Understanding the Czech Income Tax Form (2026)

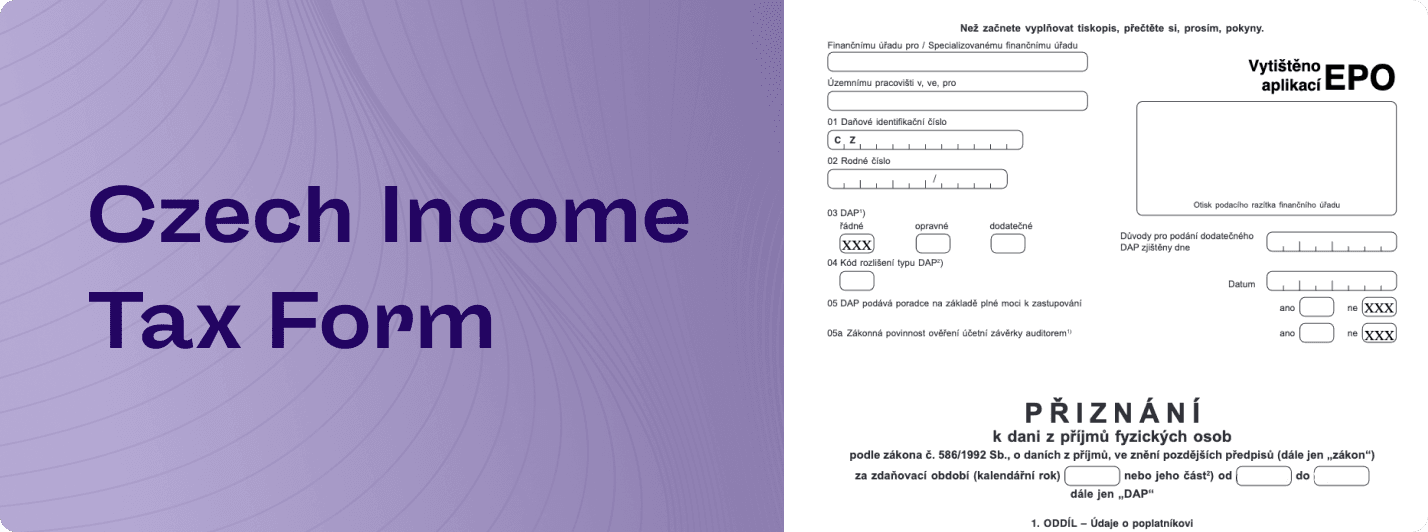

Czech tax forms (also called Přiznání k dani z příjmů fyzických osob) are used to report your income and calculate how much income tax you owe — or how much you’ll get back. Here’s what the most important lines on the form mean:

31 - Your total annual gross salary from employment and trade license (if you had employment and a trade license).

37 - Your trade license (OSVC) net income after deducting 60% fully or partly from your gross income in the 60/40 tax method.

45 - Total tax base income (if you have multiple sources of income) before deductions.

46 - Gift/donation tax deduction amount.

47 - Mortgage interest rate tax relief amount.

48 - Private pension investment relief deduction amount.

49 - Life insurance tax relief deduction amount.

54 - Total amount of all tax reliefs.

55 - Tax base after tax relief deductions.

56 - Tax amount rounded to the next 100 CZK.

57 - Income Tax amount.

60 - Rounded income tax amount.

64 - Freelance tax discount.

65 - Tax discount for an unemployed spouse.

70 - Total qualifying discount.

71 - Income tax after all tax discounts.

72 - Kid(s) tax bonus.

77 - Income tax after tax bonuses.

84 - Total tax paid by the employer (if you had income employment + trade license).

85 - Deduction amount of the tax deposit (not social and health) if you paid tax deposit last year.

91 - Final tax amount. If the amount is negative, then you will receive a tax refund; if it is positive, you will pay that amount of income tax.

101 - Your total income from the trade license.

102 - Amount of expenses deduction using the 60/40 method.

113 - Tax base/Net income amount.

Common Questions About Czech Taxes (FAQ)

When do I have to pay income tax?

You must pay Czech income tax within 60 days after submitting your tax return.

How do I pay Czech income tax in the Czech Republic?

You can pay Czech income tax by scanning the QR code on your tax return or by bank transfer to the tax office’s account, as listed in your official payment instructions. Always make sure to use the correct variable symbol (your tax ID) so the payment is matched correctly.

I already pay tax through my job — why do I need to pay more?

If you earn extra income in the Czech Republic (like from freelancing or a trade license), you must report and pay income tax on that separately. Your employer only pays tax on your salary, not on side income.

Why isn't 60% deducted from my full income with the 60/40 method?

The 60/40 method only applies to income up to CZK 2,000,000. If you earn more than that, the part of your income over CZK 2,000,000 is taxed without the 60% deduction.

