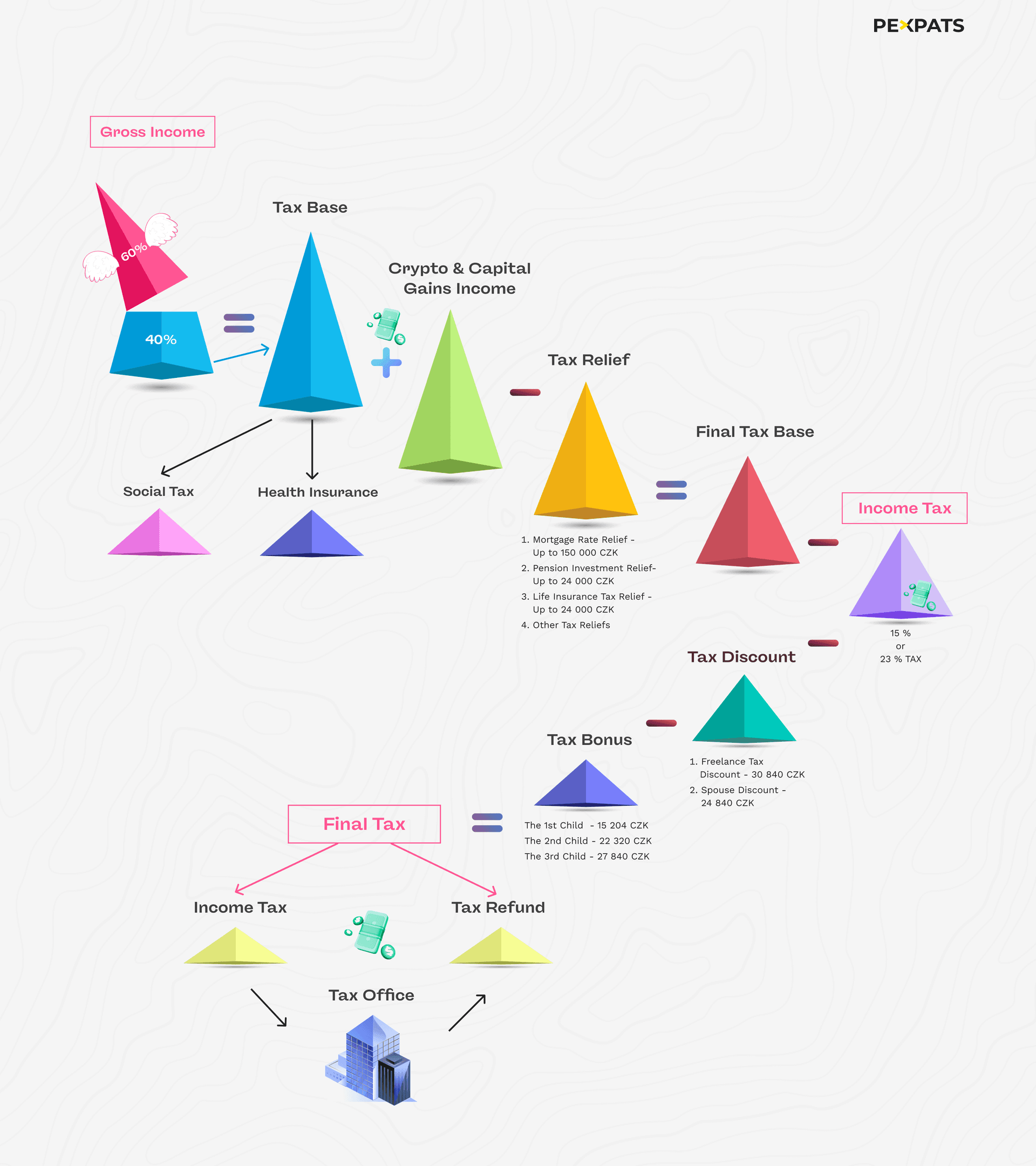

Tax relief is a deduction from your taxable income (tax base), not from gross income. It lowers the income amount used to calculate income tax.

Tax discount is applied after income tax is calculated and directly reduces the final tax

Tax bonus is a tax refund amount paid by the tax office if tax discounts are higher than the calculated tax amount.

