Employees & Czech Tax Returns - 9 Cases When You Must File

In most cases of full-time employment, the employer is responsible for filing the annual tax return of the employee. However, in the Czech Republic, there are certain cases when the employee must file their own tax return. In other cases, it can even be advantageous to voluntarily report your taxable income.

This is due to employers applying only the standard taxpayer discount when filing annual tax returns for their employees. The employer does not take into account any possible tax discounts, tax bonuses, or tax relief employees might be able to receive. Take for example tax discounts for unemployed spouses, or tax bonuses for having children. The employer will not declare these write-offs, even though it’s possible for you to reduce your tax burden.

If an employee does file their own taxable income report, they need “confirmation of taxable income from dependent activity.” The confirmation must cover the entire taxable calendar year, and report all employment over that time. If there is other taxable income according to § 7 to § 10 of the Income Tax Act, it must be reported if it is higher than CZK 6 000 per year.

Read on as we cover 9 cases when employees are obligated to file their own Czech taxable income report. We’ll also share why employees voluntarily file taxes to reduce their tax burden thanks to bonuses, discounts, and relief.

But first: Czech Payroll Tax vs Employee Income Tax

A common misunderstanding among employees and employers is the difference between Czech payroll tax and employee income tax.

Payroll tax is what an employer takes out of an employee’s monthly salary. This includes mandatory contributions to social security and health insurance, and income tax on the employee’s earnings. These amounts come out of gross salary every month, leaving the employee with their net salary afterwards.

Currently, Czech payroll tax is 15% or 23% of gross employee salary, depending on the amount of annual earnings. The rate of 23% applies to gross annual salaries over CZK 1,762,812, while the 15% is for earnings below this threshold.

Further, employee payroll tax includes:

Employee health insurance at 4.5 % of gross salary

Employee social security tax at 7.1 % of gross salary starting from 1.1.2024. Both 6.5 % for pension contribution and 0.6 % for Sickness Insurance are paid as one social security tax

The employer also pays on top of the employee’s gross salary 24.8% into employer social security tax, and 9% into employer health insurance in the Czech Republic.

On the other hand, an employee’s income tax report is not related to payroll taxes. Employee income tax takes into account an individual’s total income (including from other earnings, gifts, or inheritance). This also includes any tax relief, discounts, or bonuses they are eligible to claim.

These, the employer is not responsible to file. Thus, employees often file the employee tax return voluntarily, or for example when earning side income that they must report, or for inheritance.

Now, how about those reasons when you should file an employee tax report?

1 - Working for two employers at once

If working for two employers in one month, you must file a tax return if both employers deduct advanced income tax from your wages. For income only from dependent activities, it is possible to use a two-page tax form. However, in certain cases, you will not need to file, such as earning additional income under CZK 10,000 on a work performance agreement (DPP).

For example, say you agree to a DPP contract for one month’s work performance at CZK 9,000. This is additional income to your main employment relationship. But, because withholding tax is already paid under the DPP agreement, you are not obligated to file a personal tax report as the remuneration is CZK 10,000 or less.

Now, keep in mind, you might still be entitled to a tax return, even with a DPP of 10,000 or less. This is when you might consider the advantages of voluntarily filing.

2 - Earning above-standard income

In 2025, the Czech Republic has two brackets for income tax. The first is 15%, and applies to ‘standard’ income. The higher rate of 23% applies to ‘above-standard’ income.

23% income tax on earnings above CZK 1,762,812 annual gross (CZK 146,901 monthly)

15% income tax on earnings below CZK 1,762,812 annual gross (CZK 146,901 monthly)

These two brackets have replaced the Czech Solidarity Tax. Previously, this obligated employees to file personal tax returns if their income increased due to a solidarity tax increase.

Now, there are income limits to determine standard versus above-standard income, and which percentage (15% or 23%) each entails.

3 - Making side income from self-employment

If you have an employer but also earn income from self-employed activities, it’s necessary to file your own tax return. However, you report any activities on a trade licence (“zivno”) as secondary income, even if you make more from this “side job”. This is because your main employer already contributes to your monthly social and health insurance advances.

