If you're a freelancer in the Czech Republic and your income is from your trade license (živnostenský list), it's important to understand the financial responsibilities you'll have in your first year of business.

This applies if you're earning only from your trade license. If you're also working a full-time job in the Czech Republic and have income from your trade license too, please check out the next blog post for more information.

Social Tax for Freelancers in the Czech Republic

If you're a freelancer in the Czech Republic with a trade license (živnostenský list), you must pay minimum social tax deposits every month in your first year of business.

In the first year of business with a trade license in the Czech Republic, you always pay the minimum deposits for social security (ČSSZ) and health insurance. These deposits do not change until January of the next year. From January, health insurance increases and social insurance is recalculated based on your income

Monthly Payments

For new freelancers (those holding a trade license for the first year), the minimum monthly social tax deposit in 2026 is 3,575 CZK. For existing freelancers, the minimum is 5,720 CZK.

Note: This amount is mandatory, even if your income is 0 CZK.

Fixed Amount

The amount of social tax you must pay is fixed. This means, whether you make 0 CZK some months or 1 million CZK in others, you’ll still pay the same minimum deposit each month during your first year as a trade license freelancer in the Czech Republic.

Recalculations in the Second Year

This minimum deposit is for your first year only. In your second year, your social tax payment will be recalculated based on your actual income from the first year. Depending on your income, you may need to pay additional amounts for the previous year's balance.

Health Insurance for Freelancers in the Czech Republic

As a freelancer in the Czech Republic with a trade license, you are required to pay a health insurance deposit every month in your first year of business.

Monthly Payments

The minimum monthly health insurance deposit in 2026 is 3306 CZK. This amount is mandatory, even if your income is 0 CZK.

Fixed Amount

The health insurance deposit is fixed and doesn't depend on how much you earn each month. Whether you make 0 CZK one month or 1 million CZK in another, you are still required to pay the same minimum deposit each month during your first year of business.

Recalculations in the Second Year

This minimum deposit for health insurance is applicable only for the first year. In your second year, your health insurance payment will be recalculated based on your actual income from the first year.

Depending on how much you earned in the first year, you may need to make additional payments for the previous year's balance.

How Monthly Contribution Deposits Work

In the first year of your business with a trade license in the Czech Republic, you pay a minimum monthly deposits for Czech social tax and health insurance

Once your first tax year ends, you file your income tax return, and depending on your income amount, you may pay the balance for social and health insurance.

Also, depending on your first-year income, both social and health insurance offices set up new monthly deposit amounts for the second year. These amounts are calculated assuming your income will stay similar to what you earned in the previous year.

If your income is higher in the second year, your monthly deposits won’t fully cover your contributions, and you’ll pay the balance later.If your income in the second year is lower than the first year, you’ll have overpaid, and you’ll receive a refund.

Example: You earned 2,000,000 CZK in your first year. Since you paid minimum deposits, you’ll have to pay the balance for health insurance and Czech social tax after filing your tax return.

Example: Balance to Pay – Gross Income 2 000 000 CZK (First Tax Year)

Type of Insurance | Paid In 2026 | Real Amount Owed | Balance After Tax Report |

|---|---|---|---|

Social Insurance (ČSSZ) | 42 900 CZK | 128 480 CZK | 85 580 CZK |

Health Insurance (VZP) | 39 672 CZK | 54 000 CZK | 14 328 CZK |

Total balance | - | - | = 99 908 |

Source: Finanční správa ČR, ČSSZ, VZP (Všeobecná zdravotní pojišťovna)

Verified and maintained by Pexpats

After declaring the income from the previous ( first) year, the social tax office and health insurance set new monthly deposits for your second year, assuming you will earn 2,000,000 CZK again. These deposits are higher and expected to cover the full payments.

New Monthly Deposits Based on Previous Year’s Income (2 000 000 CZK Example)

Type of Insurance | Real Owed for 2026 | New Monthly Deposit (2027) | How Calculated |

|---|---|---|---|

Social Insurance (ČSSZ) | 128 480 CZK | 10 707 CZK/month | 128 480 CZK ÷ 12 months |

Health Insurance (VZP) | 54 000 CZK | 4 500 CZK/month | 54 000 CZK ÷ 12 months |

For example, if in your second year you earned less than the first year, say 1,000,000 CZK CZK instead of 2,000,000 CZK, your monthly deposits set from the higher income will now be too high.

