What is the Czech TIN Number (DIČ)?

The Czech TIN (Tax Identification Number), also known as DIČ (daňové identifikační číslo), is a unique number assigned to taxpayers in the Czech Republic.

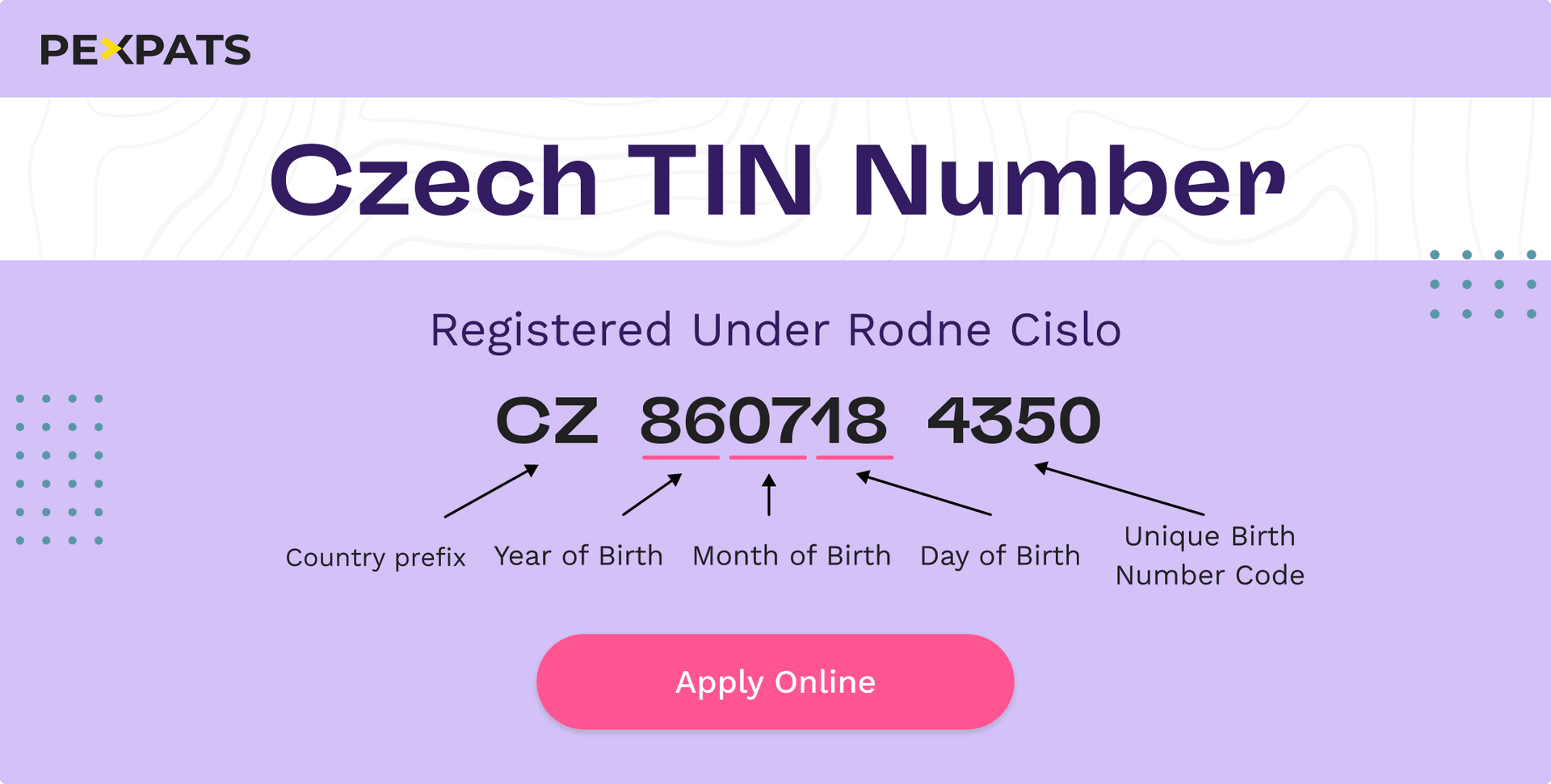

Is the Czech TIN Number the Same as the Rodne Cislo?

In most cases, the Czech TIN (Tax Identification Number)—also known as DIC—is based on your rodne cislo, which is your Czech birth number. This setup is common for Czech citizens and foreigners with official residency permits. However, simply having a rodne cislo does not automatically mean you have a TIN.

The Czech tax office must officially assign and register your Tax Identification Number under your birth number before you can actually use it.

