Start a business from anywhere

Register your Czech business completely online and 100% remotely, including all administration.

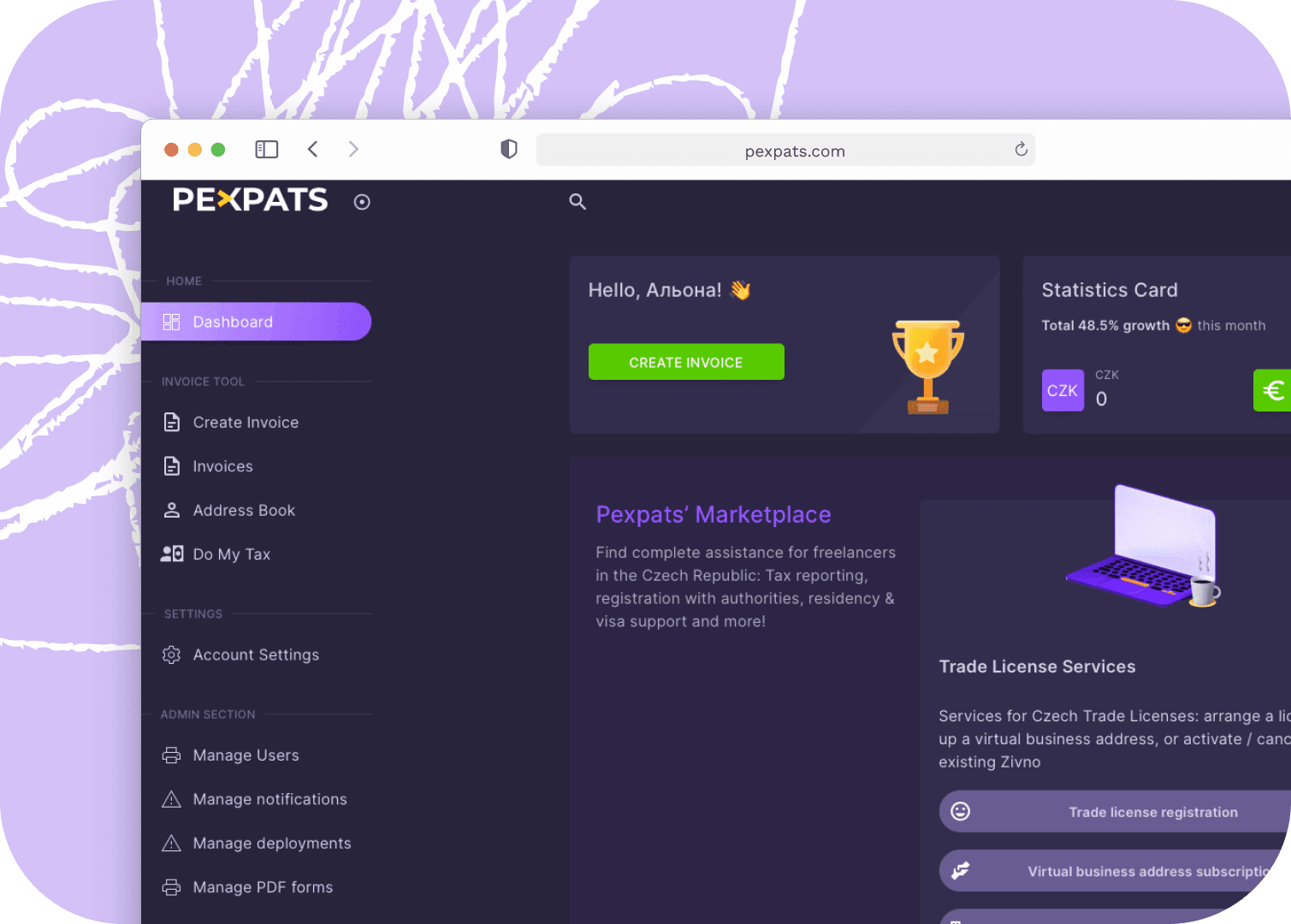

Manage & Run Your Business Easily

Run your business digitally and streamline invoicing using Pexpats’ Online Platform from anywhere.

Let Pexpats do the accounting

Give all of your freelance business’ tax reporting and accounting responsibilities to Pexpats.

Forget about all the paperwork

Start a completely paperless business in Czechia with Pexpats, no matter your current location.

Good To Know

Yes - The entire application process and everything else is possible to do 100% remotely. You don’t even need to be in Prague or visit the Pexpats’ office. We manage everything online on your behalf, no matter your current location.

Anyone with an EU passport and non-EU citizens with an existing Czech visa can qualify.

