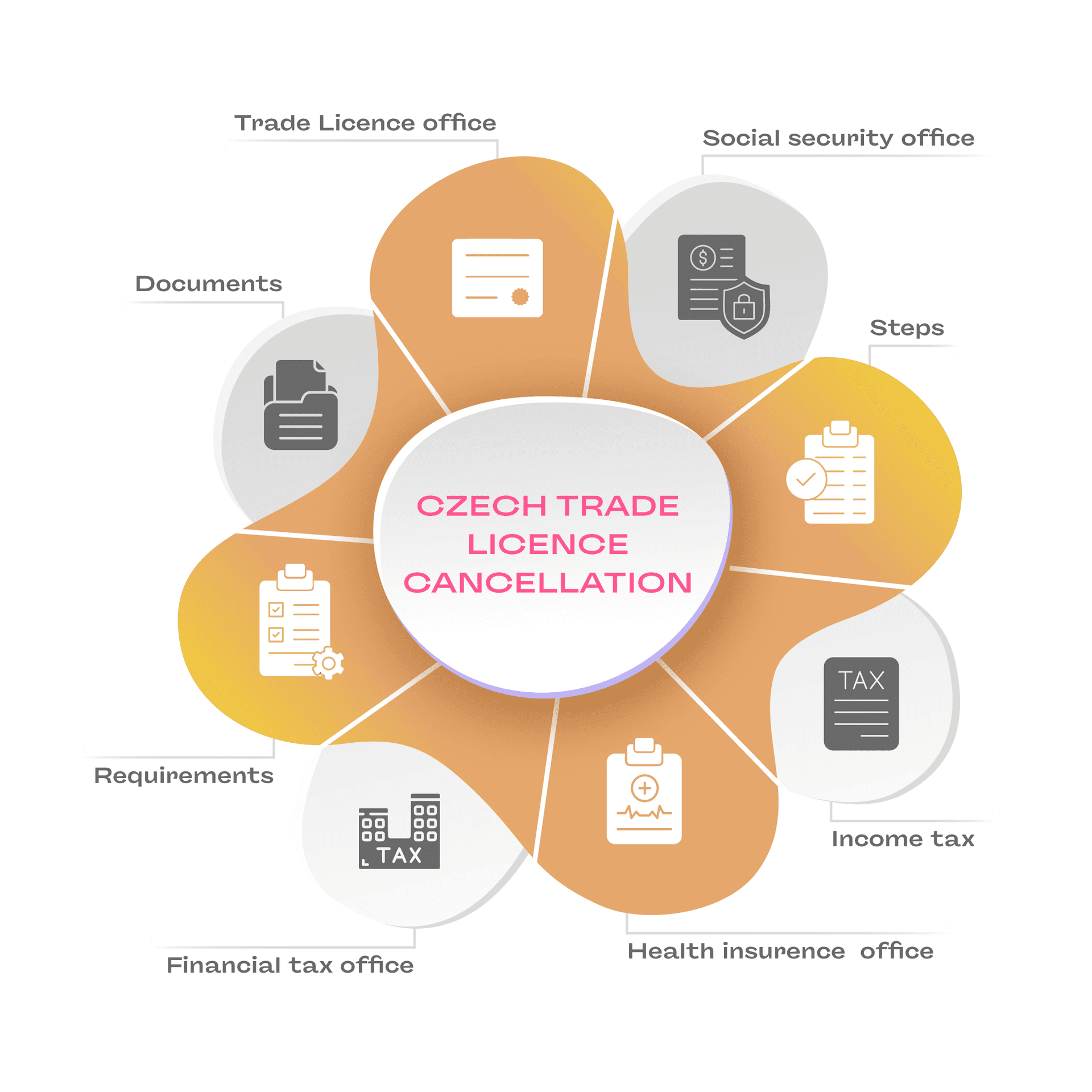

Canceling a Czech trade license (živnost) is not just about stopping your business activities and deactivating your IČO. You must also deregister from social security, health insurance, VAT, and income tax to avoid fines or debts. Below is a step-by-step guide on how to close a Czech trade license, deregister from all necessary offices, and avoid common mistakes.

How to Cancel a Czech Trade License?

To cancel a Czech trade license, you need to apply at the Trade License Office (Živnostenský úřad).

Where do I cancel my trade license? Any Municipal Office (Městský úřad) in the Czech Republic.

How long does it take? The process takes two working days.

Do I need to stop invoicing immediately? Yes. You cannot issue invoices once your IČO (business registration number) is deactivated.

💡 If you prefer not to cancel your Czech trade license permanently, you can pause it until 31.12.2099. When your trade license is paused, your IČO stays deactivated, but you won’t need to go through the full registration process again if you decide to start your business again later.

If you choose to fully cancel your trade license, you’ll need to go through the complete registration process to get a new license if you want to reopen your business in the future.