After the end of the first year, you will have to request an annual statement from your main employer. Here, you might need to settle any balance remaining. The balance will depend on your income from employment combined with the tax base from your trade license activities.

You declare income tax from employment together with that of your side business in one tax report. Any tax discounts, tax bonuses, or tax relief then applies to this merged income tax of the full previous tax year. As a trade licence holder, you can also still use the 60-40 tax reporting method if you meet certain conditions.

4 - Listing capital income

In many financial products, such as current bank accounts or savings accounts, interest is already subject to withholding tax. Taxation here is final, and thus not obligatory to include in a personal tax return.

If an employee lists capital income, according to § 8 of the Income Tax Act the employee must file a tax return. Examples of capital income include:

Shares of profit from a business corporation or a silent partner

Interest or other income generated from a granted loan or loans

Benefits for supplementary pension insurance, insurance and pension savings with contributions from the state

Private life insurance payments, or other income from insurance which does not terminate the contract

Income from a one-time deposit

Interest from holding securities

Income from a settlement, winnings, or other income

Interest from funds in a personal account unrelated to your business activities

Profits from a family foundation or trust fund

In most cases, the examples above fall under capital assets. However, if the income derives from dependent activity (employment, service, membership), it is not considered a capital asset. The same is true if the income is for a member of a cooperative, a partner in an S.R.O., a limited partner in a limited partnership, or from a legal entity.

5 - Declaring rental income

Any income from rental properties in the Czech Republic is subject to income tax according to § 9 of the Income Tax Act. This also states that taxpayers apply a 30% flat rate to expenses for the rental property. When declaring rental income, the employee fills in Appendix 2 of the Czech tax return.

6 - For other taxable revenue

Income from the sale of real estate, other property, or securities may also be subject to personal income tax. The conditions are set by law, with some exemptions that can apply (more on these below). To report other taxable revenue, the taxpayer fills in Appendix 2 in the tax return.

7 - Earning occasional income over CZK 50 000

Receiving occasional income is only exempt from income tax when it does not exceed CZK 50,000 over the taxable year. The income also cannot derive from regular business activities, or from small “side jobs.” In those cases, you would report the income as self-employed activities. These earnings you file merged with your income from employment to report your personal taxable income.

8 - Receiving non-exempt gifts in the Czech Republic

As of 2014, gift tax as well as inheritance tax has been abolished in the Czech Republic. Both now fall under regular income tax. That is unless the donation is exempt from taxes. If it is a non-exempt gift, natural persons pay 15% income tax, and natural entities pay 21%. This is declared as gratuitous income in the personal tax report.

Common exemptions from income tax include:

Donations from a spouse or direct line of family (immediate family: children, parents, grandparents, grandchildren)

Donations from a collateral family member (siblings, nieces, nephews, uncles, aunts; the spouse of a child; a spouse’s child, etc)

Gifts received for being a caretaker of a joint household, or for once being a dependent of the beneficiary, donor, or testator for maintenance purposes

Note: Donations that do not exceed CZK 50,000 per taxable year are exempt from income tax. This stands no matter the donor.

9 - Voluntarily filing for tax relief, discounts, and bonuses

Even if your employer offers annual tax reconciliation, filing your own employee tax return in the Czech Republic can result in a higher refund.

Employers usually apply only the basic taxpayer discount because that is all they are legally required to do. They normally do not include spouse discounts, child bonuses, pension or mortgage deductions, or additional income adjustments.

If you worked only part of the year or qualify for extra tax reliefs, the unused portion of the annual discount can be refunded to you — but only through a personal tax return.

How Employee Tax Refund Works in the Czech Republic?

An employee tax refund is the final yearly recalculation of your income tax. If you overpaid taxes, the Tax Office refunds the difference.

Basic logic of an employee tax return:

Take your total gross salary for the year.

Deduct all allowed tax reliefs and deductible expenses to get the taxable base.

Calculate the income tax from this base.

Subtract all tax discounts you qualify for (taxpayer, spouse, disability, etc.).

Subtract possible tax bonuses, for example, the child bonus.

Subtract the total income tax already paid from your salary during the year.

If the final amount is below zero, it means you overpaid taxes, and this becomes your employee tax refund.

