Get Czech Tax Discount

Check if you qualify for the Czech tax discount, apply, and claim your tax refund online

Claim Czech Tax Reliefs

Check if you qualify for Czech tax relief and deductions and apply to claim your tax refund.

Get a Czech Tax Bonus

Check if you qualify for Czech tax bonuses and apply for your Czech tax return refund online

Let Pexpats Do your Tax Refund

Pexpats arranges your employee tax report and tax refund, handling everything 100% remotely on your behalf.

Good To Know

A Czech employee tax return is a declaration of your employment income and any additional earnings. Filing your income tax return can be mandatory depending on specific rules, but you may also choose to file voluntarily to qualify for tax refund bonuses.

Your employer deducts income tax and contributions from your gross salary, manages monthly payroll deposits, and pays your net salary.

However, payroll processing and annual employee tax returns are different tasks. Filing your Czech employee tax return is your responsibility and important for maximizing your potential tax refunds and reliefs.

Czech employer tax is mandatory if you work for two employers, have additional income in addition to your salary, or earn a higher salary.

It’s a good idea to apply for an employer tax refund if you qualify for Czech tax discounts, reliefs, and bonuses. The employee tax refund process involves recalculating your tax deposits paid by your employer and deducting all eligible tax discounts, reliefs, and bonuses. These tax reliefs and bonuses affect the final result, allowing you to receive a portion of your paid taxes back from the tax office.

Employee Tax Refund & Check Obligations

Employee Tax Return Check here

Good To Know

To check your eligibility for a Czech tax refund or determine if you must file a Czech Republic income tax return, simply enter the data from your employment confirmation. Then, select the options that apply to your situation using our tax refund tool. This process will help you understand if you qualify for a tax refund or if filing an income tax return is mandatory for you.

Didn’t know about your tax refund qualification or forgot to apply for previous years? No problem! You can apply for an employee tax refund for the past three years. Feel free to check your eligibility for previous years using your employment confirmation.

Employee Tax Return 100% Online!

The Czech employee tax return is your annual tax declaration. Depending on your situation, filing may be mandatory, or you can file voluntarily if you qualify for a tax refund.

If you qualify for a tax refund or need to file a return, Pexpats can handle the process 100% online for you. We assist with the entire employee tax return process to help you maximize your refund in the Czech Republic.

Here’s all you need to do

1. Verify Online

Free

Online

Use our tax refund calculator above to see if you qualify for a refund or need to file a return with your employment confirmation

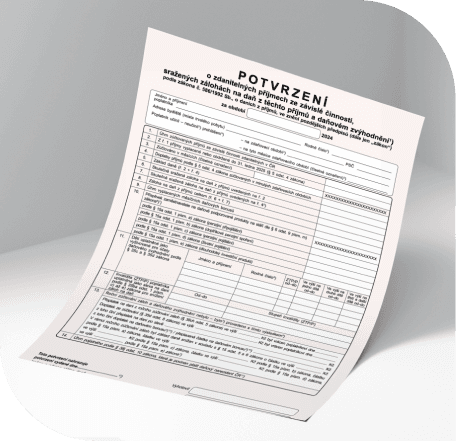

In the Czech Republic, employers provide an annual employee confirmation showing your total gross salary, typically received at the beginning of the year. This document, obtained from your HR or payroll, is necessary for filing your employee tax return and checking your tax refund eligibility. You can find the template here.

2. Verify with Pexpats

Free

Online

Send your results and information to verify them with the accountants at Pexpats, free of charge.

Use the contact form below or email all your information directly to info@pexpats.com. A Pexpats tax advisor will get back to you.

You can hide personal details and send your employee confirmation, a screenshot of your tax refund calculation from our website, and any relevant information related to tax discounts, reliefs, and bonuses. The more details you provide, the clearer we can confirm your results.

3. Apply Online

Online

Simply complete the client application form and electronically sign the Power of Attorney.

Please fill out the client order information form and attach a scan of your passport and all supporting documents.

After we receive your information, we will send you a Power of Attorney for you to digitally sign with an e-signature. With this Power of Attorney, we will represent you for all registration, taxation, and VAT administration.

4. Tax Return Application

4 900 CZK

Online

After receiving your online application and e-signed Power of Attorney, we will handle your tax return.

On your behalf, we will:

Complete your tax return remotely

Recalculate your yearly income tax

Apply for tax reliefs and discounts

Apply for qualified tax bonuses

Apply for qualified tax refunds

Sounds Good?

If you find out you qualify for a tax refund or need to file a Czech tax return, Pexpats

can help! We’ll double-check your results for free.

Just fill out the form below or email us at info@pexpats.com with your employee confirmation, screenshots of your results, and any details about tax reliefs, discounts,

or bonuses. We’re here to help you every step of the way!

Fees

4 900 CZK

Complete service amount

"Good work ain't cheap. Cheap work ain't good." Sailor Jerry

Fully Remote and Secure with PEXPATS

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Ready To Get Started?

If you're ready to join thousands of freelancers supported by Pexpats, please apply for the service below. Confirm if you are an EU or non-EU citizen before completing the form.

Life-Changing Stories from Our Happy Clients

Our reviews say it all! Hear real stories from freelancers, digital nomads, students, entrepreneurs, and expats—who found success with us.

Please, clearly describe your situation or questions in detail.

The more information you provide, the quicker and more accurate our response will be.

We reply within the same day. If you do not receive a reply within a day, please check your spam folder.

Have Questions?

If you still have questions, find anything confusing, or haven't found what you're looking for, feel free to contact our agents. We're here to help.

Fill out the form below, describe your situation, and choose the relevant service type. Our agents will prioritize your request and suggest a solution.

What we do

Business Support

Relocation Assistance

Tax Advisory

Freelance Solution Hub

Digital Finance Platform

Services

Immigration Services

Online Tax Report

All-in-one Packages

Financial Services

Immigration Services

Business Services

Personal Services

Copyright 2013 - 2026

Made with ❤️ in Czech republic

Powered by PEXPATS