Full-Time Employment vs Trade License (Contractor)

When hiring or job-seeking in the Czech Republic, there are always questions about full-time employment contracts versus trade license agreements. Some companies prefer to hire only contractors on a trade license (Živnostenský List, Zivno), while others want full-time employees.

However, both work agreements have different health and social insurance obligations, income tax requirements, and even tax relief opportunities. Read ahead to find out the best contract in your case: full-time, or contracting on a Czech trade license.

Paying Income Tax, Social Security, and Health Insurance

One advantage to full-time employment contracts is that the employer is responsible for social security, health insurance, and income tax reports. This amounts to far less responsibilities than working on a Czech trade license, which essentially makes you your own bookkeeper.

On a trade license, contractors are responsible for their own monthly insurance payments, recordkeeping, and declaring annual contributions and income. However, unlike full-time employment, there are different tax reporting options, and the tax rates are often quite advantageous.

For example, a tax rate of 15 percent applies to income under CZK 1,676,052. For income over this limit, a tax rate of 23 percent applies. Every taxpayer also receives the standard taxpayer’s discount of CZK 30,840. This together with various forms of tax relief and deductibles (if applicable) can further reduce the tax burden.

It is also why self-employed freelancers and contractors on a trade license tend to pay less income tax than employees. Contractors also have lower monthly and annual payment obligations to social security and health insurance.

Minimum Trade License Health and Social Payments

In 2025, the minimum mandatory, public health insurance payment for trade license holders is CZK 3,143 each month. Health Insurance Rate is calculated from 13.5% of 55 % of net annual income.

The minimum monthly social security payment is CZK 4,759. At the end of the year, it may be necessary to pay a balance depending on the amount of income earned.

Social security payments must be 29.2% from 55 % of annual clean income. If your earnings are higher than what the minimum deposits cover, it’s advisable to pay higher deposits voluntarily.

Trade License Income Taxes - the 60/40 Method

Usually, the most common tax method for trade license contractors is the 60/40 method. The 60/40 method provides an expense allowance of 60% of gross annual income, with the remaining 40% taxable.

It is then possible to apply multiple tax discounts and bonuses to the tax base, such as for raising children or an unemployed spouse. This makes the tax burden minimal. The freelancer also does not need to keep payment records, receipts, or invoices to prove their expenses.

Freelancer Income Tax Example

For a quick example, take a freelancer whose gross income last year was CZK 300,000. Using the 60/40 method, their income tax calculation becomes:

CZK 300,000 * 60% = CZK 180,000 (fixed expenses)

CZK 300,000 - 180,000 = 120,000 (net income)

CZK 120,000 * 15% tax rate = 18,000 (tax)

CZK 18,000 - 30,840 (automatic taxpayer’s discount) = zero owed to income tax

Notice that in this calculation, there is zero personal income tax to pay. It is also extremely convenient for freelancer, as they do not need to submit any proof of their expenses.

Full-Time Employment Taxes, Social, and Health

After a three-month probationary period, full-time employees gain the protection of Czech Employment Laws, and become the full responsibility of the employer. This means that by law the employer must pay into employee taxes, social security, and health insurance. The employee receives their net income after these payments, with the employer paying part of the costs.

