Czech Salary: How Much Do You Actually Take Home?

If you work in the Czech Republic, you might wonder how much of your salary you actually get after taxes and contribution deductions. The Czech Net Salary Calculator helps you understand your take-home pay by considering income tax, social security, and health insurance.

Salary in the Czech Republic 2026

Average salary: 48,967 CZK per month.

Minimum salary: 22,400 CZK per month.

Minimum hourly wage: 134.40 CZK per hour

High-Paying Jobs: IT, finance, and engineering offer above-average salaries.

Salaries depend on your job, experience, and location. Wages are usually higher in Prague and Brno than in smaller towns.

Czech Salary After Taxes: What’s Left in Your Pocket?

Your net salary is what’s left after deductions, including:

Health Insurance – 4.5% of your gross salary

Social Security Tax – 6.5% of your gross salary

Income Tax – 15% on most earnings, 23% for higher salaries

Tax Bonuses – Discounts for kids, a non-working spouse, or disability

For example, if your gross salary is 100,000 CZK, your net salary will be 77,237 CZK after taxes and contributions in the Czech Republic.

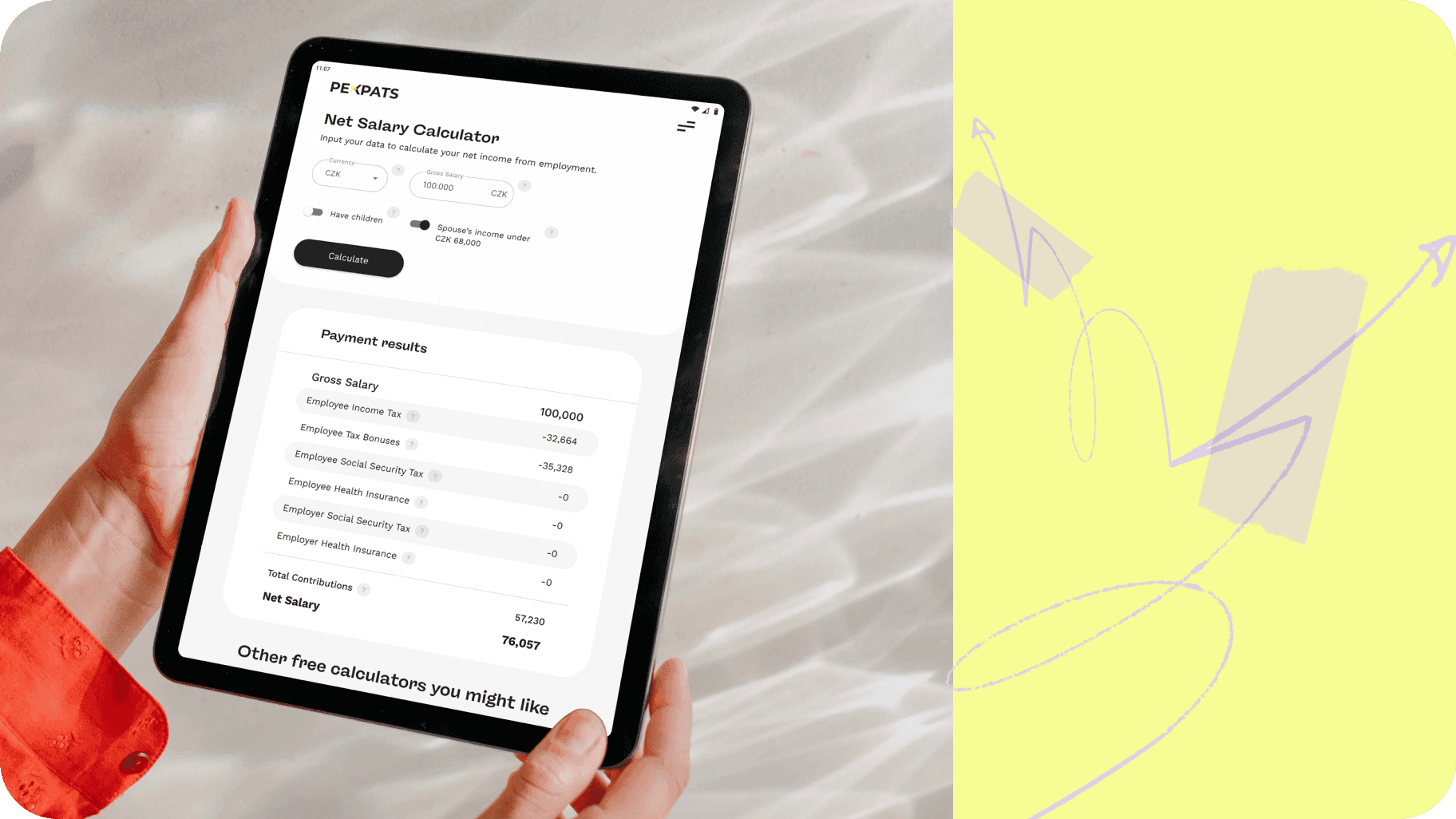

How to Calculate Czech Salary?

You can quickly figure out your net pay using the Czech Salary Calculator:

Enter your gross monthly salary

Apply spouse and child tax discounts if they apply to you

Click Calculate to see your results

The calculator will show your income tax, health insurance, and social security deductions and net salary

Czech Salary Per Hour

If you work hourly, divide your gross monthly salary by the number of hours you worked. For example, if you earn 40,000 CZK per month and work 160 hours, your hourly salary before taxes is 250 CZK.

Czech Salary Calculator: Check Your Net Salary

The Czech Net Salary Calculator is a simple tool created by tax advisors to help you see how much of your net salary you’ll actually get. It’s always updated with the latest tax rules, so you get accurate results every time.

Try the Czech Salary Calculator now and see your take-home pay in seconds!