Example: Gross income: CZK 3,000,000 60% deduction applies to the first CZK 2,000,000 → taxed on CZK 800,000 The remaining CZK 1,000,000 is taxed fully Total tax base = CZK 1,800,000

Why did I get less in tax relief or child bonuses than I expected?

Tax reliefs and bonuses are applied only for the months they apply. For example, if your child was born in June, you’ll get the bonus for 6 months. The same applies to spouse discounts, mortgage interest, and other reliefs—they’re calculated monthly, not yearly.

When will I get my tax refund?

By mid-April if you filed your return by March 31st

Within 60 days if you submitted your tax return after March 31st

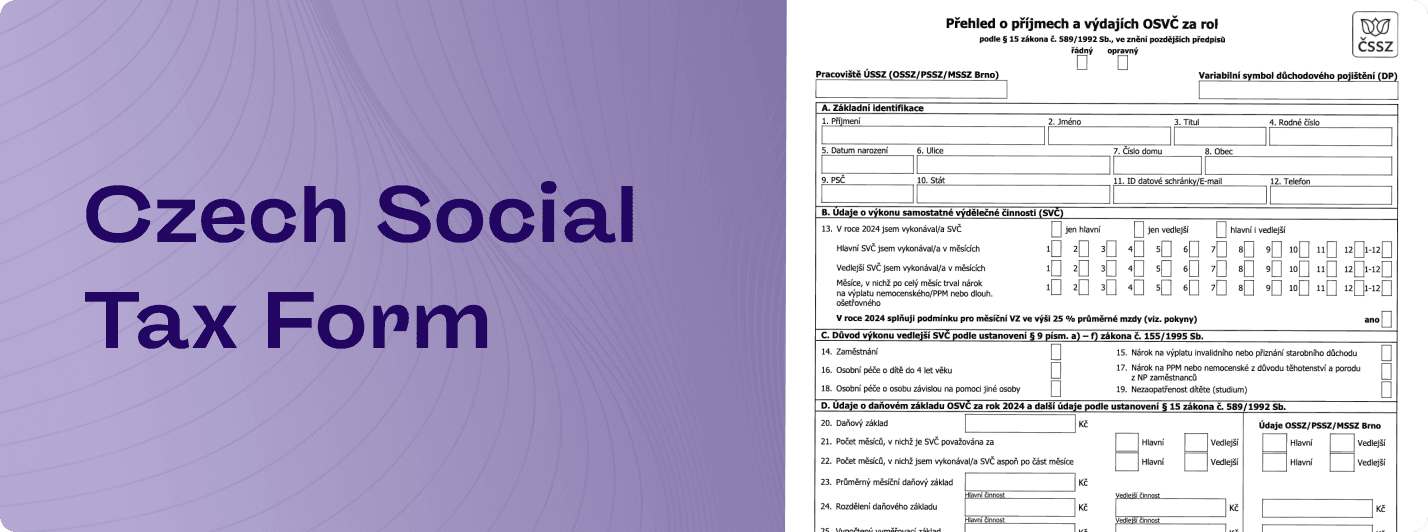

2. Understanding the Czech Social Tax Form (2026)

The Czech social insurance tax form (called Přehled o příjmech a výdajích OSVČ) is used to:

Recalculate your final social insurance tax for the previous year

Deduct the monthly deposits you already paid

Set your new monthly social tax deposits for this year, based on last year’s income

Here’s what the important lines on the form mean:

Line 20 – Your trade license net income (tax base/40%)

Line 25 – The amount used to calculate your social insurance

Line 32 – Total social tax you owe

Line 33 – Total social deposits you already paid

Line 34 – Final balance after subtracting the deposits

Line 36 – New monthly deposit for this year

How Social Tax Balance and New Deposits Are Calculated

Please check the overview below of how your social tax balance is calculated and how your new deposits are set. The steps and explanations match the lines in the social tax form, so you can easily follow how each amount is calculated.

1. Social Tax Balance

During the last year, you have paid either the minimum monthly social deposit or a monthly deposit amount set from the previous tax year. The social tax balance is then calculated from your income amount from last year, and the minimum deposits you paid are deducted from the total social tax amount you owe.

Overview of the calculation on the social tax form:

Line 23 – Taxable Amount / Net Income. Amount after deducting expenses under the 60/40 method.

Line 31.2 – Total Social Tax Calculated. The full yearly social tax calculated from your taxable amount (Line 23).

Line 33 – Total Social Tax Deposits Paid. The total amount of social tax deposits you paid last year.

Line 34 – Social Tax Balance. Total social tax calculated (Line 31.2) minus total social tax deposits paid (Line 33). This result is the balance that should be paid.

