A Pexpats’ Quick Guide on How to Do Czech Invoices:

Have you just begun freelancing in the Czech Republic but aren’t entirely sure how to do Czech invoices? Have no fear. In this guide, we’ll update you on how to invoice in the Czech Republic as a VAT or non-VAT payer.

We share requirements for invoicing work performed in the Czech Republic, and for work within or outside the EU. Learn how to do Czech invoices for everything from products to services - accurately and easily.

This guide will help you ensure your template for Czech invoicing meets all rules and requirements. Read on to discover more on how to invoice in the Czech Republic.

Czech Invoicing as a Non-VAT Payer

First, let’s begin with how to do Czech invoices as a non-VAT (Value Added Tax) payer. Invoicing without VAT is in fact much less complicated than invoicing with VAT.

If you meet the requirements to be exempt from Czech VAT, there are fewer laws and rules regulating invoicing procedures. Overall, there is less administration and bookkeeping, and less costs on the freelancer.

For non-VAT invoicing, we can break down Czech invoices into the following 6 categories. These fields must be completed in every invoice, and they are as follows.

1. Invoice Number

The first necessary field is the Invoice Number. There is no specific format for numbering, but each invoice number must be in consecutive order.

For example, if the first invoice number is “001”, the next should be “002”, followed by “003” and so on. Do not skip numbers. If your previous invoice was “001”, your text cannot be “009”.

You might include the year as well as the number of the invoice for better organization, such as “0012025”. When doing this, be sure that each invoice number afterwards follows in ascending & consecutive order, e.g. “0022025”, “0032025”, etc.

2. Information of Supplier and Subscriber

Next, include information regarding the supplier and subscriber. This includes your IČO (Company Registration Number), business name, business address, supplier bank details, and payment terms.

Within the invoice description, be sure to list the products or services included in the invoice. For example, invoice for “English lessons”, “yoga classes”, or “consultation services”.

Then, be sure to include the Rate, Quantity, and Total Amount. If it’s 5 hours of English lessons at 500 CZK per hour, specify that as follows:

Description: English Lessons

Rate: 500 CZK

Quantity: 5

Total Amount: 2,500 CZK

3. Date of Issue, Due Date, and Variable Symbol

Also include the date of issue, the payment due date, and the variable symbol (reference number) on each invoice. The Date of Issue must match the date you send the invoice. For the Due Date, this is when you as the supplier expect payment.

Each Variable Symbol is simply the reference number for the client’s record-keeping. For instance, this might be the invoice number.

4. How to Invoice with Foreign Currency

n the Czech Republic, you are allowed by law to invoice in the form of any currency. However, when doing so, you must always include information about the exchange rate of the currency. This must be from the invoiced currency to CZK on the date of issue.

To calculate the exchange rate, reference the Czech National Bank on the day of issuance. As an additional note, you might also include this in the invoice. For example, include “Exchange Rate of CNB on Date 1 EUR = X CZK”.

5. Invoicing EU-Registered Businesses Outside of the Czech Republic

When invoicing an EU business outside of the Czech Republic, we invoice under the VAT Law, Paragraph 6 (Light VAT). This states that when you invoice from the Czech Republic to an EU business, EU reverse charges can apply.

What this means is that you invoice without VAT, and any subscribers in the EU can fulfill payment without VAT.

As an additional note, include in your invoice the reverse charge for both the subscriber and the Czech Tax Office. It must be clear that this invoice/cooperation is under EU reverse VAT charges. For example, a note can include: “0% VAT EU Reverse Charge”.

6. Cooperation with CZ Businesses Registered as VAT Payers

When invoicing Czech businesses that pay VAT, listing your DIČ (Tax ID #) is not mandatory. It is however, helpful, especially for the subscriber.

Providing your DIČ, the entity you invoice will understand that they will not deduct VAT from the invoice.As a non-VAT payer, you will always invoice without VAT, even if your client is a registered VAT payer.

Invoicing in the Czech Republic as a VAT Payer

Now, let’s look at invoicing as a VAT payer. Business entities in the CZ whose turnover exceeds 2 million CZK in any consecutive 12-month period must register as a VAT payer.

With non-resident companies, they have no threshold for registration but must register as a VAT payer if they:

make any product or service subject to Czech VAT (excluding when declaration and payment of VAT is on the subscriber), or

provide products or services from the Czech Republic to another EU member state.

