Get Czech Tax Discount

Maximize Tax Discounts, Reliefs, and Bonuses with Pexpats

Czech Taxes Online

Get Czech Taxes and Contributions Calculated and Reported Online

All-in-One Service

Get Taxes and Contributions Calculated, Reported, and Audited

Let Pexpats Do Your Tax

Pexpats Handles Your Tax Report and Contributions Remotely

Good To Know

Czech Tax for Freelancers

Freelancers with a trade license (zivno) in the Czech Republic pay social tax, health insurance, and income tax. Submit your Czech tax return online to settle remaining payments and get updated deposit amounts for the next year.

Czech Tax Deadlines 2025

The 2025 Czech income tax return deadlines are:

Regular tax return: 2.4.2025

Online tax return: 2.5.2025

Tax return via advisor or lawyer: 1.7.2025

File your tax report on time to avoid penalties.

Crypto & Capital Gains

Crypto and capital gains are added to your trade license or employee income tax base in the Czech Republic, and taxes are recalculated. These profits must be declared alongside your income tax in the Czech Republic.

Tax Reliefs, Discounts & Bonuses

You can deduct various tax reliefs, tax discounts, and claim tax bonuses in the Czech Republic. Check the full list and conditions here.

Calculate Your Czech Income Tax Online

Enter your gross trade license income to calculate your Czech income tax online. Get an estimate of your income tax, social tax, and health insurance contributions based on your earnings.

Good To Know

60/40 Method for Czech Tax

The 60/40 method allows you to deduct 60% of your gross income for tax purposes and pay taxes on the remaining 40%. This method makes taxes more affordable, even if you have no expenses. It applies to everyone, regardless of nationality or residence in the Czech Republic.

Social and Health insurance

In your first year of business, you pay minimum social tax and health insurance deposits. After declaring your income, your actual social tax and health insurance payments are calculated, and the deposits paid during the year are deducted from the final amount.

Based on your previous year’s income, both the social and health insurance offices will set your deposits for the current year. If your total deposits exceed the final calculated amount, you’ll receive a refund

Czech Tax Payment Deadlines

Income Tax Payment: After declaring your Czech income tax, payment must be made within 60 days.

Social and Health Declaration: Declare your social and health contributions within 30 days after filing your income tax.

Social and Health Payment: Pay your social and health contribution balances within 60 days after declaration.

Apply Your Tax 100% Online!

As a Czech trade license holder, you need to declare your income tax and contributions once a year, then pay income tax and contribution balances. Pexpats takes care of the declarations online and gives you clear payment instructions.

Here’s all you need to do

1. Apply Online

Online

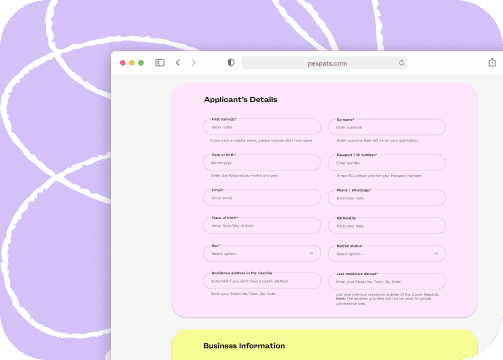

Complete the online client application form, and electronically sign Power of Attorney.

Fill Online Form

Please fill out the online client tax form below, provide all required information, and attach a scan of your passport

Sign Power of attorney

After we receive your information, we'll send you a Power of Attorney to sign digitally. This will allow us to take care of your tax and contribution declarations and handle the audit for you.

2. Tax Declaration

Online

from 5 900 CZK

After receiving your application and Power of Attorney, we'll handle your full tax and contribution declarations.

About the Service

We’ll calculate and declare your income tax, and social and health insurance, apply tax reliefs and discounts, and provide payment instructions for your Czech income tax and contribution balances. We’ll also arrange the audit.

What is included

Complete Czech Income Tax Reports:

Income tax calculation and declaration

Contribution balance calculation and declaration

Payment instructions for tax and contributions

Audit of social and health insurance

Tax reliefs, discounts, and additional income declaration

Czech Tax Filing Time

It takes 2-4 days to calculate and declare Czech income tax, and contributions, and set up payment instructions.

3. Payment Instructions

Remote

Online

After calculating and declaring your Czech income tax and contributions, we'll send you detailed payment instructions.

Czech Income Tax

After confirming your Czech income tax amount, we'll send payment instructions. If your income tax is over 30,000 CZK, we'll also provide tax deposit payment instructions

Social and Health Insurance

We’ll confirm your final social and health insurance balance, set your new monthly deposit amounts, and send you payment instructions.

How Much It Costs

Payment instructions are part of the tax declaration, and you will not be charged any additional fee

4. Audit

Remote

Online

After declaring your social and health contributions, we will arrange an audit of the contributions.

About Service

If you missed a monthly payment or confirmed the wrong total deposits for the previous year, our calculation might be incorrect. To make sure everything is right, we double-check the amounts you provided and our calculations, then arrange a final audit of your social tax and health insurance.

How Much It Costs

Audits are included in the tax declaration, and there are no extra fees.

Sounds Good?

No matter where you are or what type of income you have, you’re just one click away from declaring your Czech income tax with Pexpats.

All you need to do is complete the online client application form, and Pexpats will handle everything else for you—fully remote and online

Fees

5 900 CZK

"Good work ain't cheap. Cheap work ain't good." Sailor Jerry

Additional Expenses: 1 000 CZK - Declaring Additional Czech Employee Tax

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Capacity Available: Now Accepting New Clients.

Ready To Get Started?

Please fill out the online client form and provide the necessary information. We’ll handle the complete tax and contribution calculations, declarations, and audits. You only need to complete the form on your end.

Good To Know

What is included

Complete Czech Income Tax Reports:

Income tax calculation and filing

Contribution balance calculation and filing

Payment instructions for taxes and contributions

Social and health insurance audit

Tax reliefs, discounts, and additional income declaration

I Still Have Questions

If you still have questions, you can contact us through the form below.

Life-Changing Stories from Our Happy Clients

Our reviews say it all! Hear real stories from freelancers, digital nomads, students, entrepreneurs, and expats—who found success with us.

Please, clearly describe your situation or questions in detail.

The more information you provide, the quicker and more accurate our response will be.

We reply within the same day. If you do not receive a reply within a day, please check your spam folder.

Have Questions?

If you still have questions, find anything confusing, or haven't found what you're looking for, feel free to contact our agents. We're here to help.

Fill out the form below, describe your situation, and choose the relevant service type. Our agents will prioritize your request and suggest a solution.

What we do

Business Support

Relocation Assistance

Tax Advisory

Freelance Solution Hub

Digital Finance Platform

Services

Immigration Services

Online Tax Report

All-in-one Packages

Financial Services

Immigration Services

Business Services

Personal Services

Copyright 2013 - 2025

Made with ❤️ in Czech republic

Powered by PEXPATS