If you are an EU citizen, you will not need to move to Prague, or even have Czech residency.

No - Pexpats’ agents can virtually arrange on your behalf, including business administration, accounting and taxes without ever needing to meet in-person.

Calculate Your Costs & Net Income

Pay the lowest tax in Europe! Enter your gross income and click calculate to see your net income after costs and taxes.

Good To Know

No matter your nationality or place of residence, you always qualify for the 60/40 tax method.

It’s easy to invoice clients worldwide in any currency or language using Pexpats’ Online Platform. There are absolutely NO limits. You can work worldwide, and get paid worldwide.

You choose the bank you prefer: Revolut, Wise, or any institution you use. Your invoices are all you need to do Czech taxes.

Even if working with companies registered outside of Czechia, you will always charge zero VAT, and do not pay any VAT to the Czech government. Pexpats also takes care of your VAT administration 100% remotely.

Start a Business 100% Online!

Register your freelance trade license in Czechia quickly, easily, and 100% online. Pexpats is the only company to assist anyone from anywhere to register a business in Czechia without being physically present. And in record speed – Open a business, begin running it, and start invoicing in 2 - 4 days time!

Here’s all you need to do

1. Apply Online

Online

Simply complete a client application form, and electronically sign Power of Attorney.

Please fill out the client order information form, and attach a scan of your passport.

After we receive your information, we will send you a Power of Attorney for you to digitally sign by e-signature. With Power of Attorney, we will then represent you for all registration, taxation, and / or VAT administration.

2. Get Legal Address and Official Contact

7 300 CZK - 290 EUR

Online

Receive from Pexpats your business address and official contact person for mandatory business operations in Czechia.

Each business must have a business address for official communications with Czech authorities. However, this does not mean you need to rent an office space. Pexpats provides reliable Virtual Business Address and related services directly from our office in Prague.

Your contact person will be the Pexpats agent responsible for communication between you and the official Czech authorities. Then, whenever we receive any letter from the authorities, we scan and send it to you with translation by email. Therein, we will also summarize the communication’s contents, and suggest a solution if one is necessary.

To get a business address and contact person, simply add it to your order when filling out the online client form. Pexpats will then take care of all authorization and arrangements for your Virtual Office Address.

There are absolutely no hidden fees or additional costs during your subscription period. Subscriptions cover 12 or 24 months at time. We then notify you before your subscription expires, and allow you to extend it for another 12 or 24 months by confirmation.

3. Business Registration

10 900 CZK - 475 EUR

Online

3 days

After receiving your online application and arranging your legal business address, we will do the full registration of your business.

We register everything related to your business.

Trade License Registration

Social Tax Registration

Income Tax Office Registration

Health Insurance Registration

EHIC Insurance Card Arrangement

Contribution Payment Instructions

When we have completed the business registration, it takes only 2 - 4 days for you to start invoicing and receiving payments from clients.

4. Create Invoicing Platform Account

Free

Online

After full business registration and activation of your business number, create an account on Pexpats’ Invoicing Platform. It’s free of charge, extremely user-friendly, and enables you to issue invoices, receive payments, and manage your finances immediately.

In short, you need it! You need a platform where you can issue, keep track of and manage your client invoices. On top of that, it’s completely free to use, and allows our agents to fully manage your finances for you if you’d like.

Yes - There is no cost to use our platform. This invoicing and finance managing platform is free of charge, including all features, automations, and regular updates!

5. Payment Instructions & Support

When we arrange everything above, we will set up your social and health insurance contributions, and provide instructions for monthly payments.

In the first year of your business, you pay only monthly deposits for social and health. At the start of the next year, Pexpats will arrange your annual tax applications, and provide instructions going forward.

Pexpats will send you easy-to-follow payment instructions after your registration with authorities.

All trade license service fees include payment instructions, and lifetime after-service support for your trade license registration.

