EORI Registration for Businesses in the EU

If your business is registered in the EU or you plan to do business in the EU, it’s important to understand the EORI (Economic Operators Registration and Identification) system. Here’s a simple overview of what you need to know about EORI registration and requirements in 2025.

What is the EORI Number?

An EORI number is a unique identifier used by customs authorities across the EU to track businesses' import and export activities. It was introduced in 2009 to make customs procedures easier. If your business trades within the EU or with non-EU countries, you need an EORI number.

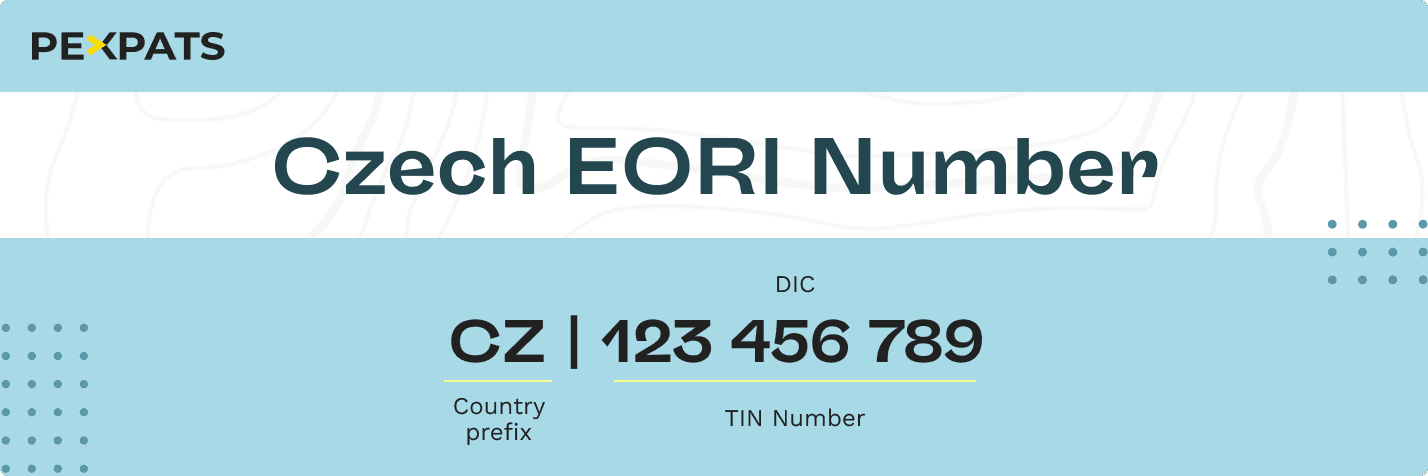

Czech EORI number consists of CZ + 9 digits for companies or CZ + 10 or 11 digits for self-employed businesses.

Why is EORI Registration Important?

All businesses involved in customs processes like import, export, and transit within the EU must register for an EORI number. It’s valid in all EU countries, making customs procedures much easier. Without an EORI number, your business won’t be able to legally trade within the EU.

New EORI Postcode Requirement in 2025

Starting in 2025, there’s an important change to the EORI registration system: businesses will need to include a valid postcode in their records. This is especially important for businesses involved in transit or export procedures through the AES (Automated Export System) or NCTS (New Computerized Transit System).

If your EORI registration is missing a valid postcode, it could cause delays of shipments at the border until the missing information is updated by the national authority.

Steps for EORI Registration

To register for an EORI number in the Czech Republic, businesses will need to provide the following documents:

Tax Registration Certificate for your company

Trade Register Document showing the right to do business

Power of Attorney (if someone else is handling the registration on your behalf)

Registering an EORI number in the Czech Republic takes 3 working days.

Is the EORI Number the Same as the DIC Number?

No, the EORI number is different from the DIC (tax) number. The DIC is used for tax purposes when selling goods and services, while the EORI number is specifically used by customs authorities to track import and export activities. However, you need to be registered for DIC before you can get an EORI number.

What Happens if a Business Doesn’t Have an EORI?

Without an EORI number, businesses can’t import or export goods within the EU. Non-EU businesses will need to apply for an EORI number before starting operations, and the application process can take up to two months, depending on the country of registration. That’s why it’s important to apply for an EORI number before you begin trading.

Can EORI Numbers Be Canceled?

Yes, if your business stops operating or goes bankrupt, your EORI number can be canceled. But if your business restarts, you can reapply for the same EORI number.