Czech income tax is a tax on earnings in the Czech Republic. In the Czech Republic, the personal income tax rate is 15% on income up to 1,676,052 CZK and 23% on income above that threshold.

Self-employed individuals (OSVČ) are also required to contribute to social security and health insurance. In most cases, both Czech citizens and foreigners living and working in the Czech Republic must file a Czech tax return. Here’s when and how to file.

Filing Czech Tax Returns - A Complete Guide for Foreigners

Anybody living and working in the Czech Republic has the obligation to pay income tax once every year. The tax return (“daňové přiznání” in Czech) is common practice for those with an active trade license (Živnostenský). However, it isn’t only freelancers and the self-employed who must file income tax returns. It’s also employees, pensioners, and students.

In 2025, this obligation covered all self-employed persons and entrepreneurs. It also extended to students holding more than one part-time job or doing self-employed business. Some received tax-exempt status, while those with no exemption had to file a tax return for 2024.

Completing a Czech tax return takes into account many factors, from tax benefits and tax rebates to calculating net wage. Filers can also reduce the tax base through charitable donations. If filers own property, they should be aware of how to properly charge real estate tax, or calculate rental income. There can be many variables (and documents) to get right, some which might particularly confuse foreigners and first-time filers.

To learn more, read on for our complete guide to filing Czech taxes. We’ll share who has to file, when to do it, and how to file Czech income taxes properly.

Who has to file Czech taxes?

With so much to cover, let’s break down Czech tax reports for the taxpayer. Who has to file taxes in the Czech Republic?

Active trade license holders (self-employed, in Czech “Živnostenský list”)

Employees with self-employment, capital gains, rent or other taxable income exceeding CZK 15,000 per year

Those working simultaneously for two employers in any one month when both jobs paid income tax in advance

Unemployed persons with capital gains, rental or other income over CZK 50,000 annual

Students who work more than one part-time job or doing self-employed business

Filing deadline for tax returns

The date for filing tax returns in the Czech Republic does not change from one taxpayer to the next. Self-employed persons, as well as employees, pensioners, students, and anybody responsible for reporting taxes all have the same deadline. For submitting the personal income tax report for 2024, this deadline is 1 April 2025.

Typically, tax season and collecting documents for most begins in March. This can change (as we saw over the course of the pandemic), but tends to be around this time of the year.

Taxpayers report income, health & social contributions, and deductibles or tax credits to calculate the remaining balance to pay in taxes.

If submitting tax returns electronically, the deadline is extended by one month. In 2025, this extended the deadline to 1 May. Taxpayers submit reports (whether by mail, in-person or digitally) to the Czech Financial Administration. However, only taxpayers who have income from dependent activities can use the two-page tax form.

How to File a Czech Tax Return?

To file a Czech tax return, follow these methods:

Via Databox – Upload your XML file with tax calculations and personal details.

Tax Office EPO – Calculate income tax, enter personal details, and submit electronically.

Portal Moje Dane – Enter your income details, calculate taxes, and file electronically.

Via Tax Advisor – Hire a tax advisor or accountant to handle your tax calculations and submissions on your behalf

Important: If you're a trade license holder and declaring self-employed (ICO) tax, you must also submit social security and health insurance declarations.

Which tax form to use?

There are two types of tax forms in the Czech Republic:

the standard four-page tax form, and;

a simplified two-page tax form.

Download either of these forms from the Financial Administration website or here, just as in previous years. Keep in mind the simplified tax form is only for those with income from dependent activities. Beyond using one of these forms, taxpayers might also need to collect some important documents.

Important documents to collect

Which documents you need to file taxes will vary depending on whether you’re employed, have a trade license, or both. If you are employed, you need to get a certificate of taxable income(Czech name of the form is Potvrzení o zdanitelných příjmech ze závislé činnosti, sražených zálohách na daň a daňovém zvýhodnění) from the employer. If you worked for multiple employers in the last tax year, then you should get the forms from each of them.