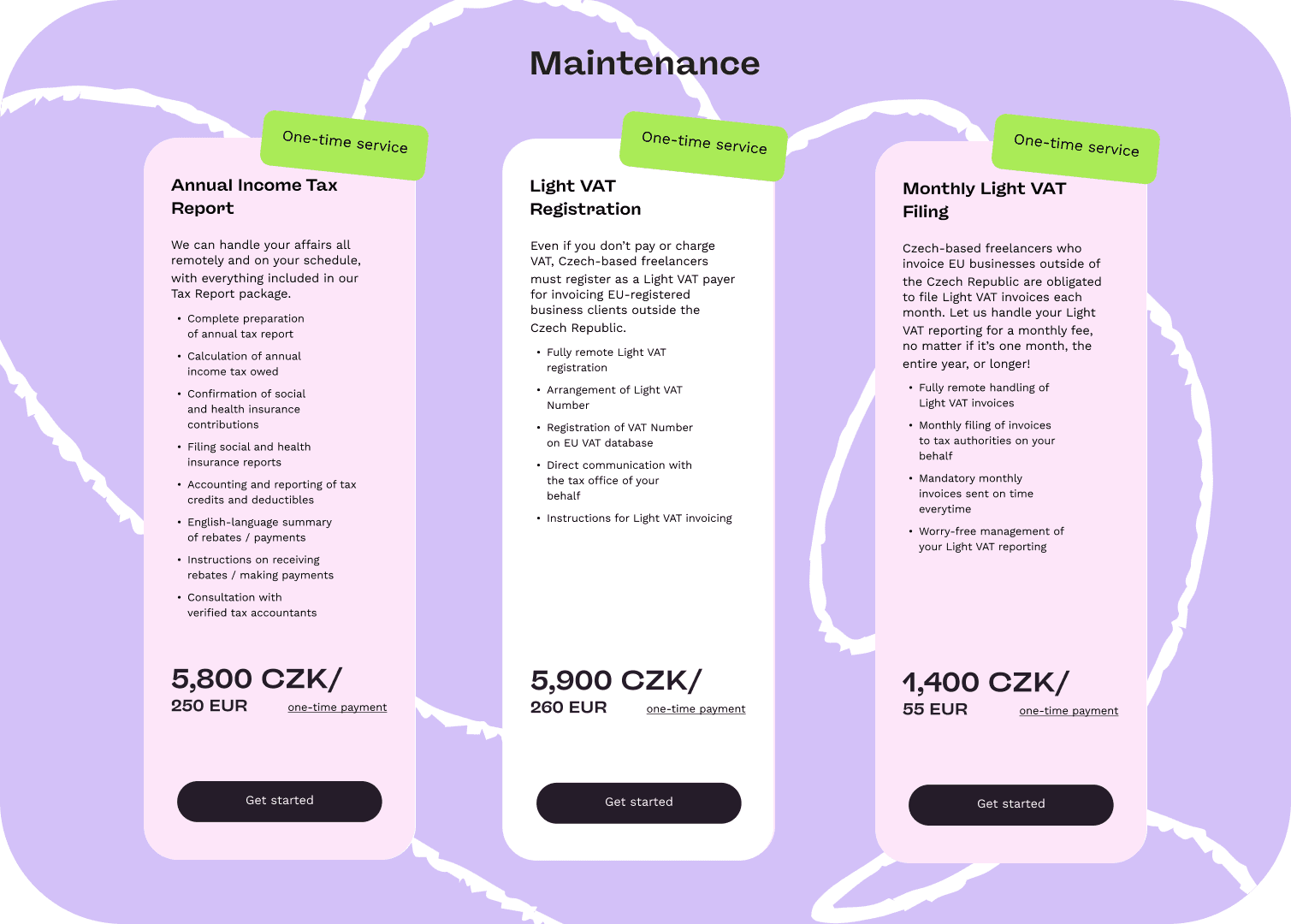

6. Business Maintenance

from 1 400 CZK - 55 EUR / month

Online

Finally, after setting up your business, payment instructions, and invoicing, you might want additional accounting and tax support. In this case, Pexpats’ certified accountants and tax advisors can take over, and assist 100% remotely.

Which service you need most often depends on the type of clients you invoice. If you work with companies registered in the EU, then you should register for VAT. This requires monthly VAT reports which you must submit even when you do not charge and pay any VAT. Another example is if you work with Non-EU companies. In this case, you will need to file only the annual tax report.

Sounds Good?

No matter where you are, you’re just one click away from launching your freelance Czech business with Pexpats. Start your journey fully remote and online today.

All you need to do is complete the online client application form, and Pexpats will manage everything else on your behalf!

