Received a Výzva or Notice from Czech Authorities?

Many people first learn about a missed Czech tax report when a letter titled “Výzva k podání přehledu OSVČ,” “Upozornění from ČSSZ,” or “Platební výměr” arrives in the mailbox or data box.

Each of these documents is an official request to submit a declaration that the office didn’t receive, usually for income tax, social security, or health insurance.

This situation is common. A form may have been sent to the wrong office, filed late, or never linked to your identification number. Fortunately, the issue can be corrected without penalty if you react quickly.

What Each Notice Means

Health Insurance provider — “Výzva k podání přehledu OSVČ” The office reminds you to send your annual health insurance declaration for the previous year. If it’s missing, a fine of up to 50,000 CZK may apply.

ČSSZ (Social Security Office) — “Upozornění” This means your social security declaration hasn’t been submitted. After receiving the notice, it must be filed within 10 days to avoid penalties.

Financial Office — “Platební výměr” The tax return was filed late or not filed at all. The Financial Office calculates daily interest until the payment is settled and sends an official payment order for interest payment.

How to Respond Correctly

Read the notice carefully. Each document includes a reference number, the tax year it applies to, and the official deadline for reply.

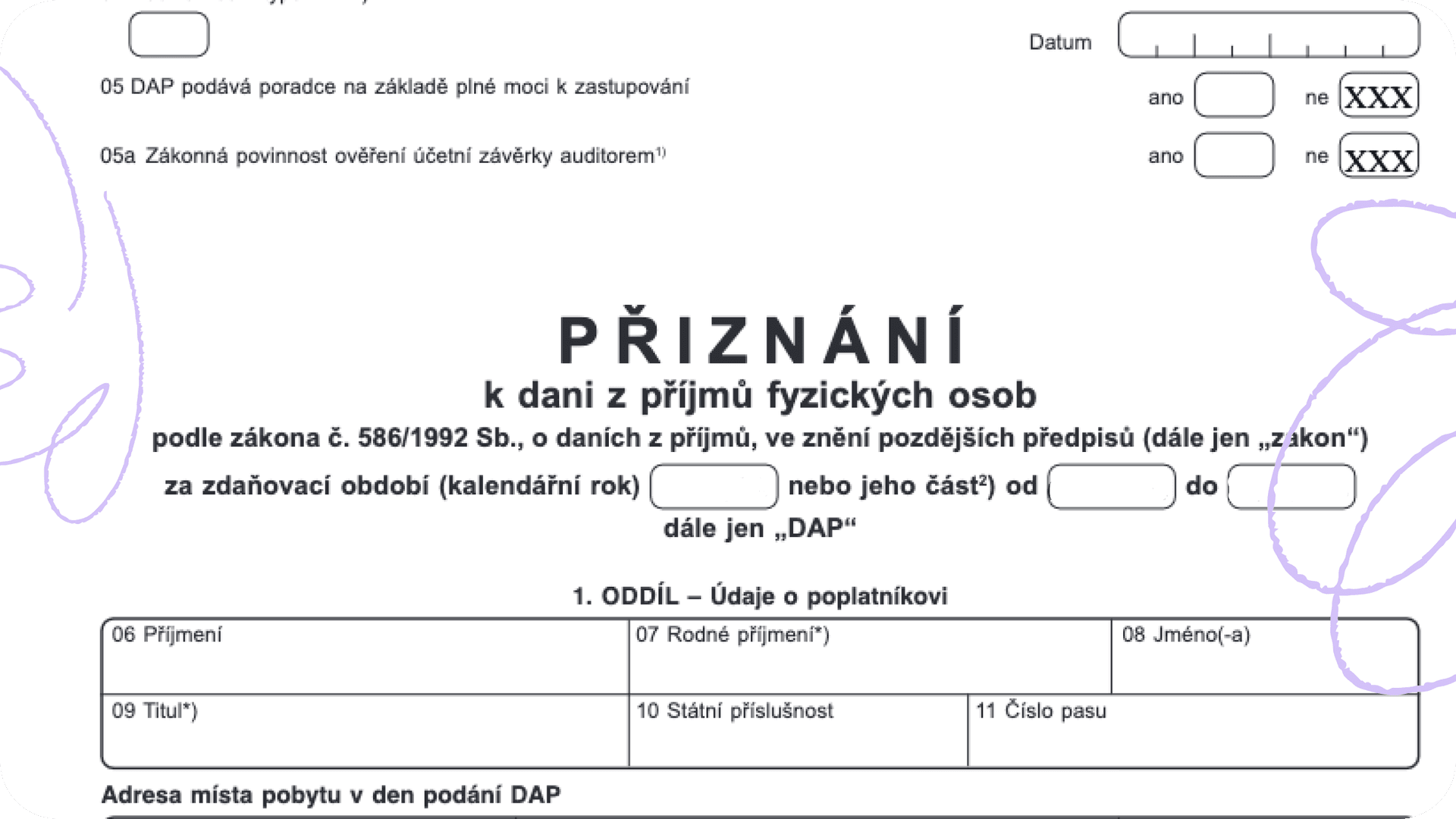

Prepare and file the required forms. These usually include the income tax return (Přiznání k dani z příjmů fyzických osob), the social security report (Přehled o příjmech a výdajích OSVČ), and the health insurance report (Přehled o příjmech OSVČ).

Pay any outstanding balance. Once you receive the payment order (platební výměr), pay the exact amount stated. It stops the interest rate from increasing.

Keep all confirmations. Save the delivery receipts (doručenky) and the accepted forms as proof that your declarations were filed and the case closed.

If You Missed Several Reports

When multiple years or declarations are missing, the authorities may cross-check data with your trade license income and issue penalties separately.In that case, it’s best to request an audit of your filings to see what needs to be fixed.

Pexpats, as a licensed tax representative, can audit and re-file your declarations remotely under the power of attorney — ensuring all reports are accepted by the Financial Office, ČSSZ, and Health Insurance provider.

Example — Missed Filing Resolved

Jana, a freelancer, forgot to submit her 2024 tax and insurance reports. In May 2025 she received a “Výzva k podání přehledu OSVČ.”

After reviewing her case, a tax consultant re-filed her declarations electronically, verified the official payment order, and confirmed that all offices accepted the documents. The only cost was a small interest amount for the delay

FAQ — Common Questions

What does “Výzva k podání přehledu OSVČ” mean? It’s a formal request from a Health Insurance provider asking you to send your annual income declaration.

Do I have to file if I earned nothing? Yes. Anyone with an active trade license must file annual tax, social, and health declarations — even with 0 CZK income.

What if I already received a payment order? Pay the exact amount shown or consult a tax advisor to verify the final calculation.

Need Help Fixing a Late Tax Report?

Resolve your missed Czech tax report with Pexpats.

Pexpats, as an authorized tax representative, works directly with the Financial Office, ČSSZ, and Health Insurance providers in the Czech Republic. We audit your filings, submit any missing declarations online under power of attorney, and provide verified payment instructions — all 100 % online for a fixed, transparent fee.