Everything You Need to Know About Light VAT in the Czech Republic

If you run a business in the Czech Republic and work with companies registered in the European Union (EU), you might need to register for Light VAT. This is a simpler VAT system for businesses that don’t need or don’t qualify for Czech National VAT registration but still have some tax responsibilities.

What is Light VAT?

In the Czech Republic, Light VAT (also called Identified Person VAT or identifikovaná osoba) is a special type of VAT registration for businesses that don’t meet the conditions for full VAT but still need to report some business activities involving EU companies. It mainly applies to transactions like buying or selling goods and services between the Czech Republic and other EU countries.

When Do You Need to Register for Light VAT?

You must register for Light VAT in the Czech Republic if any of these situations apply:

Buying Goods from Another EU Country If you purchase goods from an EU supplier and the goods are subject to VAT in the Czech Republic, you need to register.

Receiving Goods or Services from EU-Registered Businesses If your Czech-based business receives services or goods (for example, digital services or installations) from a company in another EU country, you must register for Light VAT.

Providing Services to EU-Registered Companies If you offer services to businesses in the EU but outside the Czech Republic, Light VAT registration is required.

Using Special VAT Schemes If your business takes part in special EU VAT schemes like the One Stop Shop (OSS), you may need to register.

Voluntary Registration Even if it’s not required, you can register for Light VAT voluntarily. Just be ready to explain your reasons to the tax office (such as planning to start working with EU clients).

Examples of When Light VAT Registration is Needed

IT, Design, or Consulting Services If you provide these services to or from businesses based in the EU, you need to register.

Selling Through Online Platforms If you use platforms like Airbnb, YouTube, Uber, or Booking.com, and the business involves other EU countries, Light VAT is needed.

Paying for Ads Paying for advertising on platforms like Google Ads or Facebook Ads also qualifies as an EU transaction that requires Light VAT registration.

What You Need to Do After Registering for Light VAT

You must register to light VAT at the tax office within 15 days after issuing your first invoice to an EU-registered business. Once you're registered, here’s what to take care of:

Monthly Light VAT Reports You’ll need to submit a VAT report for each month in which you’ve invoiced or received services from EU-based businesses.

No Turnover Limit Light VAT registration has no income threshold. Even if your turnover is under 2.5 million CZK, you must register as soon as you do business with an EU company

Switching to Full VAT

When your turnover exceeds 2.5 million CZK (from local Czech companies or private clients), you will need to switch to Czech national VAT. Once you register for full VAT, your Light VAT status will automatically be canceled.

Note: If you don’t register in time, the tax office can fine you up to 500,000 CZK. To stay on the safe side, make sure to register as soon as it’s required.

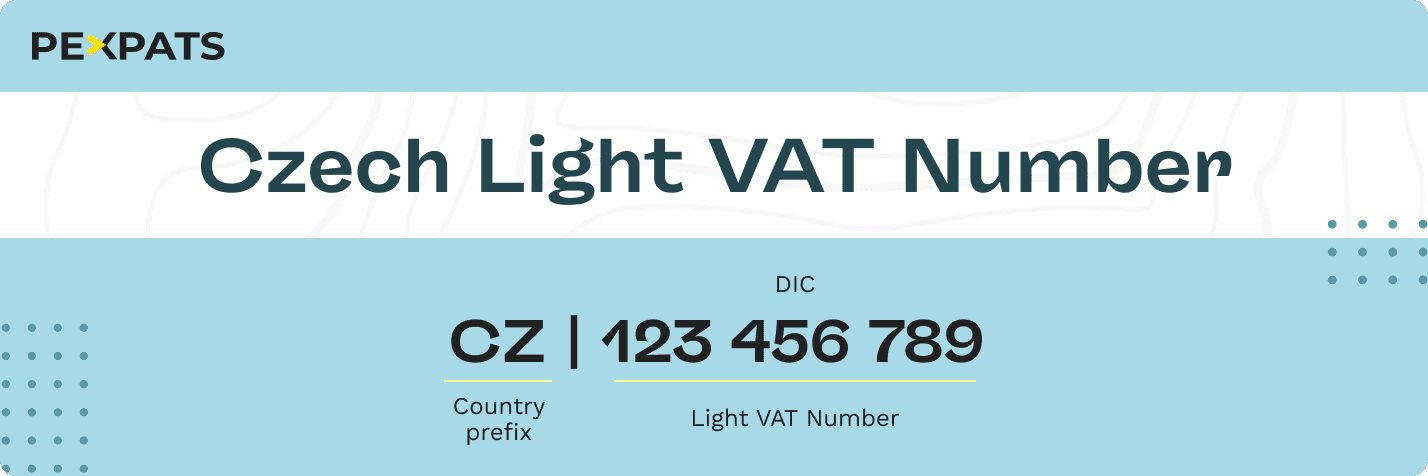

Check If You’re Registered for Light VAT

If you are not sure whether your business is registered for Light VAT in the Czech Republic or if your VAT number is valid, you can easily check using our Light VAT verification tool.

Simply enter your DIČ (tax ID number) below, and the tool will quickly verify if your Light VAT registration is active and valid.

Need Help with Light VAT Registration?

Get full support with Light VAT registration, accounting, and VAT filing—all done remotely and online. At Pexpats, we handle everything for you digitally, reliably, and on your behalf, so you don’t have to worry about paperwork or deadlines.

Common Questions About Light VAT

1. What’s the difference between Full VAT and Light VAT?

Full VAT applies when your business turnover goes over 2.5 million CZK in the tax year, and that income comes from Czech-based clients (businesses or individuals). You’ll need to charge VAT on your sales, submit monthly returns, and follow the full set of VAT rules.

Light VAT is for Czech businesses that work with EU-registered companies—for example, buying services like advertising or selling things like consulting or digital services to clients in other EU countries.

2. Can I register for Light VAT even if I don’t have to?

Yes, voluntary Light VAT registration is possible. If you're planning to work with EU companies—like selling digital services or buying software—you can register early. Just explain your reason when applying at the tax office.

3. What happens if I don’t register for Light VAT on time?

If you don’t register when required, the Czech tax office may issue a fine of up to 500,000 CZK. To avoid problems or delays in your EU business activities, it’s best to register right after your first invoice or purchase from an EU company.