This is more straightforward than filing taxes as a freelancer, who should compile all invoices from the given tax period.

Trade license holders must file taxes according to a flat-rate (60/40) expenses or real expenses. Apply these as expenses related to your business, which will later be deducted from the remaining balance owed in taxes. When choosing to file using flat-rate expenses, there is no obligation for filers to keep records of invoices or receipts.

If filing taxes using real expenses, which is sometimes more advantageous, there’s documentation to do. The person filing should keep records of all costs paid for the entire year. They must keep receipts for at least 3 years. Anything related to conducting business can apply as an expense, however with numerous exceptions.

What can you write off as business expenses?

Some costs you can write off as real expenses include:

Vehicle expenses (under certain conditions, e.g. road tax registration)

Royalties

Management service fees

Interest charges to foreign affiliates

Technology you purchase to use in your business (e.g. work computer)

Office rental for conducting your business

The Czech company will have to prove these costs meet general rules for tax deductibility, however.

NOTE: You can not combine tax methods 60/40 and real expenses. You should always choose one of them.

Exceptions to real business expenses

What doesn’t count as real expenses when reporting taxes in the Czech Republic?

Cost of food

Beverages and refreshments

Dining at restaurants

Advances to Social Security

Contributions to Health Insurance

Note: social and health advances cannot be written off as business expenses. This is because all taxpayers must prove their advances to pension insurance and to health insurance. This information is available through the respective offices at the end of the year.

Health insurance providers tend to send this automatically, while Social requires access via an e-identity / e-portal system.

Most common deductibles

Now, when filing, you’ll also want confirmation of deductions. The most common deductions are mortgage interest, donations, pension insurance, and life insurance. Filers can prove payment to any of these via confirmation from a bank, insurance provider, or other means. Other common deductibles include the following.

Dependent children or child (claimable by only one of the parents)

Deductions for a non-working spouse (whose income does not exceed a certain limit and takes care of a kid under 3 years)

How to submit an Employee tax return

Employees over the course of a tax calendar year must file a tax return if they had:

Income from self-employment;

Capital income;

Rental income, or;

Other taxable income exceeding CZK 15,000/month (see note below).

Employees can submit an Employee tax voluntarily due to bonuses.

Voluntarily for deducting tax reliefs and bonuses and getting tax refunds.

Note: You must submit a tax return even if working for two different employers who both pay advance income tax. (If income exceeds CZK 15,000, the employee must file a tax return.)

Examples of Czech employee tax returns

To avoid any confusion, we’ll share some examples of who should file an employment tax return in the Czech Republic. If any of these match your situation, you will not be able to apply for an employer annual tax statement.

1 - Were you employed with a brigada?

If you worked for a brigade earning income throughout the year from more than one company, you may have to file. For example, say you worked for employers on a classic employment contract. These employers paid a gross monthly salary of CZK 40,000. Then, to earn additional income, you work on contract for employers, whose pay you receive on top of AB’s.

At this point, if you earn taxable income from more than one employer in the same month, you must file. You cannot apply to any of the employers for an annual tax settlement.

2 - Have you been self-employed for part of the year?

Next, say you conducted self-employed business for only part of the year, from January to November. Your business began in December, giving you only one month with very minimal, taxable income, say CZK 10,000. In this case, you cannot apply for the annual tax settlement from the previous employer. You must file a Czech tax return for any income from self-employment.

3 - Did you do any part-time work?

If you worked for two part-time employers in the Czech Republic, you are obliged to file a tax return. Now, because this income comes from dependent activities only, you can use the simplified two-page tax form. This is according to § 6 of the Income Tax Act. To complete the tax return, you will however need a certificate of taxable income from both employers.

4 - Were you employed and with rental income?

In addition to employment income, if you earn anything from rentals (i.e. an apartment), you file a tax return. In this case, you will need to use the standard 4-page tax form as well as appendix number two of the return. Here, rental income according to § 9 of the Income Tax Act can be reported along with employment income.