Fees

10 900 CZK

Complete service amount

"Good work ain't cheap. Cheap work ain't good." Sailor Jerry

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

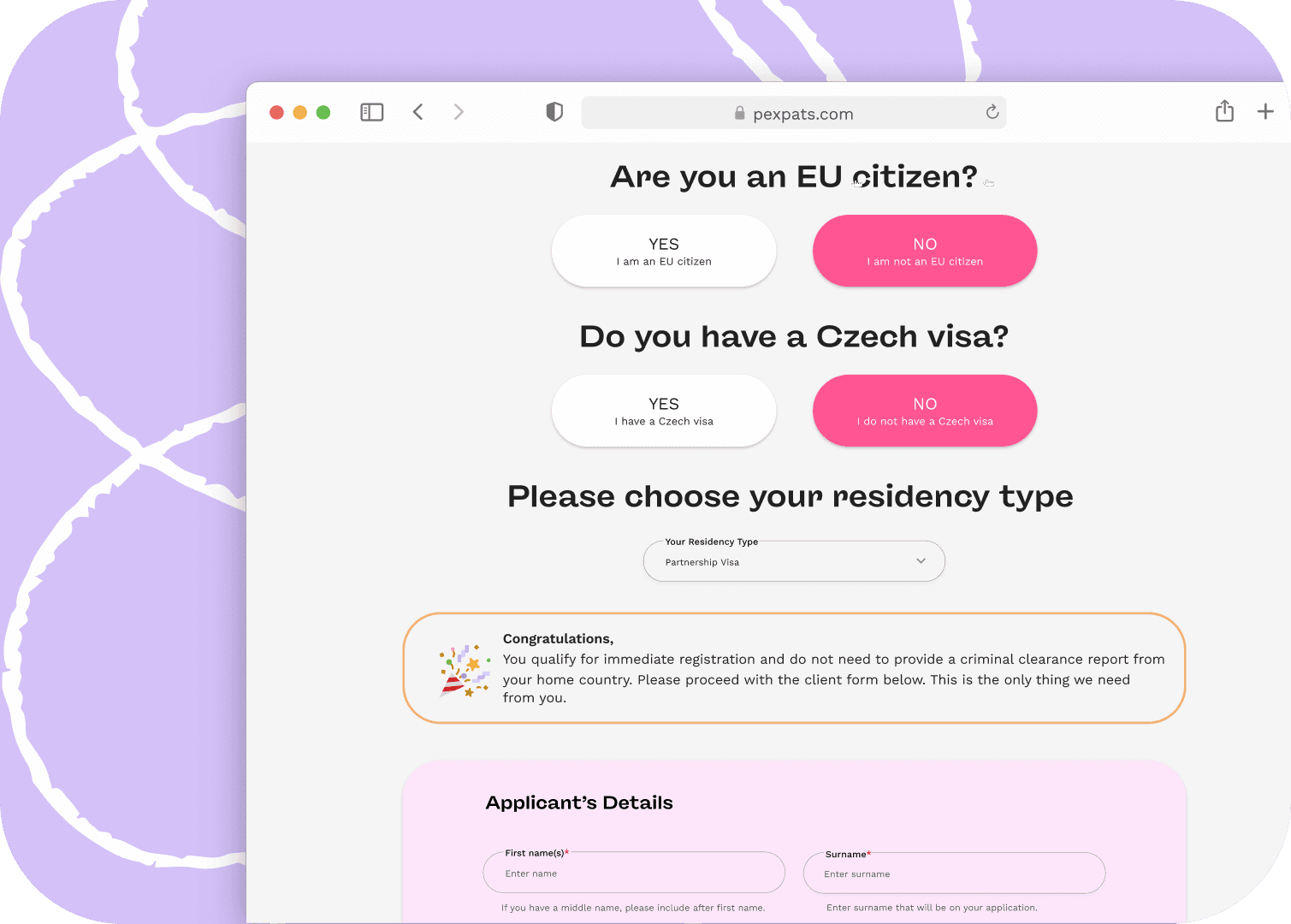

Ready To Get Started?

If you're ready to join thousands of freelancers supported by Pexpats, please apply for the service below. Confirm if you are an EU or non-EU citizen before completing the form.

Good To Know

All we need is your information and the e-signed Power of Attorney. Afterwards, we arrange all registrations, contributions, and payment instructions.

Simply fill out our client application form, and a Pexpats agent will be in contact directly.

If you still have questions, feel free to contact us via the contact form below. Otherwise, you can apply directly by filling out the form above.

Life-Changing Stories from Our Happy Clients

Our reviews say it all! Hear real stories from freelancers, digital nomads, students, entrepreneurs, and expats—who found success with us.

Please, clearly describe your situation or questions in detail.

The more information you provide, the quicker and more accurate our response will be.

We reply within the same day. If you do not receive a reply within a day, please check your spam folder.

Have Questions?

If you still have questions, find anything confusing, or haven't found what you're looking for, feel free to contact our agents. We're here to help.

Fill out the form below, describe your situation, and choose the relevant service type. Our agents will prioritize your request and suggest a solution.

What we do

Business Support

Relocation Assistance

Tax Advisory

Freelance Solution Hub

Digital Finance Platform

Services

Immigration Services

Online Tax Report

All-in-one Packages

Financial Services

Immigration Services

Business Services

Personal Services

Copyright 2013 - 2025

Made with ❤️ in Czech republic

Powered by PEXPATS