Businesses can register as a VAT payer voluntarily, even if their turnover does not reach the thresholds. This is done when the supplier provides or will provide taxable goods or VAT-exempt supplies with credit in the CZ. As a VAT payer, invoicing is similar to that for non-VAT payers. However, there are a few more fields VAT-payer invoices must contain. Let’s run through the VAT invoice now.

1. Numbering VAT Invoices

Include in every invoice the Invoice Number in consecutive order. This process is the exact same as that for non-VAT payers.

Just remember to number in ascending order (e.g. 0012025, 0022025, 0032025, etc). Again, you might want the invoice number to include both the number of invoice and the year for better record-keeping.

2. Supplier and Subscriber Information

Recording the supplier and subscriber information is also a similar process as that for non-VAT payers.

Include IČO (Company Registration Number), business name, business address, supplier bank details, and payment terms.

The only fields more to include in a Czech VAT invoice are your DIČ (Tax ID Number) and VAT number. These fields are mandatory. The Tax ID Number is used for all taxes, the most common being income tax.

You use your VAT number in other filings connected to VAT reporting, such as for VAT control statements. If your VAT number is missing from an invoice, financial authorities will not accept that invoice during tax control. In this case, it is not certain who is responsible for declaring taxes.

3. Czech VAT Invoice Descriptions

Again, every invoice should clearly state the reason for the invoice. For example, if it’s building a Web application, include “Rate”, “Quantity”, and “Total Amount” for your services - “IT Consultancy”.

The only difference for VAT payers is that Total Amount must include VAT and the VAT rate. Let’s look at an example. Imagine you are invoicing for 200 000 CZK. Your invoice description should look similar to the following.

Description: Name of Services or Product

Rate: 200 000 CZK

Quantity: 1

VAT Amount: 42 000 CZK (21% is the VAT rate for most services in the CZ)

Total Amount: 242 000 CZK

4. Issue Date, Due Date, and Variable Symbol

For these fields, the process is the same for VAT payers as for non-VAT payers. The date of issue is the exact date you send the invoice.

The due date is the date you expect payment at the latest, and the variable symbol is a reference number for clients.A variable symbol might be for example, an invoice number, which clients use for their own record-keeping.

5. Invoicing with Foreign Currency as a VAT Payer

As for invoicing in a foreign currency, it’s possible to create invoices in the Czech Republic for any currency. Again, it’s the same for non-VAT payers as for VAT payers.

Always calculate exchange rates according to the Czech National Bank’s exchange rate on the date of issue of the invoice.

Include this rate in a note on the invoice, for example: “Exchange Rate of the CNB on Date 1 EUR = X CZK.

6. Invoicing EU-Registered Businesses from the CZ

As a VAT payer, you must always invoice with VAT. This is true even if your client is a non-VAT payer, or when invoicing a natural person.

However, when invoicing for work done for an EU-registered business outside of the EU, remember the EU reverse charge rules. These allow you to invoice without VAT, and for EU subscribers to fulfill payment exempt from VAT.

Always include an additional note in the invoice to inform both the subscriber and Czech Tax authorities. The note must clearly state the reverse charge is included in the cooperation, and can be for example the specific paragraph that relates to your situation.

Also, listing your DIČ (Tax ID Number) is mandatory. Providing this makes it clear to the tax office and the subscriber that no VAT was deducted from the invoice

Bank Account and Invoice Language

You can issue Czech invoices as a Czech-registered business in any language. It is not mandatory for Czech invoices to be in Czech. Additionally, to issue and receive payments for Czech invoices, you do not need a Czech bank account.

You can use bank accounts in any country or banking platforms like Revolut or Wise. You can open an online bank account with Wise here

Solutions for Accurate and Simple Czech Invoicing Online

Are you still using Microsoft Word or Excel to create Czech Invoice templates? Perhaps you also have some accounting software to keep your records accurate and up-to-date?

The disadvantages of Word and Excel templates are many, often because these require too much manual input. You have to remember the last invoice number, change fields, add details and more. There’s also no address book, reminders, or tools for better organization.

With accounting software, you not only have to pay for a user subscription and install it to a computer. There are also many accounting tools and features you simply will not need or ever use for Czech invoicing.