2. New Social Deposit

Your new monthly social deposit is set based on your income from last year and how long your trade license was active, so your monthly payments cover the expected social tax, and you do not end up with a high balance at the end of the year.

Overview of the calculation on the social tax form:

Line 23 – Taxable Amount / Net Income. Amount after deducting expenses under the 60/40 method.

Line 31.2 – Total Social Tax Calculated. Total social tax calculated from your taxable amount (Line 23).

Line 21 – Number of Months with Active Trade License Last Year

Line 36 – New Monthly Deposits. Total social tax fee last year (Line 31.2) divided by the number of months with an active trade license last year (Line 21).

Note:

The minimum monthly social deposit in 2026 is 5,720 CZK for the main source of income, and it cannot be lower than 5,720 CZK per month.

All paid deposits are deducted at the end of the year when the tax report is filed. If your income goes down and you overpay, you will receive a refund.

You can also check how these calculations work in real examples here.

Common Questions About Czech Social Taxes (FAQ)

Why are my social deposit payments different from last year?

Because your new monthly social deposit is based on your average monthly income from last year.

If your income stays the same, the deposits will fully cover your social tax for this tax year. If your income goes up, you’ll pay a balance. If your income goes down, you’ll get a refund.

When and how do I pay the social tax balance?

You must pay the social insurance balance within 8 days after submitting the tax form. Use the same account number and variable symbol that you use for your monthly social tax deposits.

Can I lower my social deposits if I expect less income this year?

Technically yes, but we strongly recommend not trying. The tax office rarely approves these requests, and the process can take 3–4 months. If it's rejected, you’ll have a debt for the unpaid deposits — plus penalties.

Example: If your new deposit is CZK 10,000/month and you stop paying while waiting for approval, you'll be liable for the unpaid amount if rejected — with late fees.

Good to know: These are just deposits. If you really earn less this year, you’ll get a refund next year.

What’s the difference between side income and main income?

Side income = you have a full-time job AND a trade license

Main income = your income is only from a trade license (no job)

Why do I have to pay social tax on side income if my employer already pays tax?

Your employer pays tax and contributions only on your salary. If you earn anything extra (from freelancing or a trade license), you must pay social insurance on that income additionally.

Why do I need to start paying deposits now if I had low or zero side income last year?

In your first year of business, you don’t pay deposits. But from the second year, even with side income, you must pay at least the minimum deposits.

Good to know: If your income is low again this year, you’ll get some of it refunded next year.

Why do the numbers on the Social Security platform not match what I should pay?

The platform doesn’t always update correctly or on time. Please, always follow the instructions we send.

Are the social tax calculations accurate?

Yes, unless you missed deposits last year. We’ll find out after the audit, and if anything’s missing, you’ll pay it then. This doesn’t affect your current payments, so please follow our instructions on time.

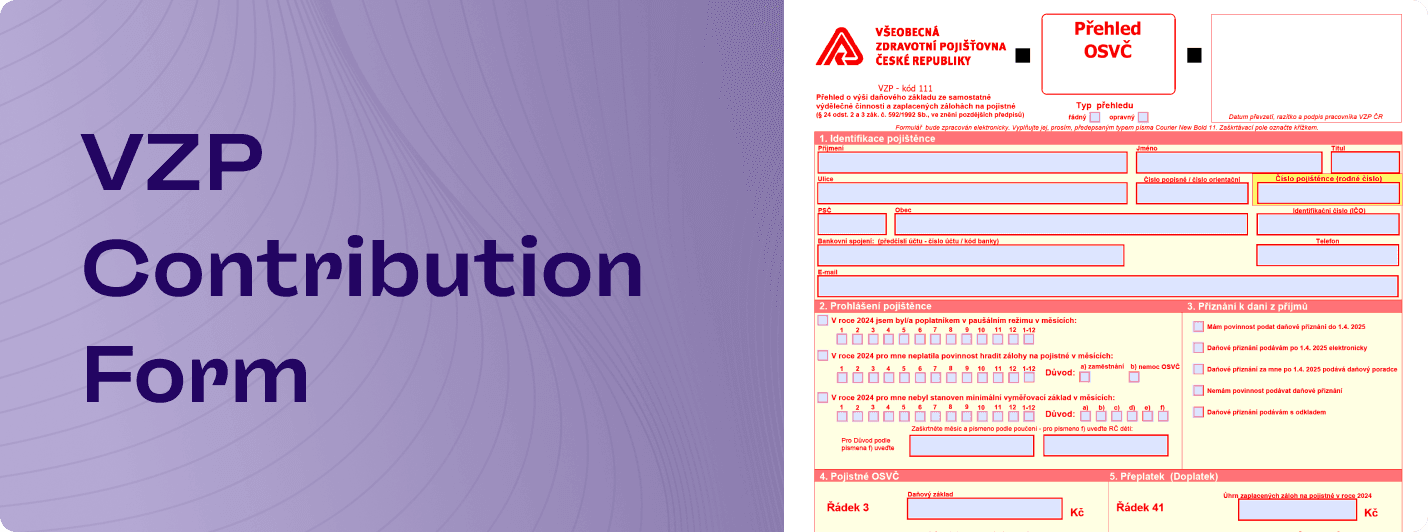

3. Understanding the Czech Insurance (VZP) Form (2026)

The Czech insurance form (called Přehled OSVČ) is used to:

