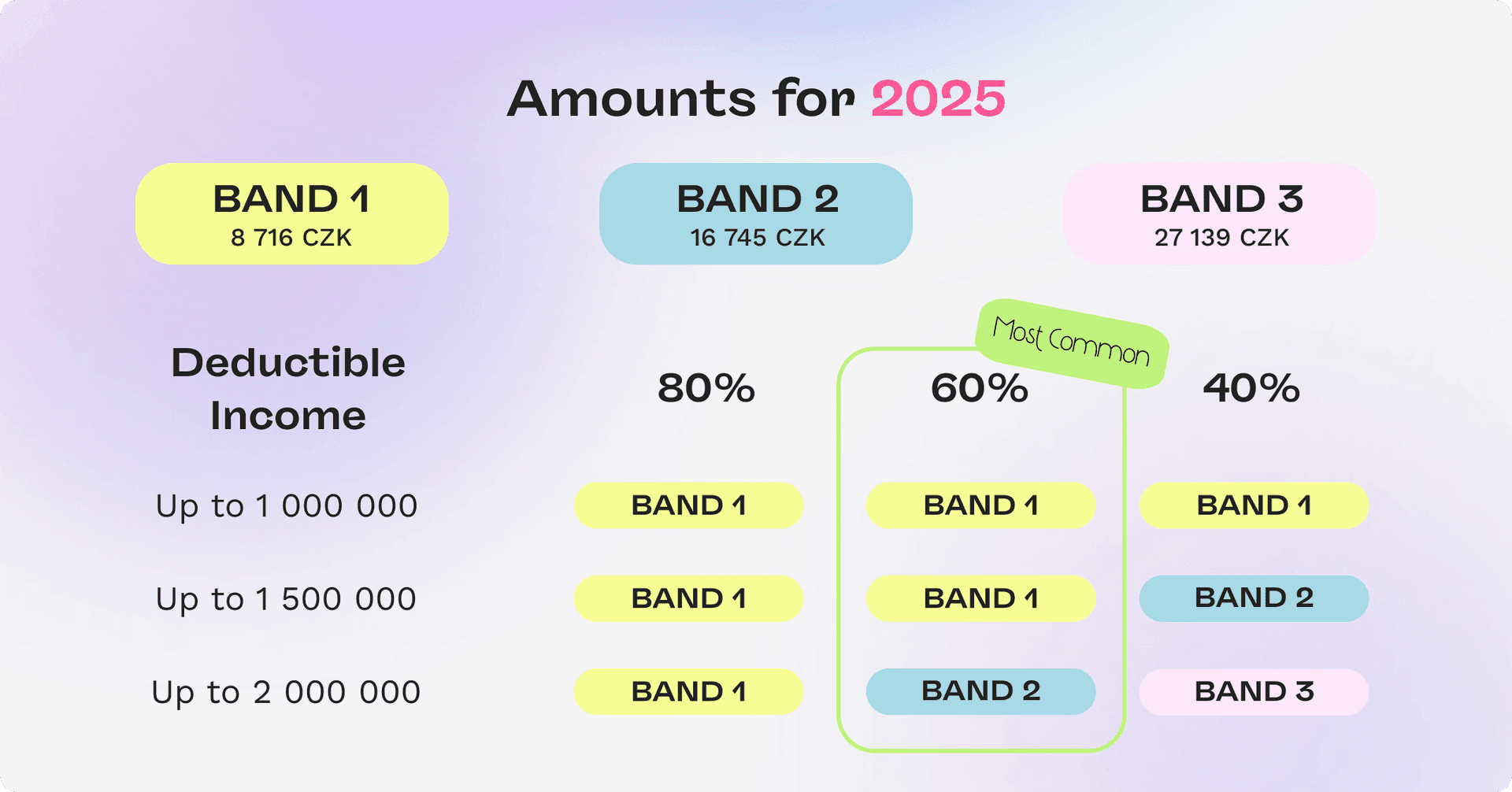

Updates to the Czech flat tax in 2026 include:

The division of tax rates into tax rate bands (according to annual income and deductible expenses);

An increase in the total income limit;

A change in the payment amount for each bracket.

The flat tax limit is up to a maximum of 2,000,000 CZK, divided into the three bands above, and depending on gross income level.

However, keep in mind that sometimes it is not advantageous to take on a flat tax reporting regime. Paying a flat tax makes more sense for single entrepreneurs. This is because these taxpayers often have few discounts, along with no tax bonuses from offspring.

If you have children or expect to claim various relief and discounts, other tax reporting methods will be more advantageous. Remember to always consider professional tax consultation before signing up for flat tax reporting if in any doubt.

Gift Tax in the Czech Republic

Officially, the Income Act of 2014 abolished Gift Tax in the Czech Republic, as well as inheritance tax. Now, taxpayers must declare all income deriving from donations as part of their regular income tax. This amounts to 15% for natural persons, or 19% from legal entities.

In other words, assets which derive from donations are subject to zero gift tax. However, they are included under income tax as gratuitous income.

This income is thus taxed at the same rate as all other income from one year to the next. That is, unless the donation is exempt from income tax. Exemptions from income tax include:

Donations from a spouse or direct relatives (children, parents, grandparents, grandchildren)

Gifts from a collateral line of kin (siblings, nieces, nephews, uncles, aunts; children’s spouses; spouse’s children, spouse’s parents, parents’ spouses)

Gifts from persons who lived with the beneficiary, donor, or testator for at least 1 year before the transfer or death of the testator in a joint household. This person would thus be a caretaker of the joint household, or were once a dependent of the beneficiary, donor, or testator for maintenance purposes.