5 - Are you an entrepreneur while on pension?

If yes, here we need to get into some numbers. Say, for example, a retired pensioner was self-employed for the taxable year at an annual income of CZK 450,000. All expenditures apply at a 60% flat rate, bringing the annual tax base to CZK 180,000. On this 180,000, the entrepreneur must pay taxes.

However, it will be excluding contributions to social and health as well as any tax bonuses or discounts.

In this specific case (in 2025), the basic discount available to all taxpayers was CZK 30,840. This number changes from year-to-year, but let’s use it for example. The tax discount decreases tax liability, which before the discount is 15% for this entrepreneur.

If income tax before applying the discount is equal to or less than the rebate, annual tax liability becomes zero. And here, it is. This means you won’t have to pay any personal income tax, but you still must submit and fill in a tax return.

How to calculate Czech personal income tax

There are two tax brackets in the Czech Republic:

15% income tax rate for those earning below approximately CZK 1,676,052.

23% income tax rate for those earning above approximately CZK 1,676,052.

There are also non-taxable items (tax deductibles) to reduce the tax base if certain legal conditions are met. Most commonly, these include: gifts, housing interest, advance deposits on pension insurance savings, or life insurance. For the lower tax base, each CZK 1,000 in rebates amounts to CZK 150 in savings. While for the higher tax base, it’s up to CZK 230 per 1000.

Want to get an estimate on your taxable income and what you’ll be paying? Try Pexpats’ free tax calculators!

Tax rebates to reduce income tax

If you’re entitled to any tax deductions, deduct these from your calculated personal income tax for the year. For 2025, each taxpayer had a taxpayer discount of CZK 30,840. Beyond this, other discounts include:

Spouses with independent income who is taking care of kid under 3 years old and not exceeding CZK 68,000 (discount of CZK 24,840 in 2025)

Also spouses with independent income under CZK 68,000 holding a ZTP / P card (49,680 crowns)

First and second-degree disabilities (CZK 5,040)

ZTP / P card holders (16,140 crowns)

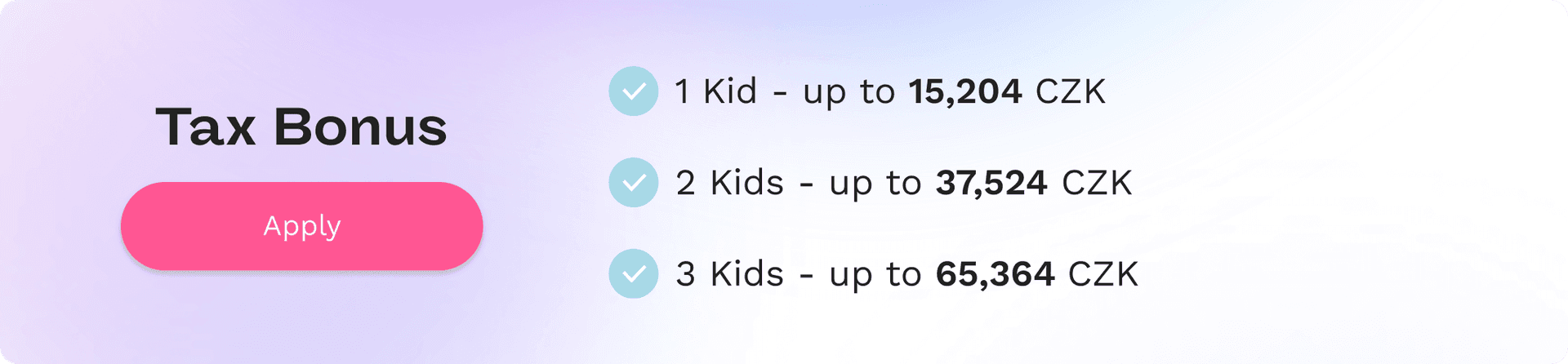

Also, parents can claim tax benefits for their children. In this case, the annual benefit allowance for 2025 is CZK 15,204 for the first child. For the second, it is 22,320 crowns, while for the third and subsequent children CZK 27,840. If the child also holds a ZTP / P card, then you can apply for double the tax benefit.