After submitting an employee tax return in the Czech Republic, the Czech Tax Office usually sends the tax refund within up to 60 days.

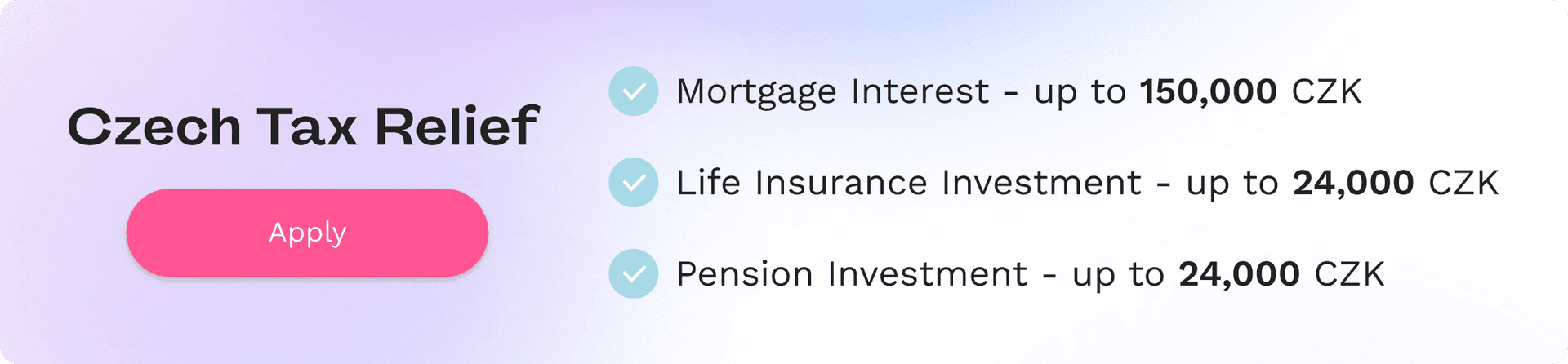

Employee Tax Relief in the Czech Republic

Employee tax relief is an amount you subtract from your yearly gross salary before calculating income tax, which lowers the final tax you pay.

Most Common Tax Reliefs 2026

Type of Relief | Who Qualifies | Maximum Deduction | Documents Needed |

|---|---|---|---|

Mortgage Interest Relief | Anyone paying mortgage interest during months with an active trade license | 150,000 CZK / year | Mortgage contract + bank confirmation of interest paid |

Private Pension Savings | Non-state pension contributors investing at least 1,700 CZK per month | 48,000 CZK | Payment confirmation with the total amount paid |

Life Insurance Relief | Czech private life insurance holders | 48,000 CZK | Payment confirmation with the total amount paid |

Financial Donations | At least 1,000 CZK donated to a Czech organization. | up to 30% of the tax base. | Donation receipt |

Blood, Plasma, and Organ Donation Relief | Anyone who donates blood, plasma, or organs in the Czech Republic | Blood or Plasma: 3,000 CZK Organ: 20,000 CZK | Confirmation from the hospital |

Continuing Education Examination Fees | Anyone who paid for exams confirming the improvement of qualifications | 10,000 CZK | Invoice or confirmation of examination fees |

In the Czech Republic, employee tax reliefs usually include:

Voluntary blood, plasma, or organ donations

Mortgage interest relief

Private pension and retirement savings

Life insurance contributions

Continuing education or professional exam fees

These reliefs reduce your taxable base, which directly reduces your income tax and can increase your employee tax refund when you file a tax return.

Employee Tax Discounts in the Czech Republic

Employee tax discounts reduce your final tax amount, not your salary or tax base.

You subtract the discount directly from the calculated income tax, which lowers how much tax you actually pay.

There are two main employee tax discounts:

Taxpayer Tax Discount – every employee can deduct 30,840 CZK per year from their final income tax.

Spouse Tax Discount – you can deduct 24,840 CZK per year if your spouse earns under 68,000 CZK annually and takes care of a child under 3 years old.

Because tax discounts are applied after the tax is calculated, they often have a stronger impact on lowering your final tax and increasing your refund.