Note: Starting from 1.1.2024, any donation that does not exceed CZK 50,000 CZK per year (tax period) is exempt from income tax. This stands regardless of the donor.

Taxes for donating real estate

Donation is one way to easily and inexpensively transfer real estate to somebody. Real estate is exempt from gift taxes. However, donating real estate does fall under income tax if you are not one of the groups above.

The same rules also apply, so natural persons will pay 15% and legal entities pay 21%. This amount falls under gratuitous income and will have subsequent tax rates from one taxable year to the next.

How to reduce the tax burden by reporting a cooperating person?

You can also transfer part of your income to a cooperating person and thereby reduce your tax burden. The cooperating person helps the self-employed person in business activities. These can be, for example, administration, accounting, customer orders, communication with suppliers, etc.

Most often, the cooperating person is a husband or wife, although in some cases it can be children or parents. The cooperating person must reside and work in the same household or participate in a joint “family business” venture. (Find the legal definition of the so-called “family business” in Section 700 of the Labour Code.)

Who can you report as a cooperating person?

A child over 18 who is currently enrolled as a student

Retired parent

Wife on parental leave

A spouse whose main employment is with the employer

If the cooperating person is currently on parental leave or otherwise employed, their cooperation is considered a secondary, independent income-earning activity. However, it is more advantageous if the cooperating person’s main self-employment is from the cooperation. This is due to the mandatory contributions to health and social insurance for secondary, self-employed persons.

Conditions for cooperating persons

Additionally, the following conditions apply to a cooperating person:

They are of at least 18 years of age with the legal power to conduct their own personal and financial affairs

There is no trade license is necessary, while activities are regarded as self-employed

Only the cooperating person is able to apply for a spouse or child discount. The entrepreneur cannot.

All income and expenses must be divided and reported by the entrepreneur and cooperating person according to the law.

Both parties must fulfill all reporting obligations.

How to report a cooperating person

To take on a cooperating person, the entrepreneur must inform the tax office, social security, and the health insurance provider. The cooperating person must also register for income tax on their own behalf, and have a Tax ID number.

Social security offices then provide a variable symbol for making advance payments. The same is true for health insurance, which also requires monthly advances from the cooperating person.

Limits on transferring income to a cooperating person

According to the Income Tax Act, if you transfer part of your income to a cooperating person, you must transfer the same percentage of expenses.

For a simple example: if you transfer 40% of your income, you must also transfer 40% of your expenses.

The Income Tax Act also stipulates maximum limits for the spouse or other cooperating persons. These are:

For a cooperating spouse, the maximum transfer limit of income and expenses is up to 50%, to a maximum of CZK 540,000.

If cooperating with a non-spouse, the maximum transfer limit is 30% of income and expenses, up to a maximum of CZK 180,000.

Note: You can have more than one business partner. However, if you have more than one cooperating person, you can transfer a maximum of 30% across multiple cooperating persons.

A practical example of reporting a cooperating person

For example, let’s take the tax report of Adam, a self-employed entrepreneur. Adam will report his spouse Eva as a cooperating person.

Adam earned 800,000 CZK and he applied the 60/40 method to his taxes.

Adam’s expenses are therefore CZK 480,000, with a profit of CZK 320,000.

Adam applies the basic taxpayer’s discount (CZK 30,840), so he pays CZK 17,160 remaining to pay in taxes.

However, Adam decides to use a cooperating person. And, because the cooperating person is Adam’s spouse, he can transfer 50% of his income and expenses to her.

Adam transfers CZK 400,000 of his income and CZK 24,000 of his expenses to his spouse Eva.

Adam’s tax return becomes the exact same as Eva’s.

They both now have an income of CZK 400,000, expenses at CZK 240,000, a profit of CZK 160,000, with a remaining 15% income tax to pay of CZK 24,000.

Adam and Eva both apply the basic taxpayer’s discount of CZK 30,840, meaning they now have zero tax liability.

In this case, Adam and Eva both pay zero income tax. Adam reduces his tax burden by claiming Eva as a cooperating person. Meanwhile, Eva’s profit likewise isn’t high enough for any tax liability.

Sickness Insurance for OSVČ (Self-Employed) in the Czech Republic

Sickness insurance is optional for freelancers and self-employed people (OSVČ) with a trade license in the Czech Republic. If you decide to pay it, it will affect your maternity leave benefits and the amount of your monthly parental leave payments.

Minimum Deposits

The minimum sickness insurance payment is 2.7% of your tax base (net income). In 2026, the minimum monthly payment is 243 CZK, and the maximum is 5,029 CZK.

First Year of Registration

During your first year of sickness insurance, you pay the minimum amount of 243 CZK, based on the official minimum tax base of 9,000 CZK in 2026

Second Year

From the second year on, your monthly payments depend on your income from the previous year.

For example, if you earned 1,000,000 CZK last year, after applying the 60/40 expense deduction method (60% expenses), your tax base is 400,000 CZK. Your new sickness insurance payment is calculated like this:

400,000 CZK × 0.55 × 0.027 ÷ 12 months = 495 CZK per month.