Recalculate your final health insurance tax for the previous year

Deduct the monthly deposits you already paid

Set your new monthly health insurance deposits for this year, based on last year’s income

NOTE: Czech insurance form can be opened only with Adobe Reader.

The Health Insurance (VZP) Form Is Structured As Follows:

Line 3 – Trade license tax base / Net income

Line 14 – Tax base from which VZP is calculated

Line 16 – Total VZP / Health insurance contributions you owe

Line 41 – Total VZP / Health insurance contributions deposit paid

Line 43 – Final balance after total deposit deduction

Line 51 – New VZP deposit

How Health Insurance (VZP) Balance and New Deposits Are Calculated

Please check the overview below of how your VZP balance is calculated and how your new VZP deposits are set. The steps and explanations match the lines in the VZP form, so you can easily follow how each amount is calculated.

1. Health Insurance (VZP) Balance

During the last year, you paid either the minimum monthly VZP deposit or a monthly deposit amount set from the previous tax year.

The VZP balance is then calculated from your income amount from last year, and the deposits you paid are deducted from the total VZP amount you owe.

Overview of the calculation on the VZP form:

Line (Řádek) 3 – Taxable Amount / Net Income: Amount after deducting expenses under the 60/40 method.

Line (Řádek) 16 – Total Health Insurance (VZP) Payment Calculated: The full yearly VZP payment is calculated from your taxable amount (Line 3).

Line (Řádek) 41 – Total VZP Deposits Paid: The total amount of VZP deposits you paid last year.

Line (Řádek) 43 – VZP Balance: Total VZP amount calculated (Line 16) minus total VZP deposits paid (Line 41). This result is the balance that should be paid.

2. New Health Insurance (VZP) Deposit

Your new monthly VZP deposit is set based on your income from last year and how long your trade license was active, so your monthly payments cover the expected VZP amount, and you do not end up with a high balance at the end of the year.

Overview of the calculation on the VZP form:

Line (Řádek) 3 – Taxable Amount / Net Income: Amount after deducting expenses under the 60/40 method.

Line (Řádek) 16 – Total Health Insurance (VZP) Payment Calculated: Total yearly VZP payment based on your taxable amount (Line 3).

Line (Řádek) 4 – Number of Months with Active Trade License Last Year

Line (Řádek) 51 – New Monthly Deposits: Total VZP payment last year (Line 16) divided by the number of months with an active trade license last year (Line 4).

Note:

All paid deposits are deducted at the end of the year when the tax report is filed. If your income goes down and you overpay, you will receive a refund.

You can also check how these calculations work in real examples here.

Common Questions About Czech Taxes (FAQ)

Why are my health insurance (VZP) payments different from last year?

Because your new monthly health insurance (VZP) deposit is based on your average monthly income from last year.

If your income stays the same, the deposits will fully cover your health insurance (VZP) for this tax year.

If your income goes up, you’ll pay a balance.

If your income goes down, you’ll get a refund.

Good to know: These are just deposits. If you really earn less this year, you’ll get a refund next year.

When and how do I pay the health insurance (VZP) balance?

You must pay the health insurance (VZP) balance within 8 days after submitting the tax form. Use the same account number and variable symbol that you use for your monthly health insurance (VZP) deposits.

What’s the difference between side income and main income?

Side income = you have a full-time job AND a trade license

Main income = your income is only from a trade license (no job)

Why do I have to pay health insurance (VZP) on side income if my employer already pays tax?

Your employer pays tax and contributions only on your salary. If you earn anything extra (from freelancing or a trade license), you must pay for health insurance on that income additionally.

Why do I need to start paying deposits now if I had low or zero side income last year?

In your first year of business, you don’t pay deposits. But from the second year, even with side income, you must pay at least the minimum deposits.

Good to know: If your income is low again this year, you’ll get some of it refunded next year.

Are the health insurance (VZP) calculations accurate?

Yes, unless you missed deposits last year. We’ll find out after the audit, and if anything’s missing, you’ll pay it then. This doesn’t affect your current payments, so please follow our instructions on time.

How to Calculate Tax and Contribution Estimates

Czech taxes can be confusing with many rules, conditions, and changing percentages. To estimate your taxes and contribution expenses for next year, use our calculator for freelancers. We regularly update it to reflect new tax rules and law changes