That means you’ve overpaid contributions during the year, and you will get a refund.

Refund Example: Income Decreased from 2 000 000 to 1 000 000 CZK (Recalculated Amounts)

Type | Paid Last Year (based on 2 000 000 CZK) | Owed After Recalculation (based on 1 000 000 CZK) | Refund |

|---|---|---|---|

Social Insurance (ČSSZ) | 128 480 CZK | 42 900 CZK | 85 580 CZK |

Health Insurance (VZP) | 54 000 CZK | 39 672 CZK | 14 328 CZK |

Total refund | - | - | = 99 908 CZK |

After filing your second-year tax report, ČSSZ and VZP will calculate the difference, issue a refund, and set new lower deposits for the third year based on your updated income of 1,000,000 CZK.

Example: Income Went Down – New Lower Monthly Deposits (1 500 000 CZK)

Type of Insurance | Real Owed For Last Year | New Monthly Deposit (This Year) | How Calculated |

|---|---|---|---|

Social Insurance (ČSSZ) | 96 360 CZK | 8 025 / month | 96 360 CZK ÷ 12 months |

Health Insurance (VZP) | 40 500 CZK | 3 375 / month | 40 500 CZK ÷ 12 months |

Generally, based on your yearly income for the previous year, you either receive a refund or need to pay the remaining balance for social and health contributions.