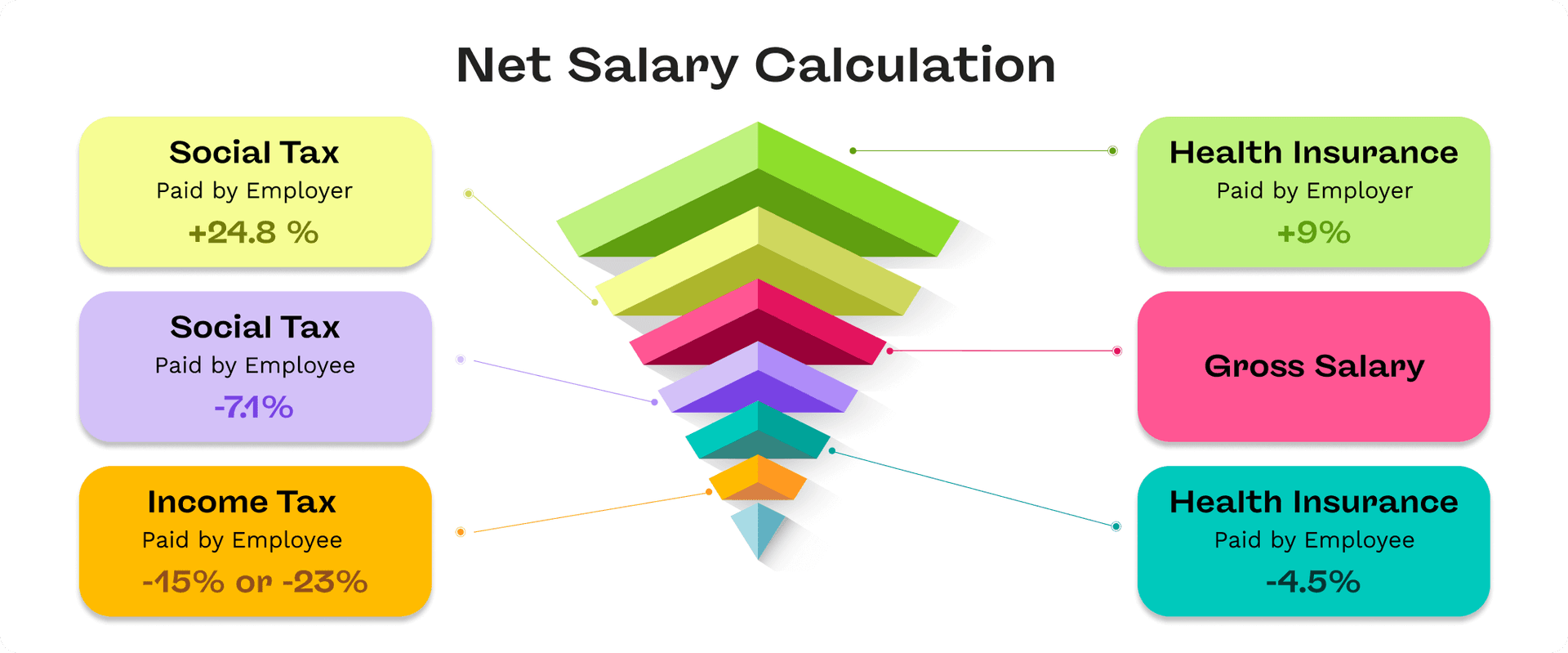

For example, in 2025/ 2026, a full-time employee pays from their gross salary the following.

Health Insurance - 4.5% of employee gross salary (the employer pays an additional 9%)

Social Security Tax - 7.1% of employee gross salary (the employer pays an additional 24.8%)

Income Tax - 15 to 23 percent, depending on total earnings (this comes directly from the employee’s gross salary)

Employee vs Trade License Net Income After Taxes

Take for example a full-time employee contract of CZK 1 million gross annual income. This calculation becomes:

CZK 1 million (gross employee annual income) - CZK 119,160 (income tax) - CZK 71,000 (social security) - CZK 45,000 (health insurance) = CZK 764,840 net income after taxes.

Now, compare that to the same CZK 1 million gross annual job offer, but on a trade license. The trade license calculation is:

CZK 1 million (gross trade license income) - CZK 29,160 (income tax) - CZK 64,240 (social security) - CZK 37,716 (health insurance) = CZK 868,884 net income after taxes.

Note: Remember that employees receive their salary after all deductions, and they do not need to submit an annual tax return. However, in some cases such as claiming additional tax credits and discounts, they can voluntarily file an employee tax return.

Also, although employees work for only one employer, they can register a trade license for a side business. This might be for earning side income with an extra job, or to claim additional income from hobbies or services

How to Open a Trade License for Side Income

If you have full-time employment and want to start a side job, you must register trade license. However, you will not need to pay social security and health in the first year. These remain the responsibility of your employer until after the end of the first year.

At this point, you must request an annual statement from your employer, and use it to determine if you need to settle any remaining balance. The balance will depend on the total income from employment, and the tax base from your trade license.

Authorities then decide your taxes on side income and contribution balances from your gross salary for the full previous year.

Note: To arrange a trade license tax return, and calculate taxes with remaining balances, you must submit an official proposal to your employer. This you do through an official Czech document, the Potvrzení o zdanitelných příjmech ze závislé činnosti.

Obtaining Mortgages, Maternity Stay, and Paternity Benefits

It is easier to obtain a mortgage for full-time employees than Czech freelancers. This is because banks view employees as more trustworthy. Employees have more worker protections from Czech employment laws, and, more importantly, easily documented and stable income.

On the other hand, trade license holders can lose work contracts, partnerships, and deals much easier. They also might have less stable income flows from temporary and seasonal contracts, when banks prefer to see steady income every month.

As for Czech maternity leave, maternity leave is a 28 (37) week leave from employment. Mothers can take maternity leave from up to 8 weeks prior to the expected birth date, and cannot be interrupted within 6 weeks after giving birth.

Similarly, either parent can request parental benefits - and they can even switch during the process. Applicants can receive a maximum of CZK 350 thousand for one child, or CZK 525 thousand for 2 or more children born at the same time. The maximum amount is determined by the overall income of the family.

In most cases, Zivnostensky list holders do not have the right to maternity leave or parental benefits. However, it is possible to voluntarily pay Czech sickness insurance.

Czech Employee Card or Freelancer Visa

Most often, the Czech Employee Card is the best option for Czech visa applicants who have a full-time employment job offer. This is because, unlike on the freelancer visa, you do not need to learn all the nuances to the Czech tax system. The employer becomes responsible for all of your paperwork, from social and health payments to filing income taxes.