Note: All exact amounts are for the previous calendar year of 2025 and are subject to change from year-to-year. Always check the exact amounts for the calendar tax year you are filing.

Who is eligible to receive the tax bonus?

Taxpayers claiming benefits for children are not required to pay income tax, and even receive money from the state. This money comes in the form of a tax bonus, but only when the tax benefit exceeds the calculated income tax.

Example of tax bonus entitlement

Say you’ve earned a gross annual profit of CZK 500,000 and claim a tax benefit for 3 children. The benefit in this case comes to a total of CZK 65,364 (15,204 + 22,320 + 27,840). Now, here, you will claim only the basic taxpayer rebate along with the aggregate discount for the three children. You cannot claim any other rebate or non-taxable item, however.

The income tax calculation will thus come to CZK 75,000 (500,000 x 15%). After deductions for the taxpayer discount, CZK 44,160 remains (75,000 - 30,860). Now, apply the benefits for the three children, and you’re entitled to CZK 21,204 (44,160- 65,364).

Should I register for VAT or Light VAT?

Anybody whose annual turnover exceeds CZK 2 million must register as a VAT payer. Value Added Tax (VAT), or in Czech “daň z přidané hodnoty” (DPH), is officially known as the European Reverse Charge. What this means is that you will not charge European-business clients VAT. It does not mean that you will pay any additional VAT.

Also, if you invoice any EU-business client who pays VAT, you must register for Light VAT. VAT Light (“identifikovaná osoba”, in Czech) must be applied for through the local tax office (finanční úřad).

Flat tax rate - advantages and disadvantages

Now, in 2025 the Czech government introduced a flat tax rate (“paušální daň”). Taxpayers who apply for the flat rate pay only a monthly advance (in 2025, CZK 8,716). This amount covers both social and health insurance, as well as CZK 100 advance to income tax. There is no filing at the end of each calendar year and typically less hassle overall. VAT payers, full-time employees, and those with self-employed activities cannot apply for the flat rate.

For foreigners, applying for a flat tax rate isn’t always advantageous, however. For one, a tax assessment for filing taxes with a home country is impossible. This is because no annual statement is filed, making it extremely complicated to prove income to foreign authorities. It also makes it impossible to obtain tax residency status, and in some cases, avoid double taxation from countries requiring it.

Czech Tax Return Application and Payment Deadlines for 2025

In 2025, the deadlines for personal and self-employed tax return applications and payments are as follows:

Paper Income Tax Applications Deadline is 2.4.2025.

Online and Electronic Income Tax Applications Deadline is 2.5.2025.

Income Tax Applications represented by Tax Advisor or Lawyer Deadline is 1.7.2025.

Income Tax Payments for Trade License Holders: Deadline is 60 Days After Tax Report Declaration

Tax Advance Payments for Trade License Holders Deadlines are June 15, 2025, and December 15, 2025. IncomeTax Advances can be paid up to 3 installments.

Trade license( zivnostensky list) Social Security and Health Insurance Application Payments Deadline is 1 month after submitting the income tax return.

Payment Balances for Social and Health Insurance Recalculation Applications Deadline is Within 8 days after applying for social and health insurance recalculation.

Still, have questions? Get professional tax assistance!

If you haven’t noticed, we know a fair bit about taxes in the Czech Republic. Should you need anything, from tax consultation to professionals handling the heavy lifting, we’ve got you covered. We can even handle everything remotely so you save time in your already busy schedule.

Reach out today to find out how we can help, whether it’s getting you answers or, better yet, filing your Czech taxes for you.