Example (step by step)

Gross income: 1,000,000 CZK

Expense method: 60/40

Tax base:

1,000,000 × 40 % = 400,000 CZK

Step 1 – Tax reliefs (reduce tax base)

You qualify for tax relief of 50,000 CZK

New tax base:

400,000 − 50,000 = 350,000 CZK

Step 2 – Income tax calculation

Income tax is calculated from 350,000 CZK

Calculated income tax: 52,500 CZK

Step 3 – Tax discounts (reduce tax amount)

You qualify for tax discounts of 30,840 CZK

Tax after discounts:

52,500 − 30,840 = 21,660 CZK

Step 4 – Tax bonus (refund)

You qualify for a tax bonus of 15,204 CZK

Final tax result:

21,660 − 15,204 = 6,456 CZK ( Tax you should pay)

If the result is negative, the tax office would pay the difference as a refund.

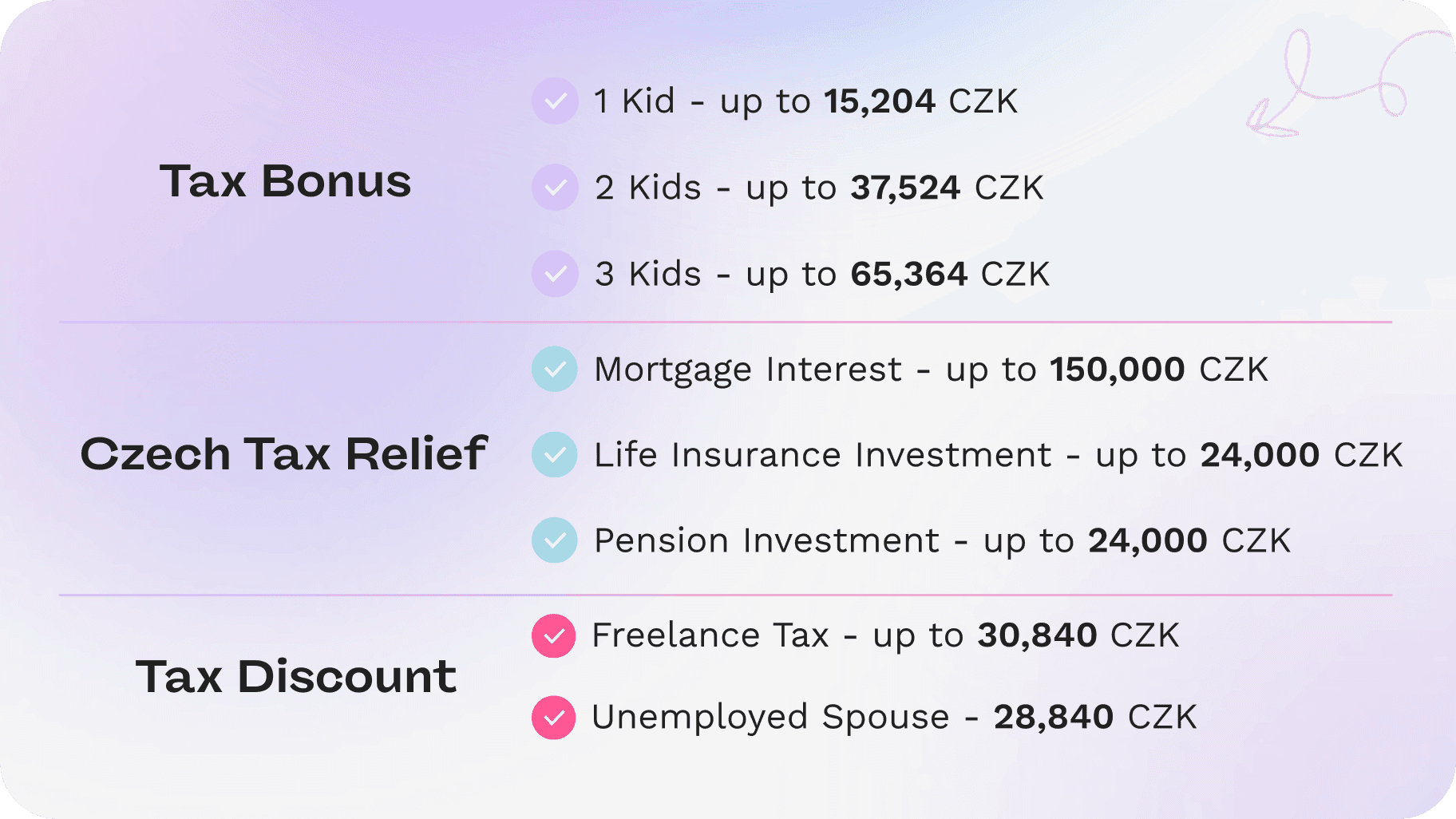

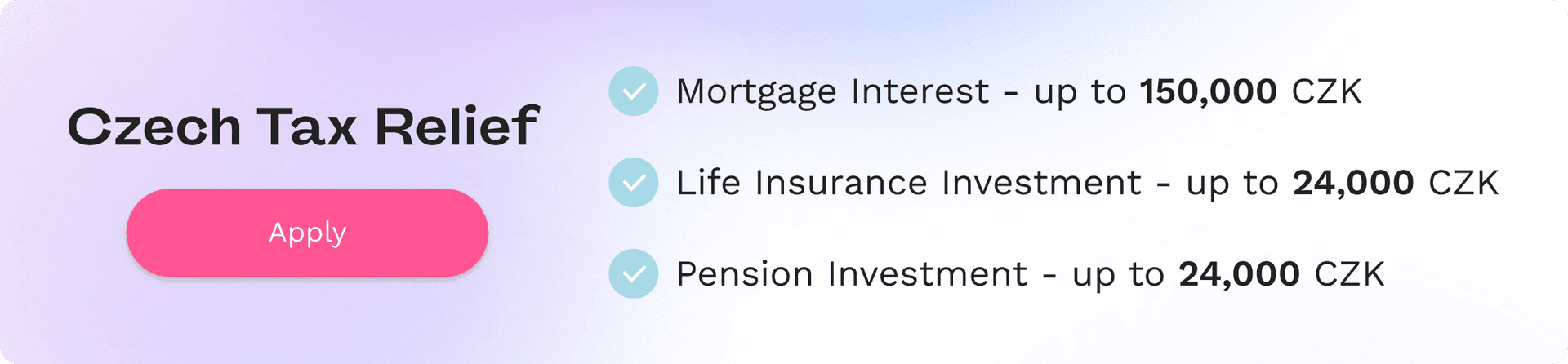

Tax Reliefs in the Czech Republic (2026)

Tax reliefs help reduce the amount of your income that gets taxed, which can lower the total tax you have to pay. Below are some of the main tax reliefs available:

Most Common Tax Reliefs 2026

Type of Relief | Who Qualifies | Maximum Deduction | Documents Needed |

|---|---|---|---|

Mortgage Interest Relief | Anyone paying mortgage interest during months with an active trade license | 150,000 CZK / year | Mortgage contract + bank confirmation of interest paid |

Private Pension Savings | Non-state pension contributors investing at least 1,700 CZK per month | 48,000 CZK | Payment confirmation with the total amount paid |

Life Insurance Relief | Czech private life insurance holders | 48,000 CZK | Payment confirmation with the total amount paid |

Financial Donations | At least 1,000 CZK donated to a Czech organization. | up to 30% of the tax base. | Donation receipt |

Blood, Plasma, and Organ Donation Relief | Anyone who donates blood, plasma, or organs in the Czech Republic | Blood or Plasma: 3,000 CZK Organ: 20,000 CZK | Confirmation from the hospital |

Continuing Education Examination Fees | Anyone who paid for exams confirming the improvement of qualifications | 10,000 CZK | Invoice or confirmation of examination fees |

Important (2026)

Tax reliefs, tax discounts, and tax bonuses are applied only if you qualify for them, and only if your annual net income exceeds 134,400 CZK.

Private Pension Savings and Life Insurance Relief combined cannot exceed 48,000 CZK per year.

All tax reliefs apply only to Czech-registered banks, insurers, hospitals, and organizations.

The maximum deductible amount depends on how many months you were eligible during the tax year.

Mortgage interest relief applies only for housing used for your own living.