With a freelancer visa, you have to essentially become your own accountant. For that reason, these visas are less common, as visa applicants tend to make mistakes like late payments and accrue significant debts.

This is why the Czech freelancer visa is typically limited to specific cases and industries that are higher in demand. Take for example native-speaking English teachers with TEFL certifications, and IT jobs or more technical fields.

Freelancer visa holders can then qualify for a different type of visa if they find full-time employment, and receive an employee card. The same is true if they begin studying and get a student visa. However, it is not possible to switch your Czech Employee Card to a freelancer or business visa without staying in the Czech Republic continuously for five years.

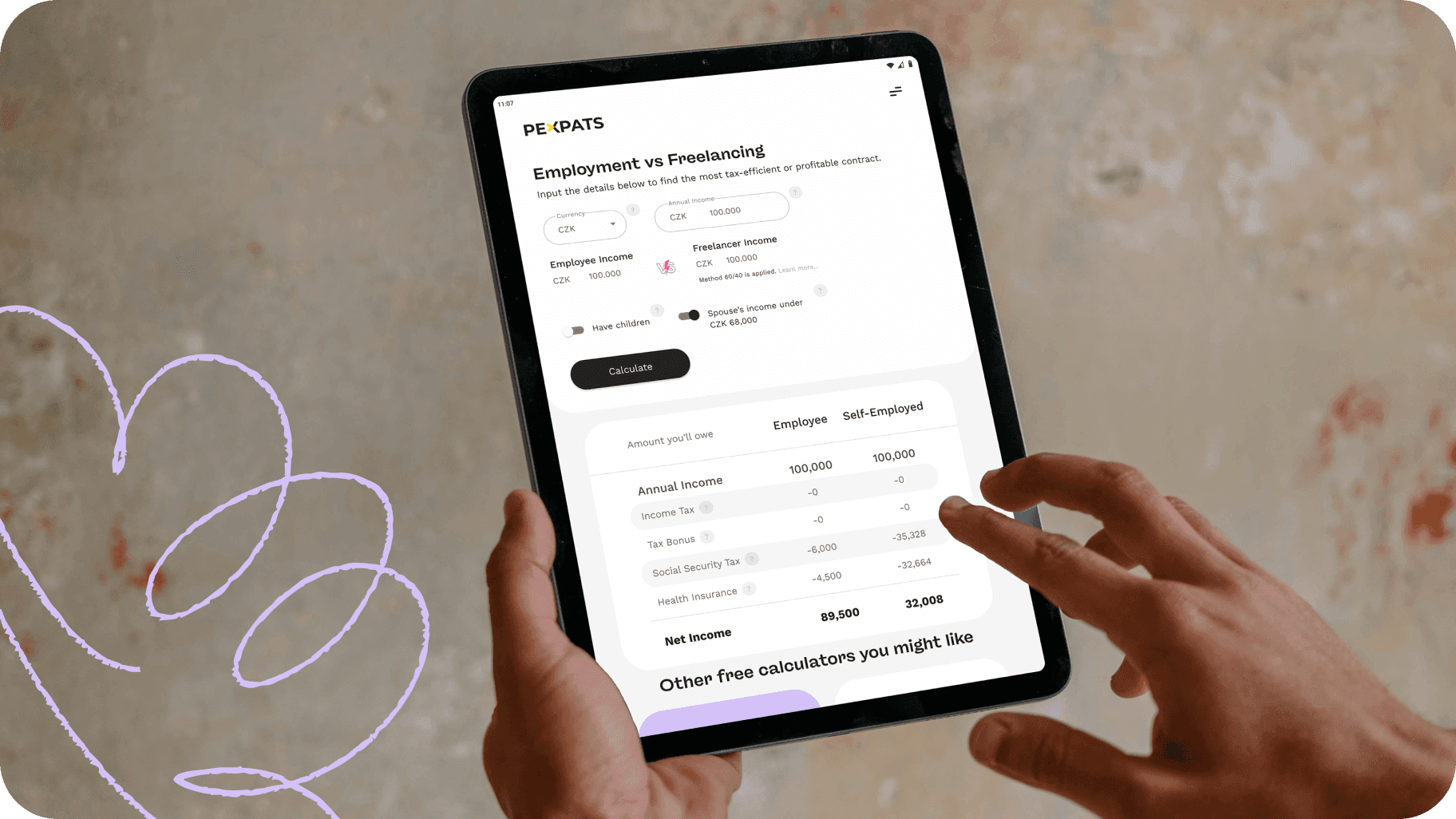

Explore Your Earnings with Pexpats’ Cost Calculators

Pexpats’ certified tax accountants and relocation experts have a mission to simplify taxes and life abroad for expats. Explore the best of our free cost calculators and tax tools to see how. Compare job offers, estimate net income, maternity leave, parental benefits and much more.

All near instantly, and at zero cost.