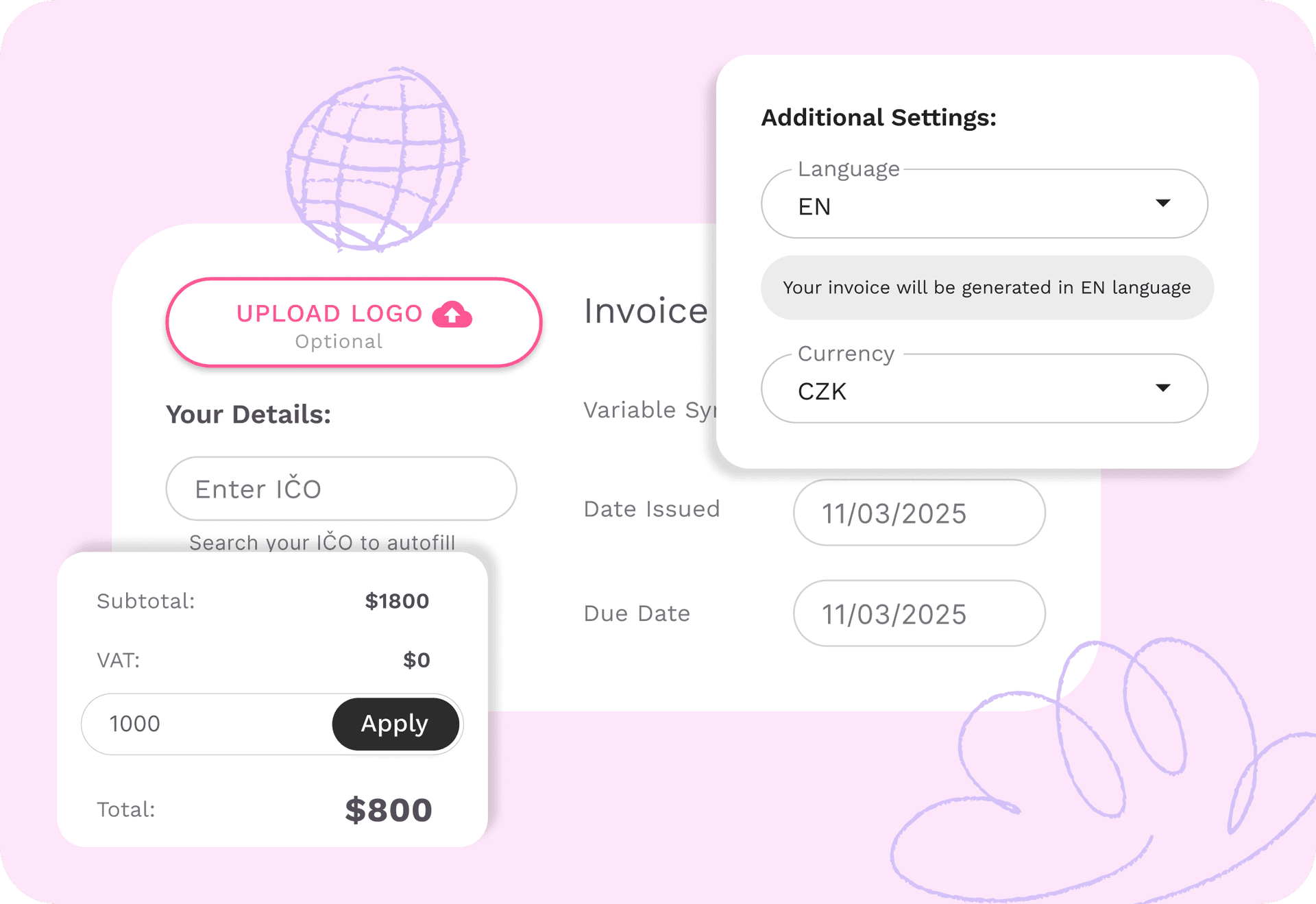

This is why we at Pexpats have created a completely free Czech online Invoice Generator. This tool is available free of charge and allows you to create and send invoices online from your own user account. Find autofill tools by simply entering your IČO, and the app fills out the rest of your information.

Ensure you know exactly how to invoice in the Czech Republic, while possessing the tools to do it quickly every time. Use autofill for the next invoice number. Access your client address book for easy invoicing. Or set payment reminders and different bank account or QR payment options. All automated, accurate, and simple.