For financial donations, the total deduction is limited to 30% of the tax base, and the minimum donation is 1,000 CZK or 2% of the tax base.

Education exam fees must relate to qualification improvement; general courses or training without certification do not qualify.

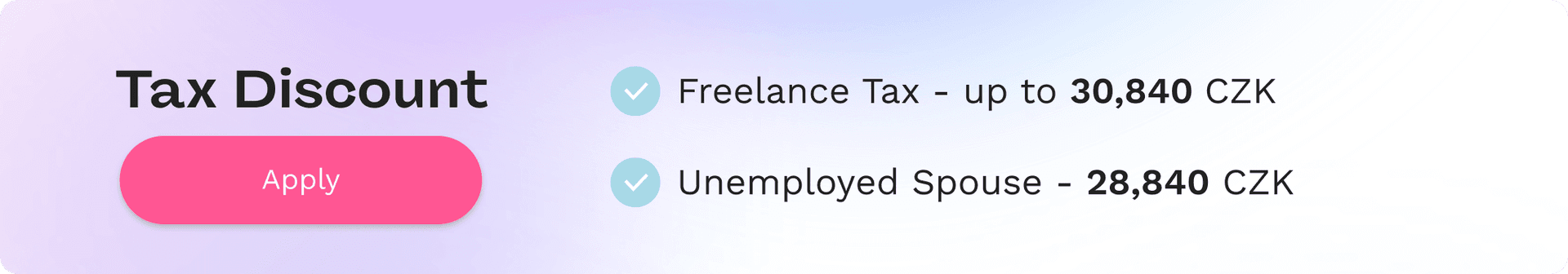

Tax Discounts in the Czech Republic (2026)

Tax discounts reduce the actual amount of tax you owe. Here are the most common tax discounts in the Czech Republic:

Most Common Tax Discounts 2026

Type of Tax Discount | Who Qualifies | Tax Discount Amount | Rules |

|---|---|---|---|

Freelancer Tax Discount | All self-employed people | 30,840 CZK/year | You get the full 30,840 CZK even if the trade license was active only part of the year. |

Spouse Discount | Married taxpayers with a spouse earning under 68,000 CZK/year | 24,480 CZK/year | Spouse must provide daily care to a child under 3; applies only for full months of marriage |

Important (2026)

The freelancer tax discount can be applied even if self-employment is a side income alongside full-time employment.

The spouse discount can be claimed if the spouse had no income or earned under 68,000 CZK. Parental leave and maternity benefits do not count as income. The spouse must live in the Czech Republic and care for a child under 3 years.

The spouse discount applies only for full months of marriage in the tax year. If the marriage started on 30 November, only December counts, and the claimable amount is 2,040 CZK for that month.

You can claim the spouse tax discount only for the months your spouse lived in the Czech Republic during the tax year. Example: If your spouse arrived in the Czech Republic in May, the spouse discount can be applied for 8 months (May–December)

To claim the spouse discount, you need a marriage certificate with a Czech translation, a residence document (biometric card or visa for a non-EU spouse), and a signed affidavit from the spouse. Pexpats has a tool for generating the spouse affidavit, which can be generated online here.