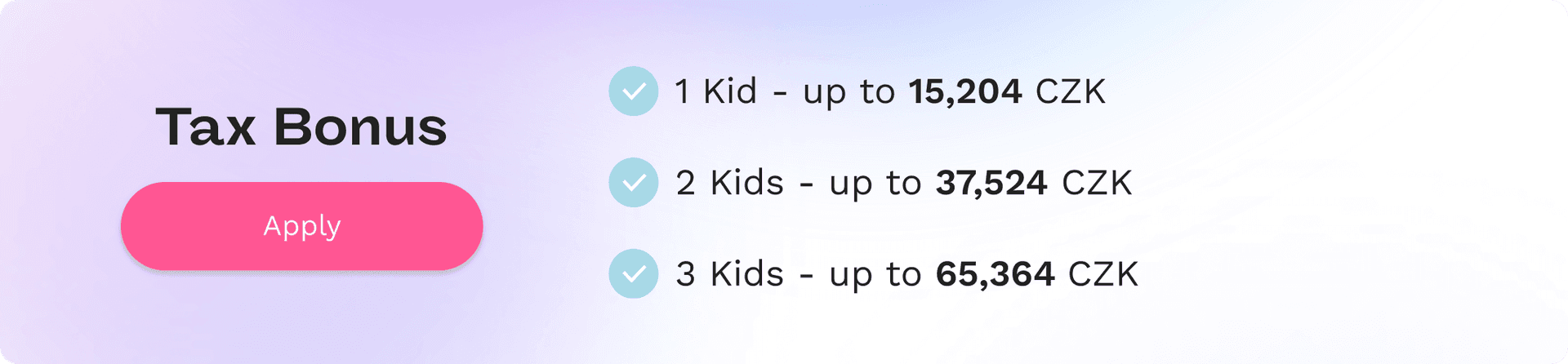

Employee Tax Bonuses (Tax Credits) in the Czech Republic

Employee tax bonus, also called a Czech tax credit, is an amount the Tax Office pays back to you if your tax result goes below zero after all discounts and reliefs are applied.

Child Tax Bonuses 2026

Child Order | Tax Bonus Amount |

|---|---|

First child | 15,204 CZK/year |

Second child | 22,320 CZK/year |

Third or more children | 27,840 CZK/year per child |

Source: Based on current rules of the Czech Financial Administration (Finanční správa ČR). Reviewed and maintained by Pexpats.

Employee tax bonuses mainly apply to parents with dependent children:

First child – up to 15,204 CZK per year

Second child – up to 22,320 CZK per year

Third and each additional child – up to 27,840 CZK per year

Only one parent can claim the child tax bonus for the same child.

The final bonus amount depends on how many months during the taxable year the parent was officially employed or had active taxable income.

Before applying for an employee tax refund in the Czech Republic, it is important to know how many previous years can still be claimed, whether you have a Czech tax number or birth number, and which documents must be prepared.

The notes below summarize the main requirements for filing an employee tax return.

Important Notes – Employee Tax Refund in the Czech Republic

Requirement | What Is Needed |

|---|---|

Tax Refund – Previous Years | In the Czech Republic, an employee tax refund can be claimed up to 3 years retroactively if tax reliefs, bonuses, or tax returns were missed. To apply for previous years, you must provide the Employee Tax Confirmation from your employer for each year claimed. |

Tax or Birth Number | To file an employee tax return you must have either a Czech Birth Number (Rodné číslo) or a Czech Tax Identification Number (DIČ / TIN). One of these numbers is mandatory on the tax form. |

Employee Tax Confirmation | The Potvrzení o zdanitelných příjmech ze závislé činnosti from your employer is required to calculate the final refund amount. A sample form can be found on Pexpats. |