Step 1: Close Your Czech Trade License (Živnost)

Documents needed for trade license cancellation:

Valid ID or passport

Completed cancellation form (available at the office)

NOTE: If you plan to reopen your trade license later, ask about pausing your trade license instead of canceling it.

Stop Overpaying: Close or Pause Your Czech Trade License Online!

If your project is on hold or you’re not currently working, you’re still required to pay monthly social security and health insurance contributions! To avoid unnecessary payments, it’s a good idea to either pause or cancel your Czech trade license. This way, you can stop paying for something you’re not using.

Step 2: Deregister from Social Security

After canceling your trade license, you must deregister from Social Security (ČSSZ).

Where to cancel Social Security? Local Social Security Office (ČSSZ).

What happens if I don’t deregister? The social security office will still expect monthly payments, leading to debts.

Request a confirmation letter to prove your deregistration.

💡 Important note: Social tax is not automatically canceled when you cancel your trade license. If you don’t cancel your social tax separately, the Social Insurance Office will continue expecting monthly deposits, which may result in overdue payments and additional penalties.

Step 3: Cancel Czech Health Insurance

When you cancel your trade license, your health insurance is not automatically canceled. You’ll need to cancel it separately.

Where do I cancel Czech health insurance? You can cancel your Czech health insurance with your provider, such as VZP, OZP, or another health insurance company.

What happens if I don’t cancel health insurance? If you don’t cancel, you’ll still be charged monthly health insurance payments.

What if I want to stay in the Czech Republic? If you plan to stay in the Czech Republic, it’s better to register as a self-payer for health insurance instead of canceling it completely.

Step 4: Deregister from Income Tax

Where to cancel income tax registration? Local Financial Tax Office (Finanční úřad).

Is income tax cancellation mandatory? No, but if you need proof of tax residency in another country, you should request deregistration confirmation.

💡 Important note: Cancel Advance Tax Payments: If you were making advance tax deposits, cancel them to avoid penalties.

Step 5: VAT Deregistration

If you were registered for VAT or Light VAT, you must deregister additionally after you cancel your trade license.

Where to cancel VAT? Local Financial Tax Office (Finanční úřad).

What happens if I don’t cancel VAT? You could face penalties of up to 500,000 CZK.

💡 Important note: Don’t forget to declare any pending invoices issued to EU-registered companies.

Step 6: Flat Tax Cancellation

If you are registered for flat tax, you should also cancel flat tax registration to avoid overdue payments and penalties.

Where to cancel the flat tax in the Czech Republic? Local Financial Tax Office (Finanční úřad).

Why cancel flat tax? Even after closing your trade license, the tax office will expect payments unless you deregister.

Step 7: Check Outstanding Social & Health Payments

Even after deregistering from social security and health insurance, request an audit from both offices.

Where to check the unpaid contributions?

Social Security Office (ČSSZ)

Health Insurance Provider

💡 Important note: Penalties for late payments keep increasing until all debts are cleared.

Step 8: File Your Final Income Tax Return

You must file an income tax return and submit reports for social and health contributions, even if your trade license was only active for part of the year.

Is an income tax return required after closing a trade license? Yes, even if you worked for only a few months or days during the tax year, you are still required to file an income tax return for that year.

When is the deadline? The deadline for filing is April 1st of the following year.

What happens if I miss the deadline? If you miss the deadline, you may face penalties and legal issues.

Ensure Your Trade License Is Fully Canceled

Don’t risk fines or penalties for missing a step. Let our experts handle your trade license cancellation, tax deregistration, and more—all online!

How to cancel a Czech trade license: all steps

To cancel a Czech trade license correctly, you must complete several deregistration steps in a specific order.

The table below shows all required steps, where to submit each step, and the correct order.

Czech trade license cancellation – step-by-step overview

Step | Where to submit | What you must do | Order |

|---|---|---|---|

1 | Trade Licensing Office (Živnostenský úřad) | Cancel the trade license (živnost) | First |

2 | Social Security Office (ČSSZ) | Deregister as self-employed (social security) | After step 1 |

3 | Public Health Insurance | Deregister as self-employed (health insurance) | After step 2 |

4 | Tax Office (Finanční úřad) | Notify the end of self-employment | After step 3 |

If you skip or change the order of these steps, some administrative or insurance obligations may continue.

What to do after the trade license is cancelled

After cancelling the trade license and deregistering with the main authorities, you may still need to complete additional obligations related to your previous self-employment activity.

After cancellation: additional obligations

Obligation | Applies when | What to do |

|---|---|---|

VAT deregistration | If VAT-registered | Deregister VAT with the Tax Office (Finanční úřad) |

Flat tax cancellation | If using the flat tax regime | Cancel flat tax with the Tax Office (Finanční úřad) |

Outstanding social and health payments | Always | Check and pay any remaining balances |

Income tax return | Always | File the final tax return for the last active year |