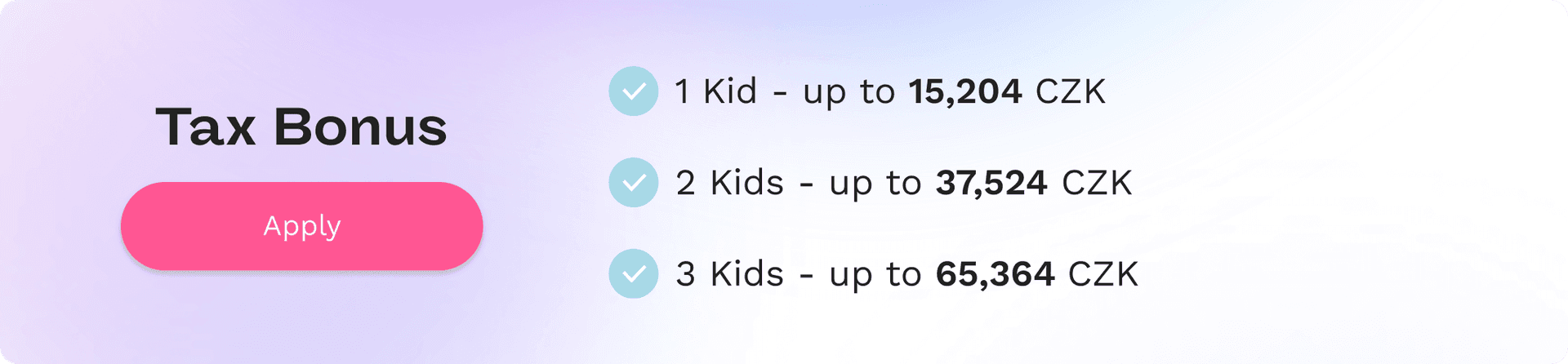

Child Tax Bonus in the Czech Republic (2026)

A tax bonus is a tax credit refund for overpaid taxes after all deductions. This bonus is available for parents who live in the Czech Republic with their children.

Child Tax Bonuses 2026

Child Order | Tax Bonus Amount |

|---|---|

First child | 15,204 CZK/year |

Second child | 22,320 CZK/year |

Third or more children | 27,840 CZK/year per child |

Source: Based on current rules of the Czech Financial Administration (Finanční správa ČR). Reviewed and maintained by Pexpats.

Important (2026)

Only one parent can claim the child tax bonus for a specific child. To confirm this, a spouse affidavit must be signed confirming that the other parent does not claim the bonus.

Pexpats has an online tool where this affidavit can be generated for claiming the tax bonus and tax refund in the Czech Republic.

The child must live in the Czech Republic for the tax bonus to apply. The Czech child tax bonus can be claimed only for the months the child lived in the Czech Republic. Example: If you moved to the Czech Republic with your child in September, you can claim the child bonus for 4 months (September–December).

The tax bonus is calculated based on the number of full calendar months the child existed during the tax year. For example, if a child was born on 30 November, only December counts as a full month, and you can claim 1/12 of the annual bonus (for the first child: 1,267 CZK).

The length of your trade-license activity does not affect eligibility for the child tax bonus. If the child existed for the full year, you can claim the full annual bonus even if your trade license was active for only one month during the year.

If tax discounts and the child tax bonus together reduce the calculated income tax below zero, the tax office pays the difference as a tax refund. This refund is paid directly by the Czech tax office.

What do you need to provide:

Birth certificate (with Czech translation).

Biometric card or visa (for a non-EU child).

School attendance confirmation (for children over 7).

Signed affidavit with the child’s details from your spouse. Can be generated here.

Czech Republic Tax Reliefs, Discounts & Bonuses FAQ

1. What are tax reliefs in the Czech Republic? Tax reliefs are expenses you can deduct from your taxable income, lowering your tax base and reducing the amount of taxes you pay.

2. Who qualifies for tax reliefs in the Czech Republic? Freelancers (OSVČ), employees, and parents can qualify for tax reliefs if their income meets the required thresholds for the tax year.

3. What is a tax discount in the Czech Republic? A tax discount reduces the total tax amount you owe. It’s deducted directly from your calculated tax.

4. What is a tax bonus in the Czech Republic? A tax bonus is a refund from the tax office if your final tax amount is less than the bonus. It’s mainly for parents with children.

5. How do tax reliefs work for freelancers in the Czech Republic? Freelancers can use tax reliefs if their annual net income exceeds 134,400 CZK in 2026.

6. Are tax discounts available for freelancers in the Czech Republic? Yes, freelancers can claim tax discounts, such as the annual tax discount for freelancers (OSVČ), reducing their final tax bill.

7. Can I claim tax reliefs for donations in the Czech Republic? Yes, you can deduct donations from your tax base if they meet the required conditions.

8. How do I apply for tax reliefs in the Czech Republic? You apply by submitting the necessary documentation (e.g., receipts, bank statements) when filing your tax return.

9. Tax Overpayment Refund in the Czech Republic: How Much Do You Need to Get It Back?

If you overpay taxes in Czechia, you’ll only get a refund if the amount is more than 200 CZK, Any overpayment 200 CZK or less is not refunded. The Tax Office keeps the amount on your account and automatically applies it to future tax payments.