A Simple Guide to Czech VAT: What You Need to Know

In the Czech Republic, businesses must register for VAT (Value Added Tax) if their annual turnover exceeds 2.5 million CZK. However, there are certain situations where it may still be beneficial to register voluntarily for VAT.

When Do You Need to Register for Czech VAT?

To qualify for Czech VAT, you must meet two conditions:

Your turnover in the tax year must be over 2.5 million CZK.

Your income of 2.5 million CZK must come from Czech-registered businesses or private individuals (not businesses outside the Czech Republic).

You must fulfill both of these conditions to qualify for VAT registration.

What Do VAT Payers Have to Do?

Once you’re registered for VAT, you have several responsibilities:

Record keeping: You must keep accurate records of all your business transactions.

VAT filings: You need to submit your VAT reports regularly.

Invoicing: Your invoices must include the words “Faktura - daňový doklad” to indicate you’re a VAT payer.

Keep records for 10 years: Make sure to store your VAT records for at least 10 years.

How Does VAT Work in the Czech Republic?

There are two main VAT rates:

Standard rate: 21%

Reduced rate: 12%

Example:

If you buy a product for 1,210 CZK, VAT at 21% is 210 CZK. You pay the full 1,210 CZK and later claim back the 210 CZK when you file your VAT reports.

If you sell that product for 1,900 CZK, your customer pays 1,900 CZK, but you need to pay 329.75 CZK to the government.

Your gross profit on the sale would be 690 CZK. After paying VAT and claiming the VAT you paid on the purchase, you’ll have to pay a final VAT amount of 119.75 CZK, leaving you with a net profit of 570.25 CZK.

VAT returns are usually due monthly, but after a year of VAT payments, you can apply to switch to quarterly filings if you meet the criteria.

When Is It Worth Voluntarily Registering for VAT?

Even if you don’t have to register, there are situations where it can be beneficial:

If you buy more from VAT-registered businesses than you sell.

If your customers are VAT payers, they can reclaim VAT, which can make your products or services cheaper for them.

If you sell to other businesses in the EU.

If you buy goods with the standard VAT rate (21%) and sell them at the reduced rate (12%).

If you plan to purchase high-value assets, as you can reclaim the VAT.

How to Register for Czech VAT:

To register for VAT in the Czech Republic, apply at the Czech Tax Office. You’ll need to provide:

Your business registration documents

Proof of turnover exceeding 2.5 million CZK in the tax year

Relevant invoices, contracts, or bank statements

The VAT registration form

Once you’ve submitted everything, you should receive confirmation of your VAT registration within 15 days.

Important Things to Remember About VAT Registration

If your turnover exceeds 2.5 million CZK but you forget to register, you’ll still need to pay VAT on income earned after you should have registered.

For example, if you hit the 2.5 million CZK limit in November but don’t register until December, you’ll need to pay VAT on any invoices from October to December, even if you didn’t charge VAT at the time.

Changes in 2025: VAT Registration Limit Raised

In 2025, the VAT registration limit was raised from 2 million CZK to 2.5 million CZK. If you registered for VAT in the past but earned less than 2.5 million CZK in the last year, you can now be eligible to cancel your VAT registration.

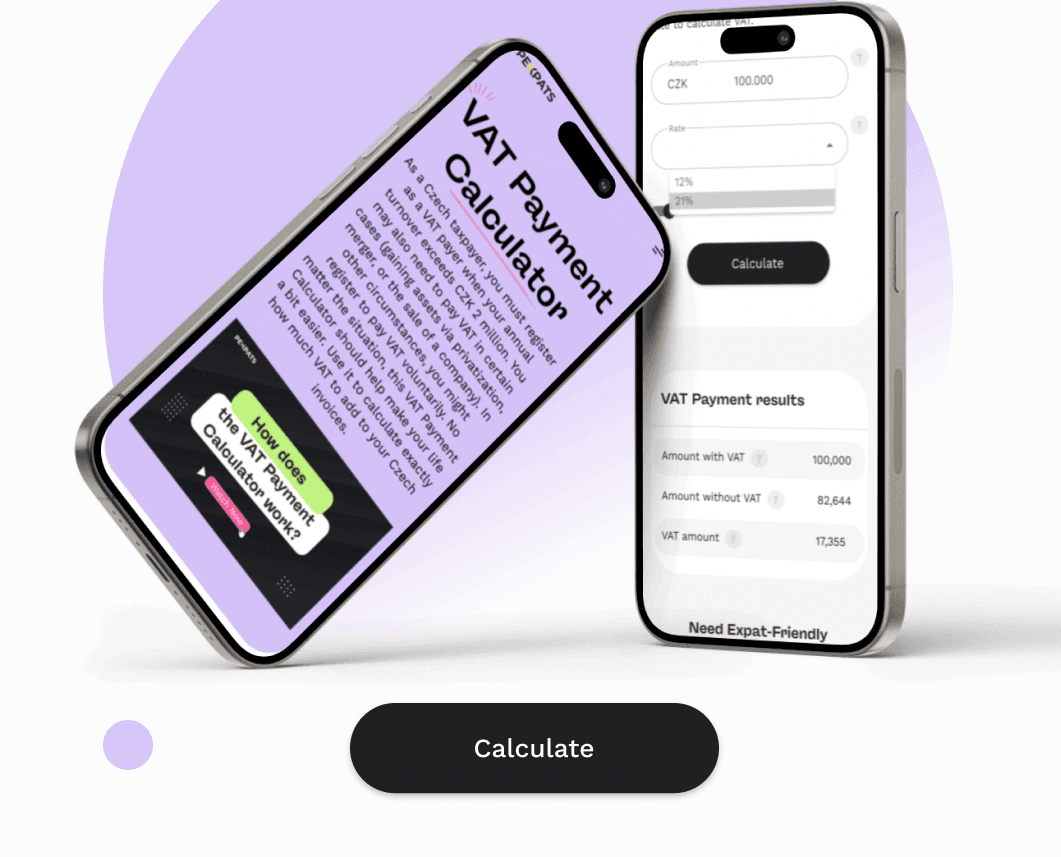

Czech VAT Calculator

Confused about VAT? If you're unsure about how to calculate your VAT payments or need help with VAT rates, try our VAT payment calculator for a quick and easy solution.