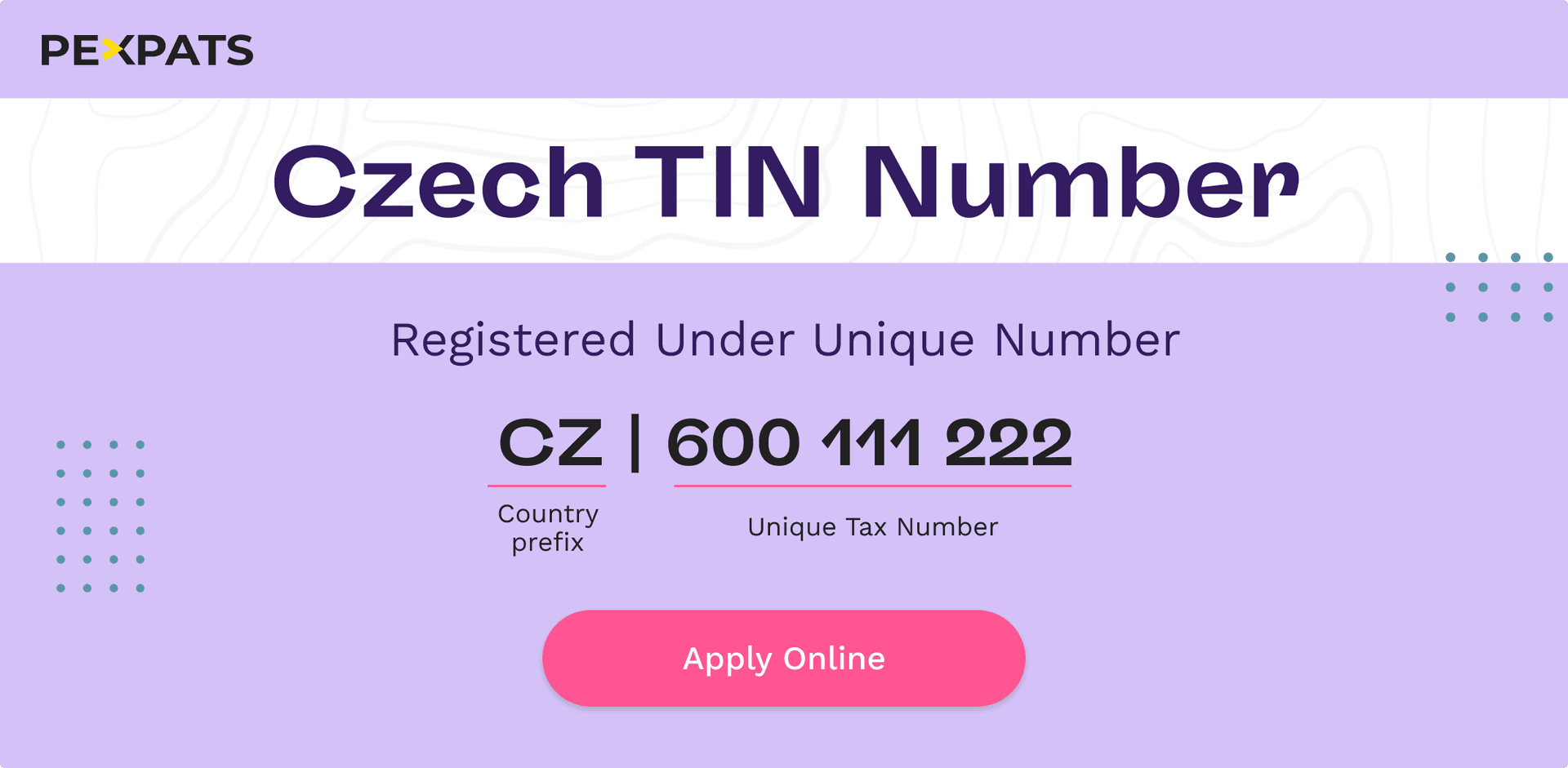

Czech TIN Number Without Rodne Cislo (Using a VCP Number)

Most foreigners living in the Czech Republic don’t have a rodne cislo (Czech birth number). But not having one doesn’t mean you can’t get a TIN (Tax Identification Number). In these cases, the Czech tax office generates a unique TIN called a VCP number (vlastní číslo plátce).

This tax number is made specifically for foreigners who don’t have a rodne cislo and works just like any other Czech TIN. Once it’s generated, your VCP number stays the same, even if you stop working or no longer file tax returns.

How to Get a Czech TIN Number?

A Czech TIN number is assigned by the tax office, typically during your first income declaration—this could be your first salary, property tax, or trade license registration.

It’s important to note that the TIN number is not just for businesses. Currently or previously employed people, as well as anyone who has filed a tax return have a TIN number

Haven’t declared any taxes yet? If you've never been employed or registered as self-employed, and haven't declared taxes before, you can apply for a TIN number voluntarily. To get your Czech TIN number, visit your local tax office, where you will receive a TIN number certificate upon registration.

Why Do You Need a TIN (DIČ) Number?

A TIN number is often required by banks to confirm your tax residency. Without a TIN number, you cannot file income tax reports or obtain tax residency certificates in the Czech Republic.

Issues with Bank Apps and TIN Validation

Some international banks or apps may not recognize the TIN number generated by the Czech tax office for foreigners. These apps might only expect a rodné číslo (Czech birth number), which can lead to confusion. If your unique TIN number is rejected, it doesn’t mean it’s invalid—the app simply has the wrong validation process.

To avoid such issues, EU citizens in the Czech Republic should consider applying for Czech temporary residency and obtaining a rodné číslo( Czech birth number)

ICO, DIČ, and VAT Numbers for Czech Self-Employed Individuals

ICO Number: This is your business registration number, primarily used for invoicing and contracts.

DIČ Number: Your tax identification number, used for communication with tax authorities and tax payments.

VAT Number: If you register for VAT, your Czech VAT number will be in the format CZ + your DIČ number. The VAT number is necessary for handling local and international VAT-related matters.

Not sure if your VAT number is valid?

Verify it by entering your Czech DIC( VAT) Number