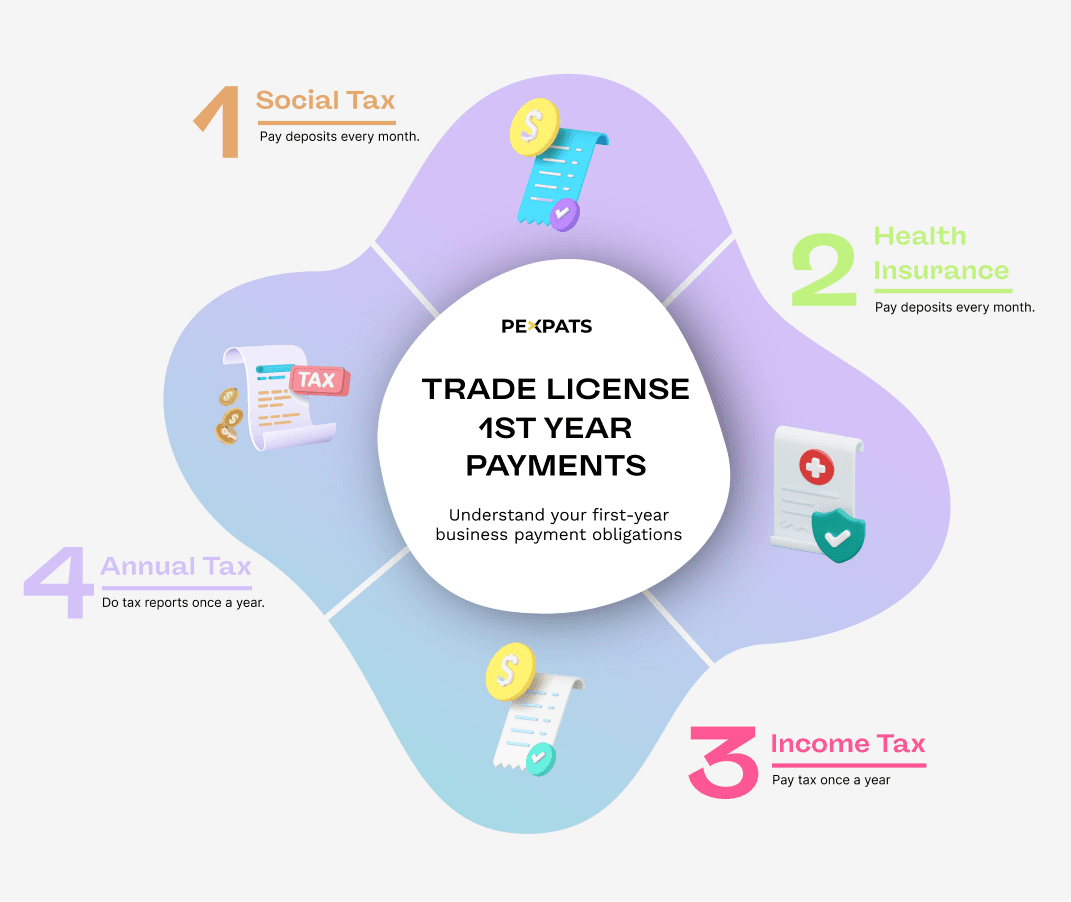

Income Tax

Annual Payment

Income tax is paid to the Czech financial tax office from the income of your trade license business, and it is paid once a year. You only pay income tax after submitting an income tax declaration for the previous year.

No Monthly Payments in the First Year

In the first year of your business, you don’t pay any monthly income tax or deposits. In the second year, after submitting your income tax report, you'll pay income tax depending on your income from the previous year.

Light VAT: Working with EU Companies

If you work with EU companies, you must consider Light VAT registration.

When to Register for Light VAT? If you issue invoices to companies within the EU (but outside the Czech Republic), you should register for Light VAT and submit monthly VAT reports.

Light VAT is a 0% VAT rate for transactions with EU companies, but you still need to report these transactions.

Note: If you invoice a company based in the EU, make sure to complete your Light VAT registration within 8 days to avoid penalties.

How to Check Czech Tax Payments

If you want to track your payment history with the Czech authorities for contributions, there is a way to check payments for the Czech social security tax and health insurance in the Czech Republic.

How to check social tax payments in the Czech Republic?

To check Czech social tax payments, you need to have a business Databox. If you haven’t received the business login details within 1.5 months after your trade license was registered, you can stop by any Czech post office and request a Databox password reset.

Please check how to reset the Czech business Databox here.

You can log in to the social tax office portal here using your Databox login details and view your Czech social tax payments.

How to check VZP (health insurance payments) in the Czech Republic?

You can check your Czech VZP (health insurance) payment history and track your payments using the MojeVZP application. It is available for both Android and iOS devices.

You must activate the application in person at any VZP office.

To activate MojeVZP, simply visit any VZP office with your passport or ID.

Summary

If you're working as a freelancer in the Czech Republic with a trade license (živnostenský list), these are the main payments to keep in mind during your first year:

Social Insurance

When: Monthly

Amount in 2026: 3,575 CZK (for new freelancers)

Note: Fixed monthly amount, even if you earn 0 CZK.

Health Insurance

When: Monthly

Amount in 2026: 3,306 CZK

Note: Also, a fixed amount each month, no matter your income.

Income Tax

When: Once a year (in your second year)

Amount: Based on how much you earned in year one

Note: Paid after you file your tax return with the Czech tax office.

Light VAT (if needed)

When: Monthly

Amount: 0% VAT

Note: Only applies if you invoice companies in the EU (outside the Czech Republic). Must register within 8 days.

Switching from Main Income to Side Income

If you start full-time employment but want to keep your trade license, you must change your status to side income. Update your registration at:

Social Security Office (ČSSZ) – register as secondary income,

Health Insurance provider – register as secondary income.

Note: If you don’t switch, both offices will continue treating your trade license as your main income and will expect monthly minimum deposits. This creates debts and penalties, because, as side income, you should only pay contributions after your first annual tax return. In the first year of side income, no deposits are paid in advance.

Czech Trade License: Main vs. Side Income FAQ

What happens if I forget to switch my registration?

If you don’t switch your trade license registration from main income to side income, ČSSZ and your Health Insurance provider will continue charging monthly minimum deposits. This can create debts and penalties.

Do I need to inform my employer?

No. Your employer reports your job directly. Only you must update your registration with the Social Security Office (ČSSZ) and your Health Insurance provider.

Can foreigners use side income?

Yes. Both EU and non-EU foreigners can register their trade license as side income if they already have full-time employment in the Czech Republic.

When do I pay as side income?

In the first year, no deposits are required. Contributions are settled only after you file your first annual tax return. You can calculate the exact social security, health insurance, and tax contributions for side income using the Pexpats Side Job & Trade License Calculator. It is the only calculator in the Czech Republic that works for people combining employment income and trade license income.