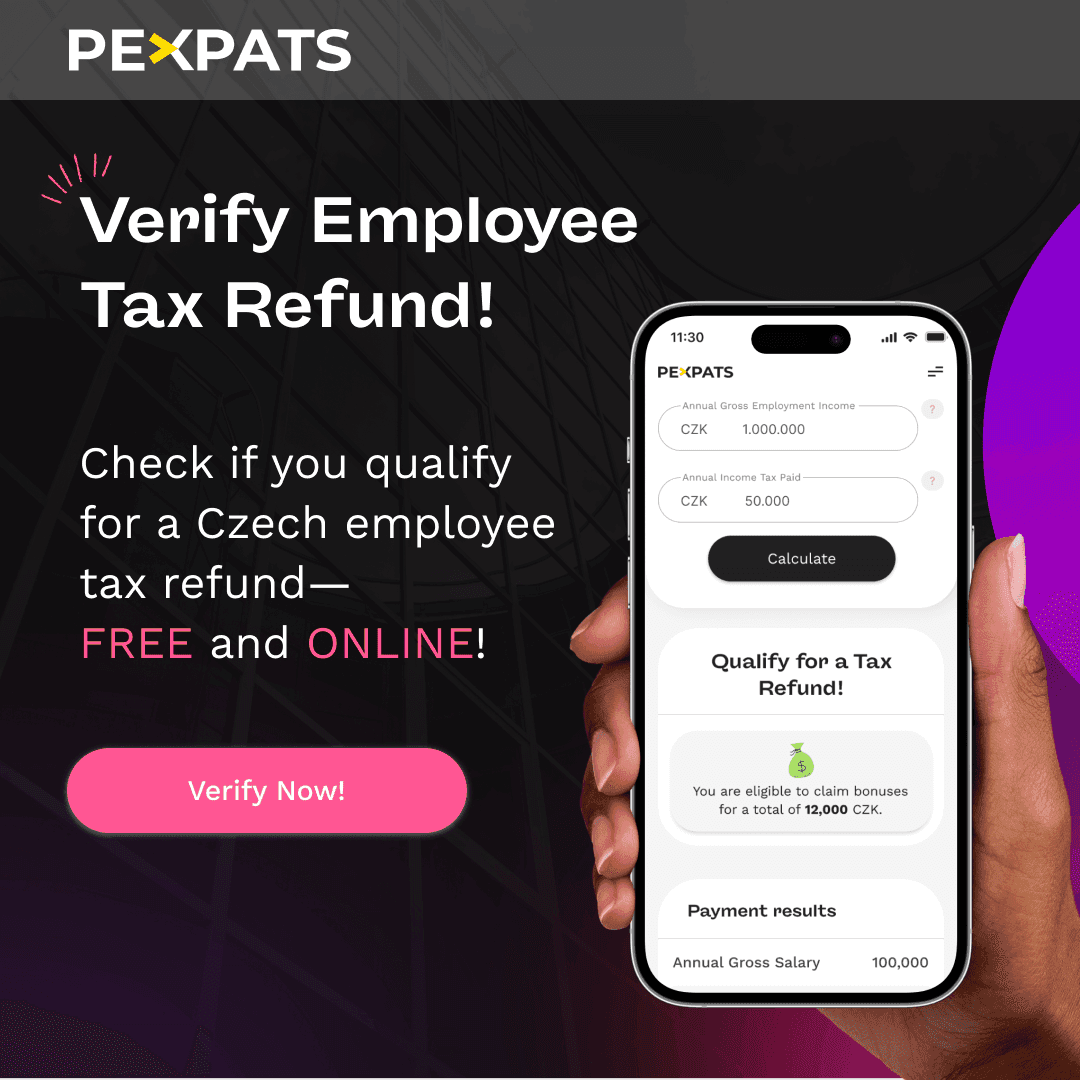

Want to calculate it yourself? There’s a tool for that!

Why not try Pexpat’s free Online Employee Tax Return Calculator for the Czech Republic? Determine if you should or must file an employee tax return by simply checking the boxes that apply to your unique situation. Calculations also account for how much your employer paid, and any tax relief, discounts, or bonuses you can receive.

Get professional support for your personal tax return

If you have questions about reporting your taxable income in the Czech Republic, Pexpats has answers. Our certified accountants provide professional tax services for Czech employees, freelancers, and businesses alike. We’ll assist you in finding all tax relief, discounts, and bonuses available to reduce your tax burden, and save on taxes in the end.

Just reach out for professional, worry-free tax services and consultation for whatever your Czech tax reporting needs may be.