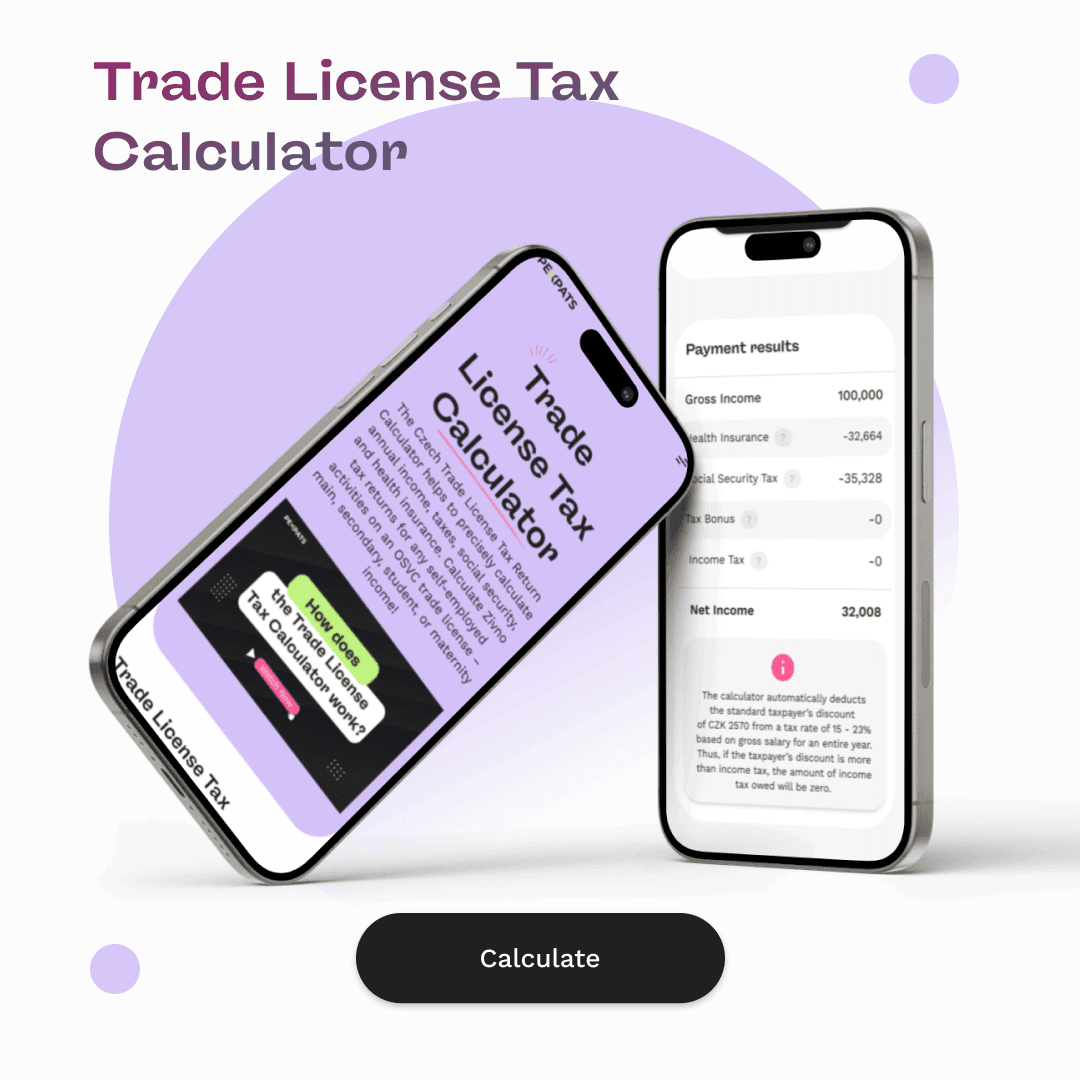

Czech Trade License Tax Calculator

The Czech Trade License Tax Calculator is a tool created by tax experts to help Czech Trade License holders (also called Zivno holders) calculate their income tax, contributions, and net income.

This tool is perfect for anyone with a trade license, whether it’s their main income, secondary income, or income while studying or on maternity leave.

How to Use the Trade License Tax Calculator

Choose Your Tax Registration Type Start by choosing your tax registration type:

Main Income: If your trade license is your main source of income.

Secondary Income: If you have income from both full-time work and your trade license.

Maternity/Student: If you are a student or on maternity leave and have income from your trade license.

Enter Your Income Details Enter your total yearly income from your trade license.

Calculate Your Results Click the "Calculate" button to get your results. The calculator will show:

Income Tax: Based on your chosen tax registration type after the Czech tax discount of 30,840 CZK.

Contributions: Health insurance and social security contributions.

Net Income: Your final income after tax deductions and contributions.

Watch this video for a full walkthrough of how to use the Czech Trade License Tax Calculator and get a clear picture of your net income.

Example Calculation

Let’s say your yearly income from your trade license is 240,000 CZK. Here’s how the results are calculated:

Income Tax: Based on your chosen tax type after the Czech tax discount of 30,840 CZK.

Contributions: Health insurance and social security contributions are based on your income type.

Net Income: What you take home after all deductions.

If your trade license income doesn’t reach a certain amount, you might not need to pay social tax. However, you will always pay income tax and health insurance.

Social Tax on Trade License Income

For secondary income, there are special rules for social tax. There may be a minimum income level for social tax to apply and a maximum level under which you don’t pay social tax.

Income Tax and Health Insurance Obligations No matter how much you earn, you must always pay income tax and health insurance on your trade license income.

The Czech Trade License Tax Calculator is a helpful tool for Zivno holders in the Czech Republic. It makes it easy to calculate your net income after taxes and contributions. Whether your trade license is your main or secondary source of income, this tool helps you see exactly how much you’ll take home. The calculator is updated regularly to keep up with new government rules, so you always get accurate results.

Try the Czech Trade License Tax Calculator today to get a clear picture of your net income from your trade license!